Fraud associated with check payments is on the rise, and can have devastating impacts on financial institutions and their business and consumer accounts. As fraudsters and cybercriminals become more sophisticated, institutions must remain hyper aware and proactive in safeguarding their assets and end users in digital banking solutions. In this blog, we’ll explore the basic concepts of check fraud, share key industry trends and highlight solutions such as Positive Pay designed to help your institution and your account holders stay ahead of emerging risks.

Check fraud is a form of financial crime where someone illegally manipulates or uses checks to trick others into giving them money or valuable goods. This can happen in various ways, such as writing checks from bank accounts that don’t have enough funds, forging someone’s signature, or altering the amount on a check after it’s been written. Some criminals even go as far as creating counterfeit checks that look real, making it harder to spot the scam. The consequences of check fraud can be serious, resulting in significant financial losses for both individuals and businesses. As technology advances, fraudsters continue to develop new tactics, which makes it essential for financial institutions and law enforcement to stay vigilant and protect against these deceptive practices.

Despite a significant decline in the use of checks over the years, check fraud remains a pressing issue that consumers and businesses must be aware of. In fact, as the frequency of check transactions has decreased, the rate of check fraud incidents has risen sharply, with reports of Suspicious Activity Reports (SARs) related to check fraud increasing by 134% from 2020 to 2023.

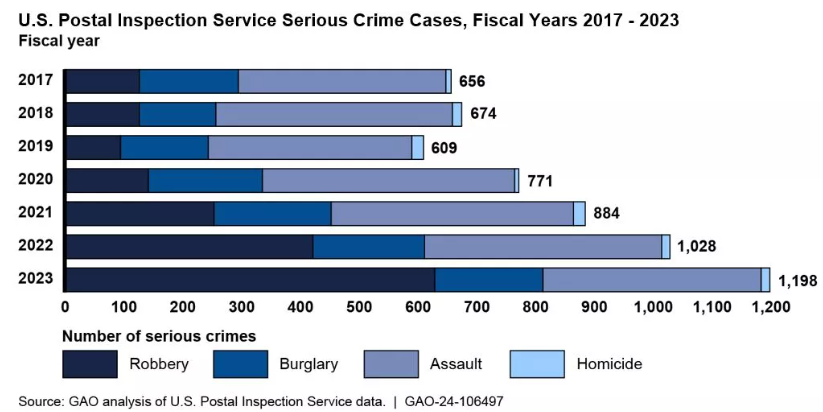

What exactly is causing this increase? Fraudsters are increasingly targeting the 17 billion checks exchanged each year in the U.S. due to their relative ease of manipulation associated with mail theft. Criminals often steal checks from mailboxes and postal workers, exploiting vulnerabilities in the postal system, such as outdated security measures and the presence of large volumes of checks sent during events like the COVID-19 pandemic.

#image_title

Check fraud encompasses a variety of schemes and tactics, making it a significant concern for consumers and businesses alike. Among the many forms of check fraud, two methods stand out as particularly prevalent in the United States: check washing and check counterfeiting. In this section, we’ll dive deeper into these forms of check fraud and how they are executed.

Source: Financial Crimes Enforcement Network, 2024

Check fraud impacts different generations in unique ways, reflecting their varying levels of familiarity with technology and financial systems. Baby boomers, who are often more accustomed to traditional banking methods, are frequently targeted through elder fraud tactics like robocalls and scams related to healthcare or government benefits, romance, or prizes. They are an attractive target to fraudsters as they typically have financial savings, own a home, and have good credit while also tending to be more vulnerable due to a combination of trust in familiar channels and a lack of exposure to newer digital fraud tactics.

On the other hand, millennials, who are generally more tech-savvy and comfortable with digital interactions, encounter check fraud through different channels. They are significantly more likely to fall victim to scams involving fake checks, often presented as opportunities for online shopping, job offers, or financial rewards. Reports indicate that millennials are 93% more likely than older generations to lose money to fake check scams, which also often look like a way to earn money. This increased susceptibility may stem from their engagement with peer-to-peer payment platforms and digital wallets, which can be exploited by fraudsters using familiar communication methods like texts or social media.

The generational divide in how fraud is experienced underscores the need for tailored and layered fraud prevention strategies. Financial institutions must adapt their education and outreach efforts to cater to the specific vulnerabilities and habits of each generation. For instance, while baby boomers may benefit from direct communications about the risks of traditional check usage, Millennials might require guidance on recognizing digital scams and securing their online transactions. By understanding these differences, financial institutions can better protect their customers or members and foster a safer financial environment for all generations.

Check fraud poses a significant challenge not only for consumers and businesses but also for the financial institutions that service them. If the risks of check fraud are not addressed with utmost urgency and care, financial institutions can experience substantial financial losses, increased operational costs, and reputational damage. When fraud occurs, financial institutions often bear the cost of compensating affected account holders, especially if fraud detection and prevention systems fail to catch the fraudulent activity in time. However, if the business delays in reporting or fails to safeguard its accounts, the liability may shift. Additionally, the process of investigating fraud cases, handling legal issues, and implementing stronger security measures can strain resources.

Positive Pay plays a vital role in preventing payments fraud. Below are some key solutions that help safeguard against check fraud.

Payee Positive Pay inspects the check image presented and compares the payee name provided on the issuance file with the payee on the check image. Any discrepancy flags the check as potentially fraudulent, prompting alerts to be sent to the account holder for further action and is also available for teller line validation of on-us checks presented to be cashed. This process significantly diminishes the risk of check fraud.

Check Positive Pay operates by verifying each check presented for payment against a list of checks previously authorized and issued by the company (a.k.a an issuance file). This issuance file or list includes essential details such as check number, account number, dollar amount, and payee and is also available for teller line validation of on-us checks presented to be cashed.

Reverse Positive Pay presents a report of checks that are clearing the account to validate the check number, dollar amount and payee.

In our Banking on Security: Check & Real-Time Payments Fraud webinar, Elizabeth Bailey, fraud manager from ABNB Federal Credit Union (ABNB) shares ABNB’s experiences with identifying check fraud and mitigating losses for their members and their institution as whole. She shared that members may be victimized and targeted by fraudsters, by way of stolen checks in the mail, for example. On the other hand, there could be members that try to victimize ABNB as an institution, by trying to deposit an altered or fraudulent check to their account.

ABNB practices a number of proactive measures to help prevent and mitigate losses associated with check fraud. Here are a few examples that were shared:

Want to learn more? Watch the recording of our webinar, Banking on Security: Check & Real-Time Payments Fraud where our panel of experts, representing diverse perspectives from product development, compliance, and real-world account holder experiences, shared their firsthand accounts of detecting, managing, and mitigating fraud. Regardless of your role within your institution, this webinar will equip your team with the knowledge and tools necessary to strengthen your fraud defenses.

Want to learn more? Schedule a demo with an Alkami representative to explore Alkami’s Check & ACH Positive Pay solutions.