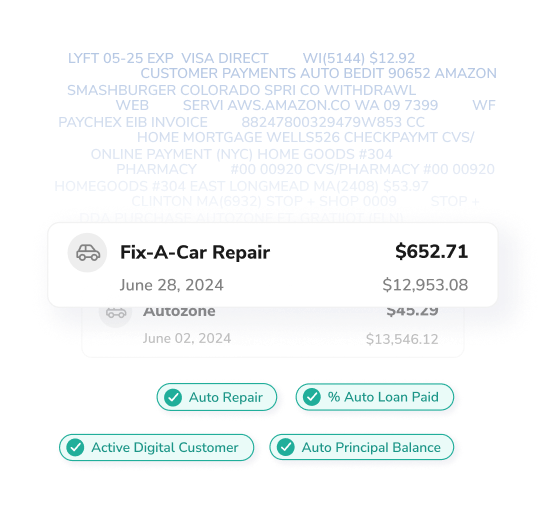

“Alkami identifies every useful data point in the transaction stream that can help us better serve our members.”

Alisha Johnson

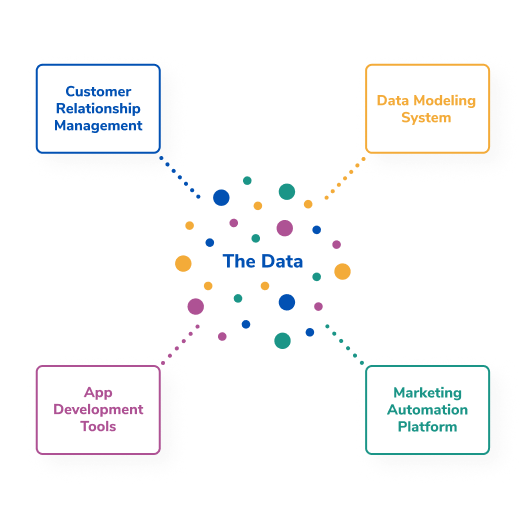

Unlock the power of your data analytics in banking across all account holders and activity. Access 50K+ data tags ready for your financial institution—you can view the top 100 data tags used by our customers here.