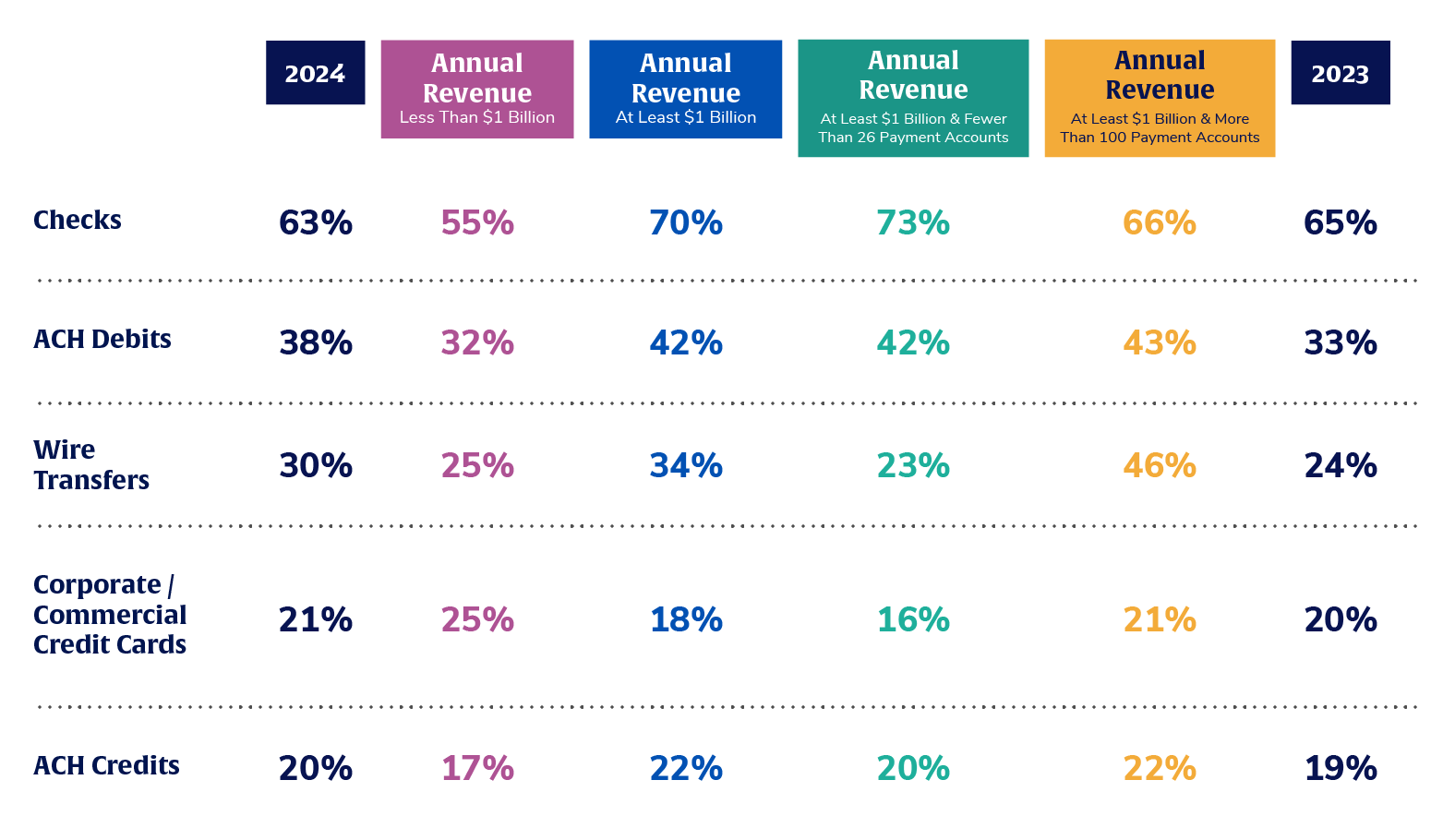

Fraud is on the rise, and checks are still the top target. According to the 2025 AFP® Payments Fraud and Control Survey, 79% of organizations faced attempted or actual payment fraud in 2024. And among all payment methods, checks lead the pack, with 63% reporting fraud attempts.

Despite this, more than 90% of organizations still use checks, and 75% send them through the United States Postal Service (USPS) without tracking. No wonder fraudsters keep coming back. This isn’t old-school crime, it’s easy money.

That’s exactly why solutions like Payee Positive Pay have become essential. By verifying the payee name on each check, financial institutions can catch altered or counterfeit items before they clear—and before losses stack up.

Payee Positive Pay is an essential check fraud prevention solution that helps banks and credit unions detect check fraud by comparing the payee name on a presented check image against the payee name field on the business client check issue file.

This is made possible with a payee match confidence score (0 to 999), which uses the latest technology to determine whether the confidence level meets your set threshold. You define a standard confidence score but can adjust it at the account level, and the system takes care of the heavy lifting.

Payee Positive Pay isn’t just about catching fraud—it’s about catching it efficiently. Alkami’s analysis of all of our financial institution customers with Payee Positive Pay showed a key benchmark for those who had over 10,000 monthly items requiring payee verification. The key benchmarks are: the overall number of items exceeding the 800 confidence score threshold or payee name match success rate for all financial institutions’ payee items was 93.7%. The figure for those with 10,000 or more monthly payee items sits at 95.2%.

That might seem impressive at first glance, but when you consider the scale, even a small percentage of mismatches can result in thousands of flagged exceptions requiring manual intervention by a business client or potentially the financial institution’s staff. Each of those exceptions slows down processing, adds operational burden, and increases fraud exposure. While they may still be catching fraud attempts, their efficiency is decreasing. The takeaway? There’s real opportunity for improvement—and real risk in settling for average.

Here are the usual suspects behind low payee match success rates:

Items using different font sizes and different font types may lead to lower confidence scores.

Overly decorative check designs or certain backgrounds might win design awards—but they’re scanner nightmares. Keep designs and backgrounds simple and scanner-friendly.

Let’s be clear: Alkami’s Payee Positive Pay handles handwritten checks with impressive accuracy. The real challenge isn’t handwriting—it’s messy or difficult to read handwriting. Encouraging printed checks can help boost match rates even further.

Altering a payee name is one of the oldest tricks in the fraud book. Thankfully, an advanced Payee Positive Pay system can flag these fast.

Improving payee match rates doesn’t always require a massive system overhaul—sometimes, small operational tweaks can make a measurable difference. Many financial institutions already have the right tools in place; the challenge is making sure those tools are optimized and consistently applied. Below are practical ways to fine-tune your approach and drive better results.

One high-volume Trustmark Bank (Trustmark) business client was manually reviewing 300 to 400 checks per week using Reverse Positive Pay. These weren’t flagged exceptions—they were reviewing every check the client issues. While this setup can be beneficial for small to medium businesses with low check volume, it wasn’t ideal for this client’s size or workload—but at the time, it was the best available option.

Trustmark strategically adopted Payee Positive Pay to deliver enhanced fraud protection and efficiency to their business clients. When the solution became available, this particular client made the transition quickly, drawn by the system’s simplicity and the ability to reduce manual check reviews. Instead of combing through hundreds of checks each week, the client now only reviews true exceptions—typically just 12–24 items. With teller validation and streamlined back-end processes, the result is a significantly more efficient workflow and a smarter, more targeted fraud defense strategy.

[Call out] Want to hear the full story? Watch the on-demand Boost Positive Pay Adoption & Stop Check Fraud webinar to hear directly from Ryan Hill, first vice president, director of treasury services product management at Trustmark Bank, on how they achieved these results, and how your institution can too.

The payee name success rate sets a clear benchmark—but it’s not a ceiling. Many institutions are now focusing on how to reduce manual exception review and improve operational efficiency without sacrificing fraud protection.

Alkami’s Payee Positive Pay solution is designed to support that goal by helping financial institutions:

Whether you’re refining an existing fraud strategy or launching Payee Positive Pay for the first time, Alkami delivers the tools to make it easier, smarter, and more effective.

Q: How is Payee Positive Pay different from regular Positive Pay?

A: Traditional Check Positive Pay verifies the check number and amount. Payee Positive Pay adds verification of the payee name, dramatically increasing fraud detection.

Q: What’s considered a “good” payee match score?

A: Over 800 is generally solid—but watch for consistency. A few bad months could signal an issue with payees’ scanners or check formats.

Q: How do confidence scores work?

A: They range from 0–999. Higher scores = higher confidence the payee name is a match. You set your institution’s threshold to flag items for review.

Q: How can Alkami help improve our payee match success rate?

A: Alkami uses the latest payee match technology in a secure Application Server Provider (ASP) environment that’s continuously updated – so you’re always working with the most advanced tools available. From data tuning to exception automation, our platform helps reduce manual reviews and increase operational efficiency, so you can improve match accuracy while saving time.