As temperatures heat up, typically so does consumer spending. With summer kicking off in the U.S., the Alkami research team used transaction enrichment and data analysis to take a closer look at consumer spending when it comes to several traditional summertime activities.

With more agreeable weather for outdoor activities, and more people taking time off of work to enjoy them, summer vacations have rebounded despite spending concerns and inflation impacts. To balance responsibilities with pleasure, some consumers are even foregoing other indulgences in order to reallocate funds to summer activities.

By better understanding these seasonal trends, financial institutions can more accurately analyze their own consumer personas in order to put personalized banking into practice, providing more tailored products and marketing efforts, maximizing their own summertime revenue.

The allure of camping remains strong with Americans looking to get off the grid and experience nature in an increasingly high-tech world. With over 50 million taking to camping each year since 2020, the recreational activity shows no signs of slowing in popularity.

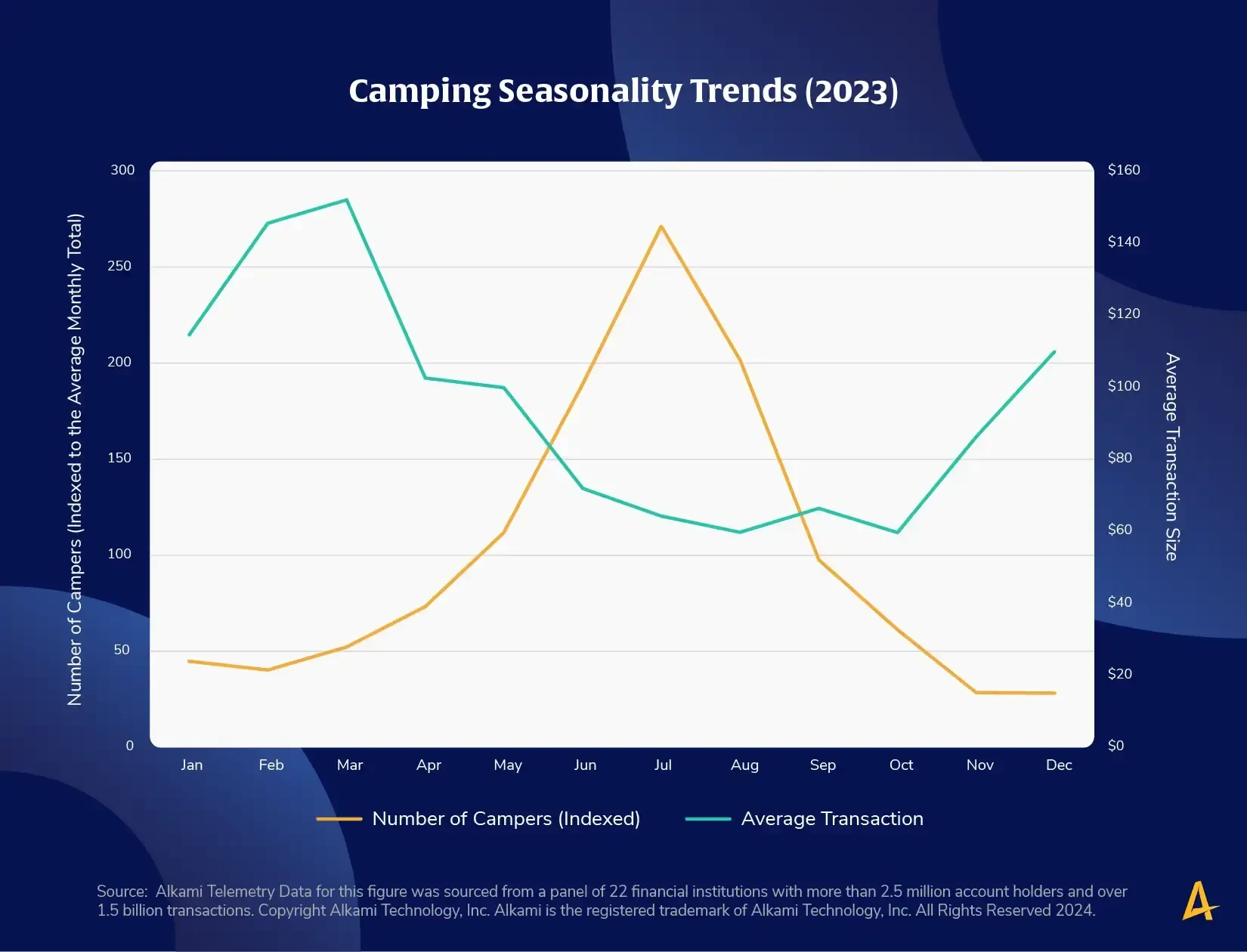

To better understand how consumers are engaging with camping, and to identify opportunities for financial institutions to optimize engagement with these recreational expenses, Alkami Research explored trends among campers’ spending habits. By looking at seasonal trends at campsites over 2023, including both the number of accounts with campsite transactions and the average dollar among those transactions, the team anticipated seasonal peaks during the popular summer months.

The data confirmed this activity trend with June, July, and August leading the way in campsite activity. Perhaps more surprisingly, however, were the transaction amount peaks during winter months. Alkami researchers attribute these seasonal increases to two different types of campers: tent, who dominate the summer months, and recreational vehicle (RVs), who can travel to more welcoming climates and typically have more expendable income, also allowing for higher average transactions.

Key Takeaway

Financial institutions can benefit from further breaking down the camper persona based on different types and trends. By evaluating consumer spending data, financial institutions can target summertime tent campers, likely with families, and create messaging that resonates best with them. Separately, financial institutions can segment out RV campers who are more likely to be older or retired individuals and couples who have different needs, including vehicle financing and insurance payments, that financial institutions can become a resource for.

Day camps have traditionally been a summertime activity for families looking for ways to engage, entertain, and supervise their children outside of regular school year engagements.

Curious about the trends in day camp participation in this shifting landscape, Alkami Research analyzed consumer spending transactions in 2023. The results demonstrated that while children may participate in day camps predominantly in the summer months, spending and planning starts much earlier. Nearly 37% of parent and caregiver spending on day camps occurs from January through April, with another spike following in May and June as the season approaches.

Key Takeaway

Financial institutions can create a “Has Children'' persona for their account holders based on day camp spending, providing a unique marketing opportunity for more than just cultivating top-of-wallet status for summer activity expenses. Financial institutions can also proactively offer complimentary products to parents and caregivers such as educational savings accounts that may be relevant to consumer needs. Timing can also play an important role in being the financial institution of record for key transactions, reminding parents ahead of the approaching seasons not only to use their debit or credit card for day camp tuition, but also for other timely purchases such as back-to-school shopping or school fees.

Tennis is a year-round sport that can take advantage of both seasonality and indoor courts, yet tennis is often thought of as a summertime activity. To add further insight to these beliefs and identify spending trends, Alkami researchers analyzed consumer data to reveal whether seasonality plays a role for tennis enthusiast spending.

The data confirmed that while tennis is a nearly year-round activity, spending demonstrates a sustained increase throughout the summer months. These expenses run the gamut from supplies such as athletic wear and equipment to league fees. Notably, spending spikes in April as the summer season approaches and many tennis clubs charge annual membership dues.

Key Takeaway

Further segmenting sports enthusiasts based on their particular pastime can help financial institutions provide more personalized banking engagements and messaging at the right times to capitalize on key consumer spending opportunities. Included in this can be reminders for consumers to use specific cards for upcoming membership renewals, ensuring the bank or credit union remains a top-of-wallet option. Importantly, key timing for this is in January, as tennis players begin looking to pick their game back up after the holiday season. Personalized banking opportunities such as incorporating tennis imagery alongside financial products, such as certificates of deposit or home equity line of credits (HELOCs), can help catch consumer attention.

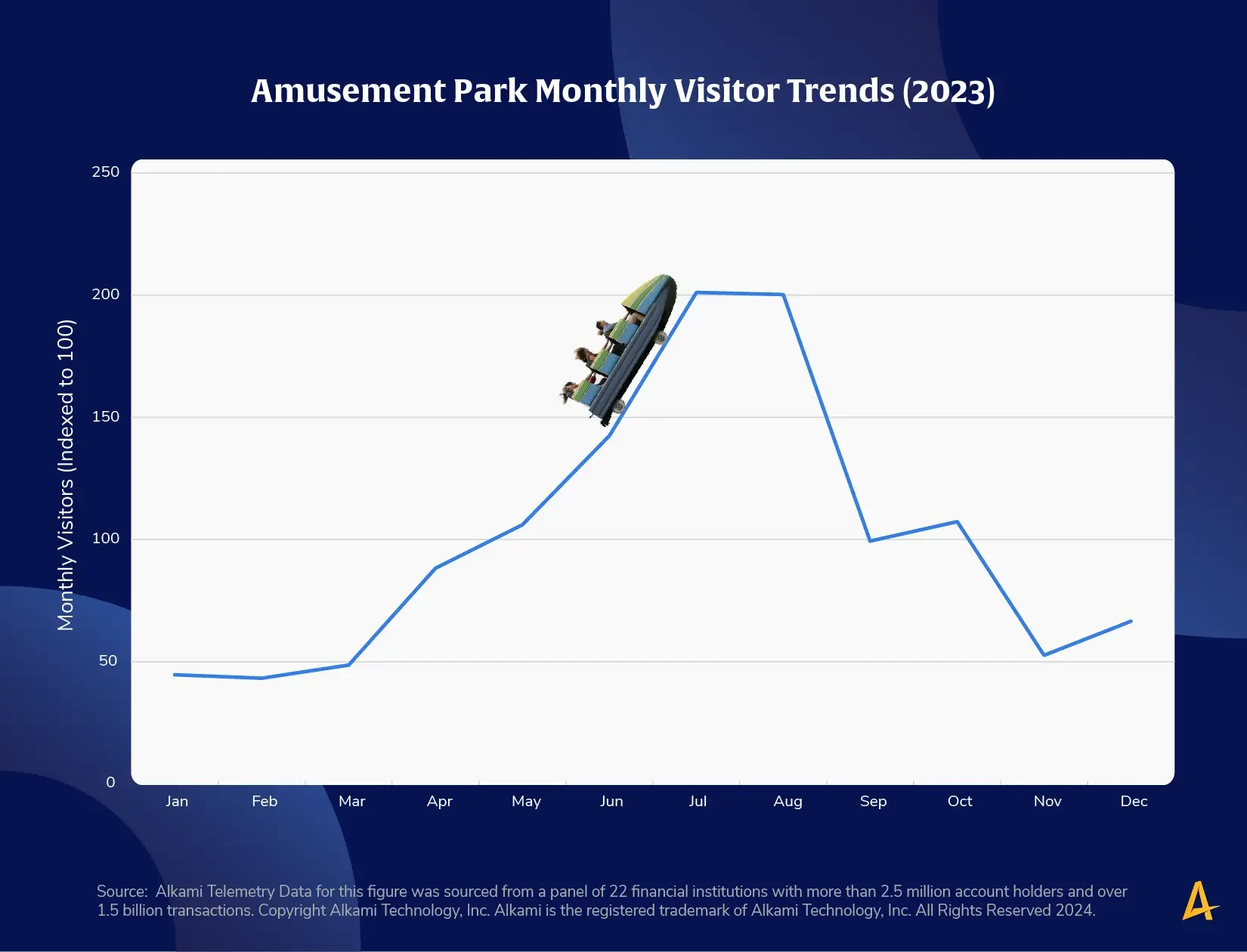

Another time-honored summertime activity is a visit to an amusement park. Notably, the number of theme parks in the U.S. increased by 9.8% annually between 2018 and 2023, bringing the total to nearly 650 venues. With so many options to choose from, Alkami researchers worked to explore whether there were trends in when consumers are taking the time to visit amusement parks and how financial institutions can cater to this demographic, especially with 38% located in warmer states like California, Texas, and Florida.

Data confirmed expectations that amusement park visits peak during the summer based on consumer transaction data, with the busiest months being July and August. An interesting spike in visits occurs in October and again in December, likely attributed to those theme parks that provide Halloween and holiday programming to bolster attendance during the offseason.

Key Takeaway

Financial institutions can use knowledge of this trend to remind consumers to use their products for seasonal spending, but the opportunity can go far beyond individual spending. Financial institutions can look for ways to partner with local amusement parks to drive specific card usage within a specific park’s visitor persona, helping to increase top-of-wallet status while bolstering co-marketing efforts. This also provides a unique and fun avenue for creative personalized banking engagements that take advantage of roller coaster imagery and promote financial stability products such as debt consolidation and other consumer loans.