Despite the rise of real-time payments and digital wallets, one legacy payment type continues to hold surprising influence in the world of business banking: the paper check.

And unfortunately, fraudsters have noticed.

According to the 2025 AFP Payments Fraud and Control Survey, 63% of organizations experienced check fraud attempts—more than any other payment method. Check washing, counterfeit checks, and altered payee names are on the rise, costing financial institutions and their business and commercial clients millions, further eroding trust with these highly valued relationships.

Payee match, a key feature of payee positive pay, provides a highly effective defense against today’s most common check fraud tactics. Yet despite its proven value, adoption remains stubbornly low. Only 29% of financial institutions are satisfied with how many of their business clients are actively using check positive pay tools. The gap between availability and actual usage continues to leave clients—and financial institutions—exposed.

So what’s really holding back adoption—and what can financial institutions do to change that?

Check Fraud is no longer a risk—it’s a certainty. According to Datos Insights, 94% of bank executives reported an increase in check fraud among business clients.

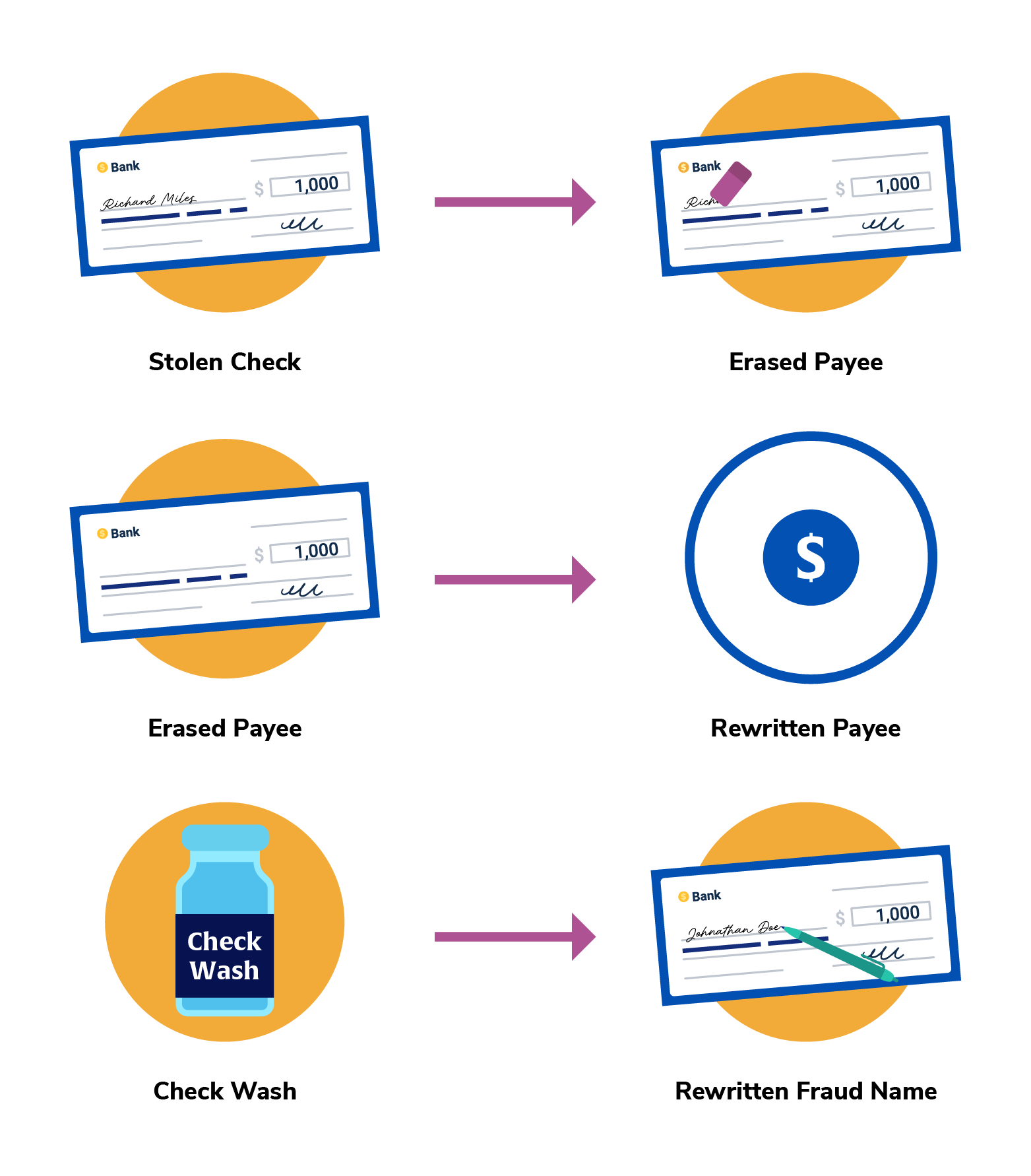

The most common attack method? Check washing—where fraudsters steal a legitimate check, use chemicals to erase the original payee name, then change the payee name to themselves. Check washing is a tactic that often goes undetected without additional layers of verification like payee match, which compares the payee name on the cleared check to the one originally issued.

Payee match is an advanced form of check positive pay that verifies three key data points before a check clears:

| Feature | Check Positive Pay | Payee Positive Pay |

| Check Number Match | ✅ | ✅ |

| Dollar Amount Match | ✅ | ✅ |

| Payee Name Match | ❌ | ✅ |

When a business issues a check, it submits details in a check issuance file—including the routing number, account number, check number, amount, and payee name—to its financial institution. When a check drawn on an account enrolled in payee positive pay is later presented for payment, the system compares those details. If there’s a mismatch, the check is flagged as an exception for the financial institution or account holder to review and accept or return the check. Payee positive pay can also be done at the teller line for checks being presented for cashing.

This simple step makes all the difference when dealing with altered checks or sophisticated fraud attempts.

Despite its effectiveness, payee positive pay still faces significant adoption challenges. Here’s what’s slowing things down:

These aren’t just barriers—they’re opportunities for forward-thinking financial institutions to step in and lead.

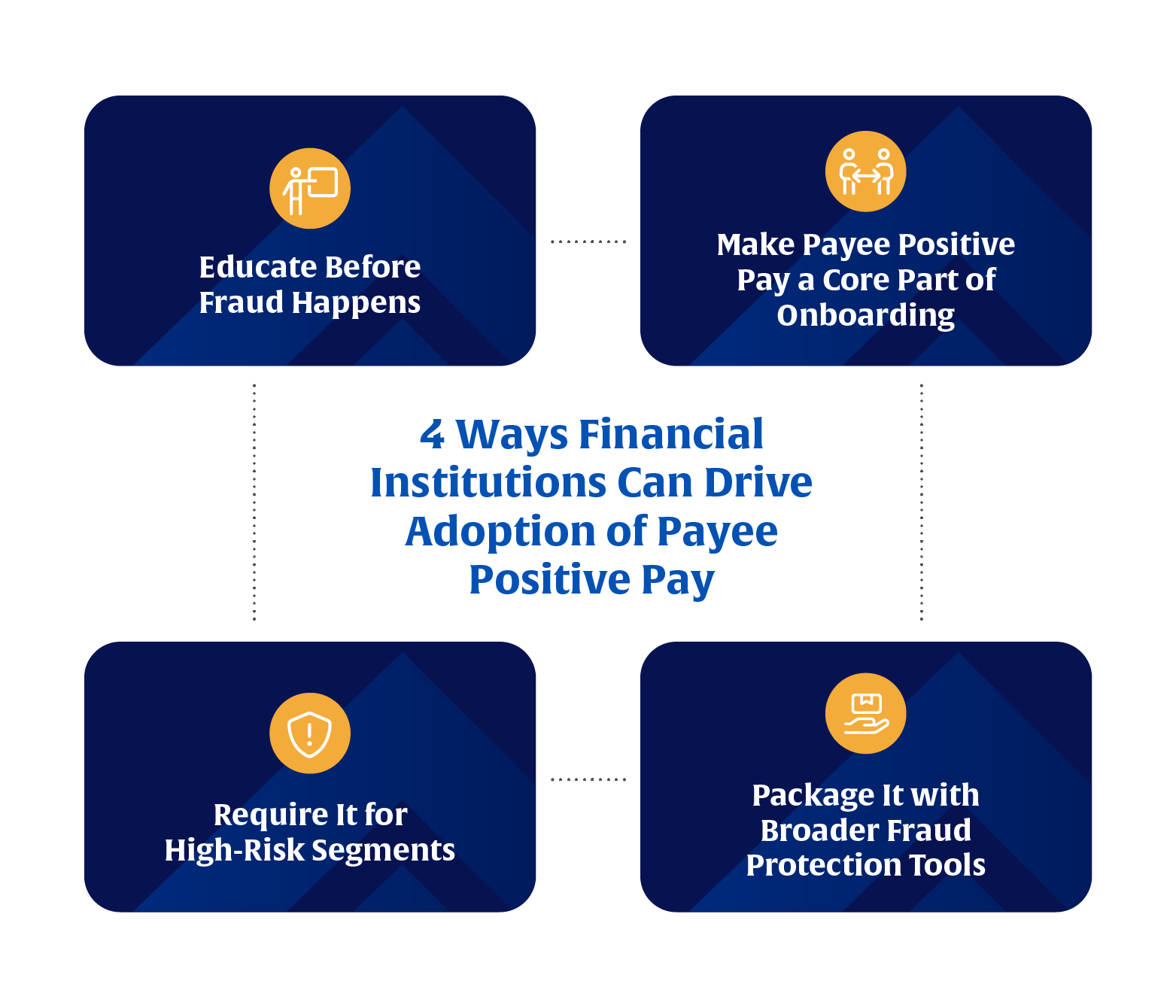

Many business clients do not realize how exposed they are until it’s too late. Shift that narrative by making fraud education part of the client experience.

Consider the following education tactics:

Don’t treat payee positive pay like an add-on. Just like dual controls or multi-factor authentication (MFA), payee positive pay should be a default part of the account setup process for business clients—baked in, not bolted on.

How to reimagine the business onboarding experience:

Fraudsters don’t specialize—they experiment. Financial institutions should take a layered approach to fraud prevention that spans channels, users and transaction types. From smarter MFA to behavioral analytics to proactive tools like ACH positive pay, a multi-pronged strategy is essential. Explore how top institutions are combining tech and education to stay ahead of fraud.

Here’s how your institution can strengthen fraud prevention while increasing adoption:

These bundled strategies not only increase protection—they increase product stickiness and cross-sell opportunities.

In business banking, check fraud is no longer just a security concern—it’s a strategic threat.

The risk is well-documented, the solution exists, and the business case for adoption is clear. Yet too many financial institutions still treat payee positive pay as an optional add-on, rather than what it truly is: a core control in a modern fraud prevention strategy.

Adoption doesn’t just protect your business clients—it protects your reputation, reduces your exposure, and positions your institution as a proactive partner in an era where trust is everything.

The opportunity now is to lead.

Lead with education.

Lead with integration.

Lead with protection built into the products your clients already use.

Because if your institution isn’t making payee positive pay the standard, it’s only a matter of time before a fraudster makes the decision for you.