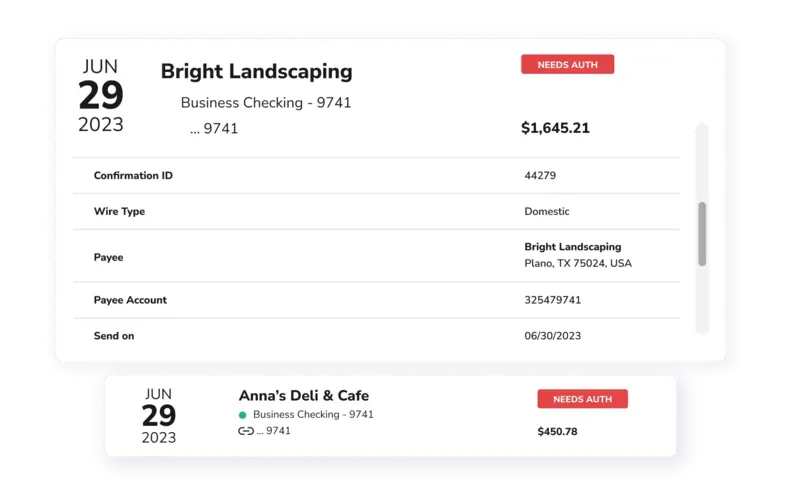

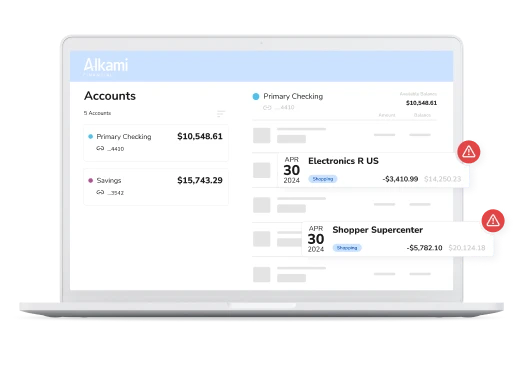

Did you know that 65% of organizations were victims of attempted or actual payments fraud activity in 2022? Through education and payment fraud prevention technology like Check and ACH Positive Pay, your FI can proactively combat fraudsters as new payment method vulnerabilities evolve.

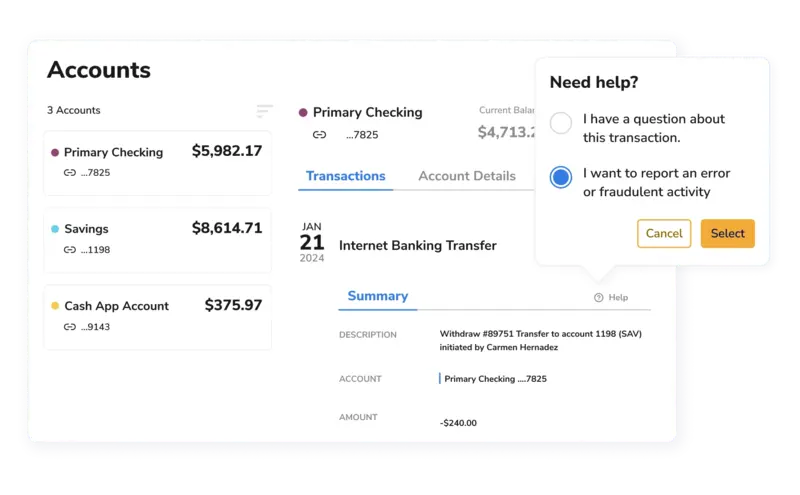

With 82% of Americans leveraging digital payments and 65% of organizations impacted by payment fraud, FIs may struggle to grow by relying on outdated, manual systems to process disputes. Without automation to digitize and modernize the management of payment disputes, banks and credit unions face the challenges of non-compliance audit risk, staff training, increasing write-offs/losses, and a negative user experience.

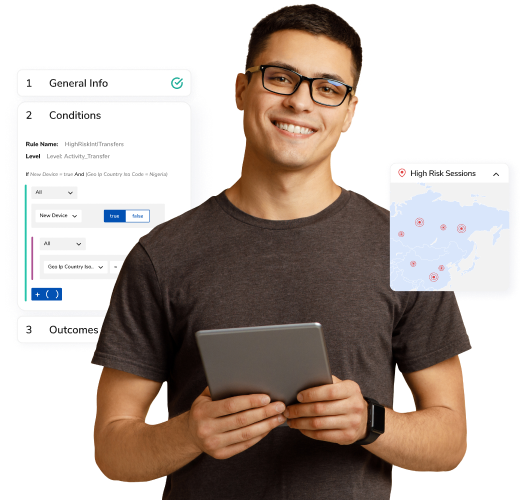

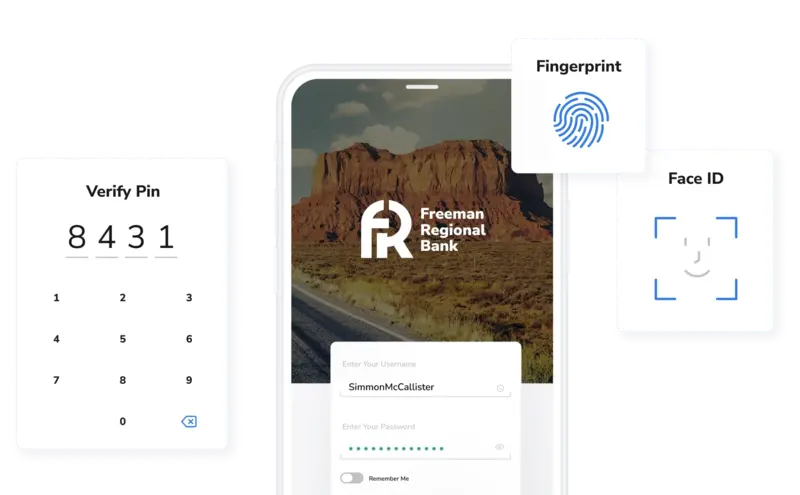

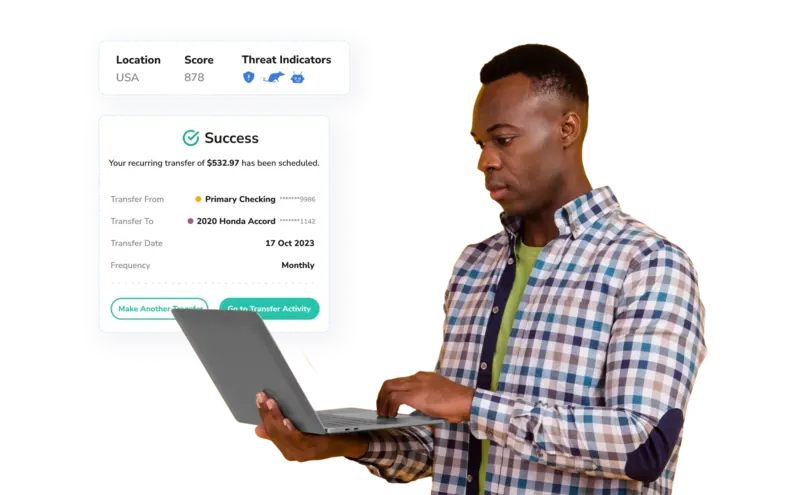

Watch now to understand how you can apply behavioral biometrics to detect high risk events and proactively defend against digital risk and tech-savvy fraudsters.