Customer Insights & Marketing Automation

Financial services marketing automation

What if you could generate seven-figure revenue with a marketing campaign that takes minutes to set up? With Alkami, you can. See how fast and easy it is to execute revenue-generating marketing campaigns with financial services marketing automation.

Clients using Alkami Customer Insights & Marketing Automation experience 13X ROI*

Insights derived from real-time transaction data are a great predictor of what account holders are going to do next. With Alkami Customer Insights & Marketing Automation, banks and credit unions can use these insights to build lists of account holders to send messages to – delivering the right message to the right audience. Automated full cycle attribution reporting identifies account holders who were influenced to achieve the campaign goal as a result of your financial services marketing automation efforts.

On average as of September 2022

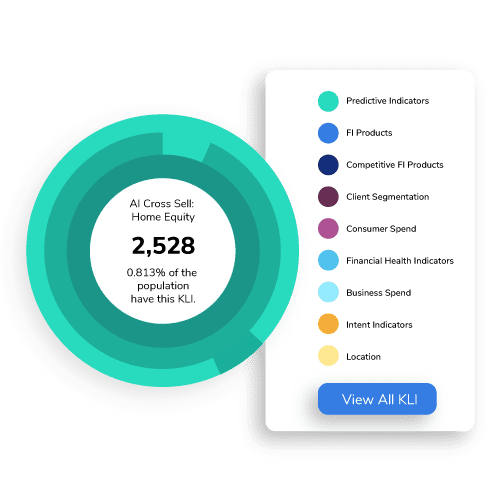

Get to know your account holders

What account holders spend money on every day highlights what’s important to them. That’s why insights built from transaction data are key to executing personalized campaigns that drive revenue. By unlocking transaction insights, you can gain a complete picture of your account holders to hyper-personalize the messages they see.

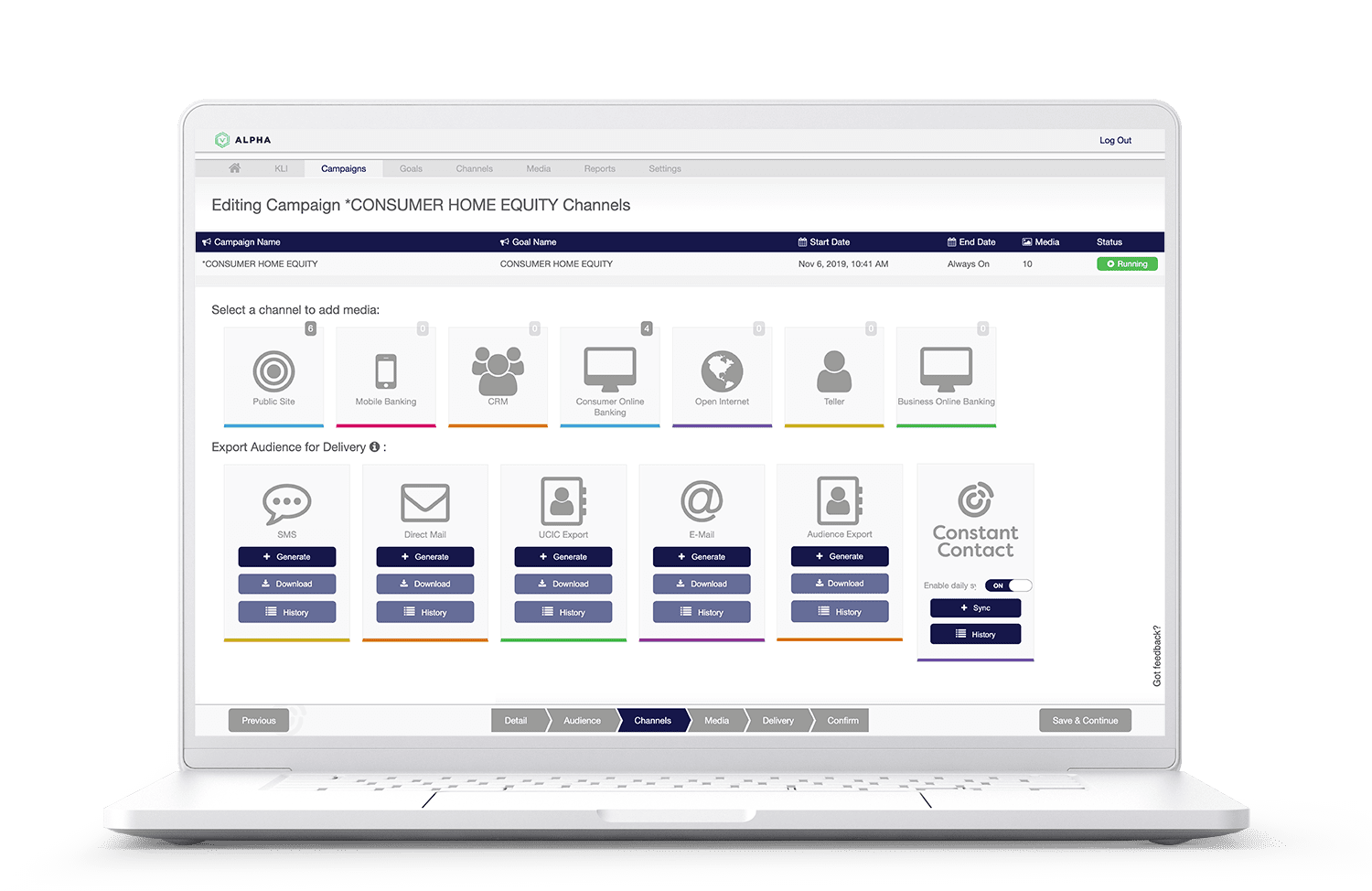

Find your target audience in your data

For most financial institutions (FIs), finding the right audience may take weeks of back-and-forth with IT. With Alkami, it takes minutes. Having analyzed thousands of successful marketing campaigns, we know what works so you can get results fast. Gain access to 100+ recommended audiences that are proven to drive engagement.

Want to do it yourself? The self-serve audience list builder makes it easy to segment your account holders using insights built from everyday spend transactions. With integrations to popular campaign delivery tools, you can execute more high-performing campaigns faster than ever before.

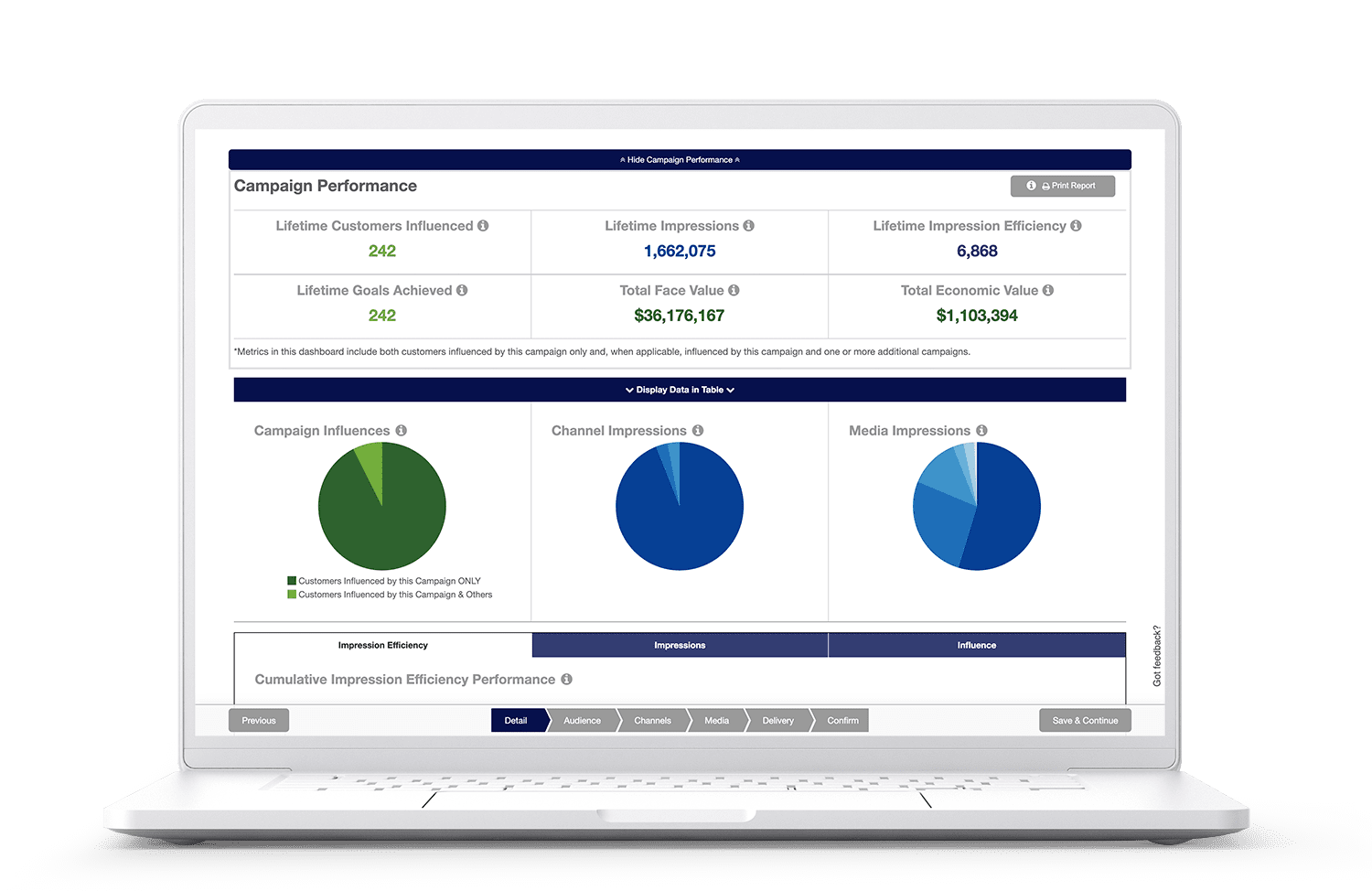

Automate campaign reporting

Reporting campaign performance can take days of digging through multiple data sources and channels. With Alkami, your results are automatically tracked, by campaign, channel, goal, and content type. No more spreadsheets to figure out which campaigns drive revenue for your FI.

Automated reporting allows you to quickly adapt to campaign engagement, so you can double-down on content that’s performing well and stop wasting resources on campaigns with low engagement.

Get hands-on support from day one

Each Alkami Data & Marketing Solutions client is assigned a dedicated Client Success Manager. These CSMs are experts in leveraging your data to support your marketing objectives. From onboarding to performance tracking, your CSM is there to help at every step.

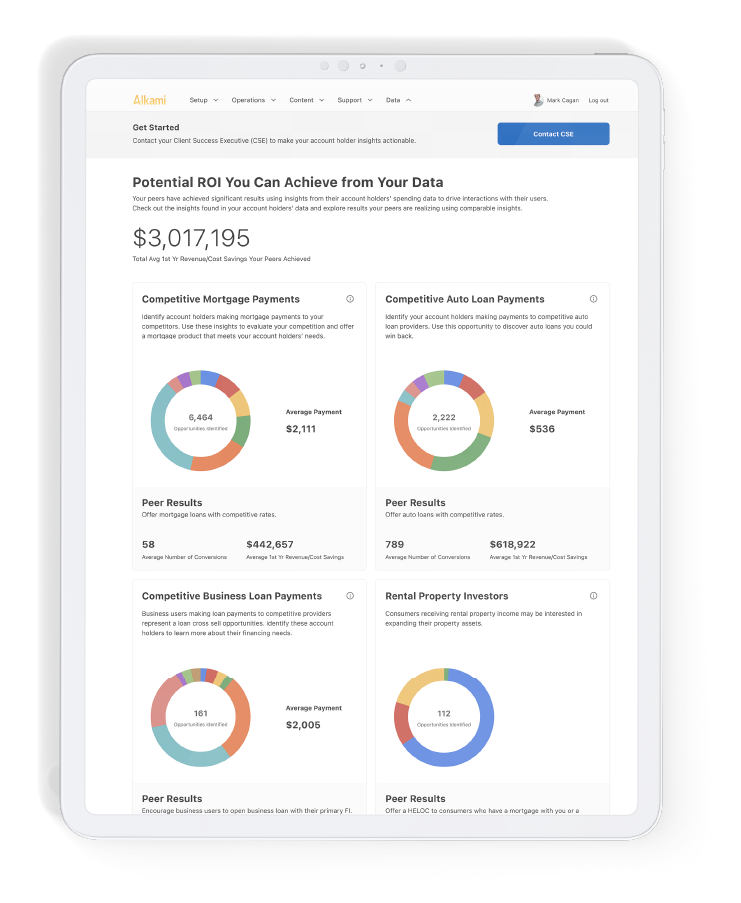

DATA ROI POTENTIAL DASHBOARD

Discover your opportunity with data

Unify the banking journey

Alkami’s financial services marketing automation helps you and your account holders grow strategically.

AI Predictive Modeling

Artificial intelligence in banking speeds your time to market and provides on-demand access to account holder insights.

Learn more >

Transaction Data Cleansing

Make better decisions with transaction data cleansing and financial data quality management tools.

Learn more >

Customer Insights

Empower your FI to unlock actionable insights about your account holders’ financial behaviors.

Learn more >

Commercial Banking Solutions

Commercial Banking Solutions Data & Marketing Solutions

Data & Marketing Solutions Positive Pay & ACH Reporting

Positive Pay & ACH Reporting Who We Serve

Who We Serve