Client Success, Resources, Testimonial

June 26, 2025

Elevating The Payments Experience with Digital Banking Solutions

Why American Eagle FCU Chose Alkami’s Digital Banking Solutions and Paymentus’s Payments Solutions f...

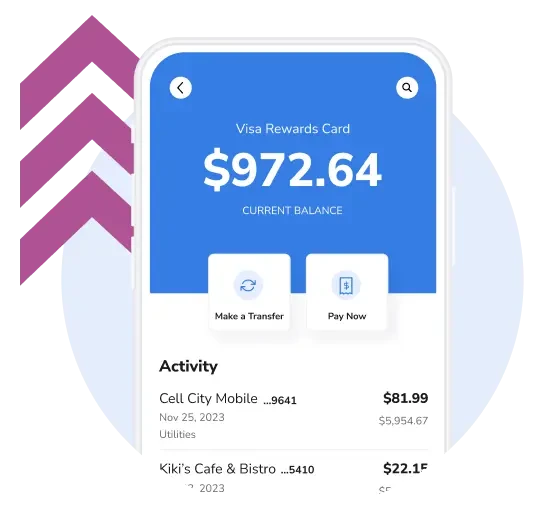

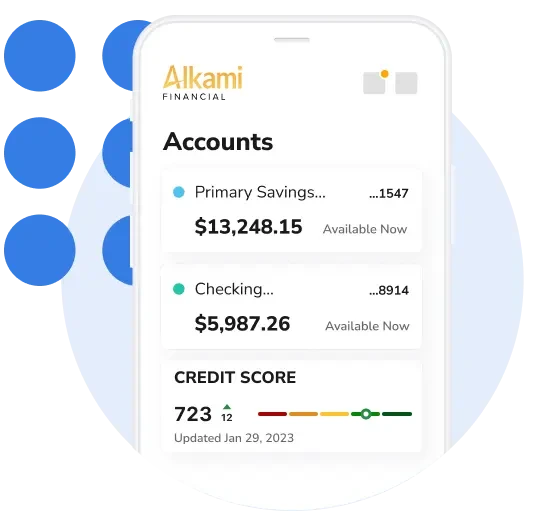

Digital banking users engage with many apps to manage their finances, which leaves them unable to have one clear view of their financial health. What if your institution could deliver the holistic financial picture consumers want, while uncovering the competitive insights your institution needs?

With Alkami’s personalized retail banking solutions, you can do exactly that. Now, financial institutions can leverage their digital banking platform to drive engagement, improve financial health, and unlock revenue opportunities.