At Alkami Co:lab 2025, our panel discussion featuring Holly Hughes from ProSight Financial Association, Monica Barker from Mascoma Bank, and Dawn Brummett from ORNL Federal Credit Union explored the journey of women in the banking industry.

Holly commenced the session by providing an overview of the pioneers who shaped the industry. Highlighting stories about trailblazers who defied the odds long before women were at the helm of global financial institutions. Their legacy not only laid the foundation for women’s roles in finance but continues to inspire a new generation of leaders.

A quick synopsis… In 1877, Louisa B. Stephens made history by becoming one of the first women to serve on a bank board in the United States. She was appointed to the board of the First National Bank of Marion, Iowa. This milestone came during a time when women faced significant challenges in securing financial independence, let alone being accepted in historically male-dominated leadership roles. In 1903, Maggie Lena Walker became the first woman in the U.S. to charter a bank. Walker had a clear vision and her bank became a cornerstone of the African American community, offering services such as savings accounts, loans, and insurance; creating an avenue for wealth building and stability.

While Stephens and Walker are among the most prominent early women in banking, they were not alone in their efforts. Shifts in the legal and social landscape enabled monumental changes in women’s access to financial services and their representation in leadership. In 1974, the Equal Credit Opportunity Act was passed, enabling women to apply for credit independently, opening the doors to financial freedom. This legislation marked a significant step toward empowering women to manage their finances without a male cosigner. One year later in 1975, The First Women’s Bank opened in New York City, becoming the first bank owned and operated by women for women.

Over the next fifty years, women began to fill more seats in boardrooms, their roles evolved in banking, opening up opportunities for new positions not only as tellers but also in leadership, management, and technology. In 2024, there were more women in senior positions across central banks and leading financial institutions than in previous years. Today, women continue to lead and influence the banking industry in profound ways from technology to cultivating an empowered workforce.

During the panel discussion, Monica and Dawn shared experiences and lessons learned from their professional journeys. It was an interesting juxtaposition as the audience heard viewpoints from two women at different stages in their careers. Following their conversation, the focus shifted to the future of women in banking and what that means for the people who are actively influencing and shaping the industry. Financial institutions are the backbone of the U.S. economy and play such a pivotal role in their local communities. Banks and credit unions have an incredible ability to drive change and create positive outcomes in their account holders’ lives.

For the final portion of our session, we turned the spotlight on our audience to ask them about their thoughts on the future of women in banking – in their professional journey, in the workplace, and in terms of technological advancements. Here’s what they had to say…

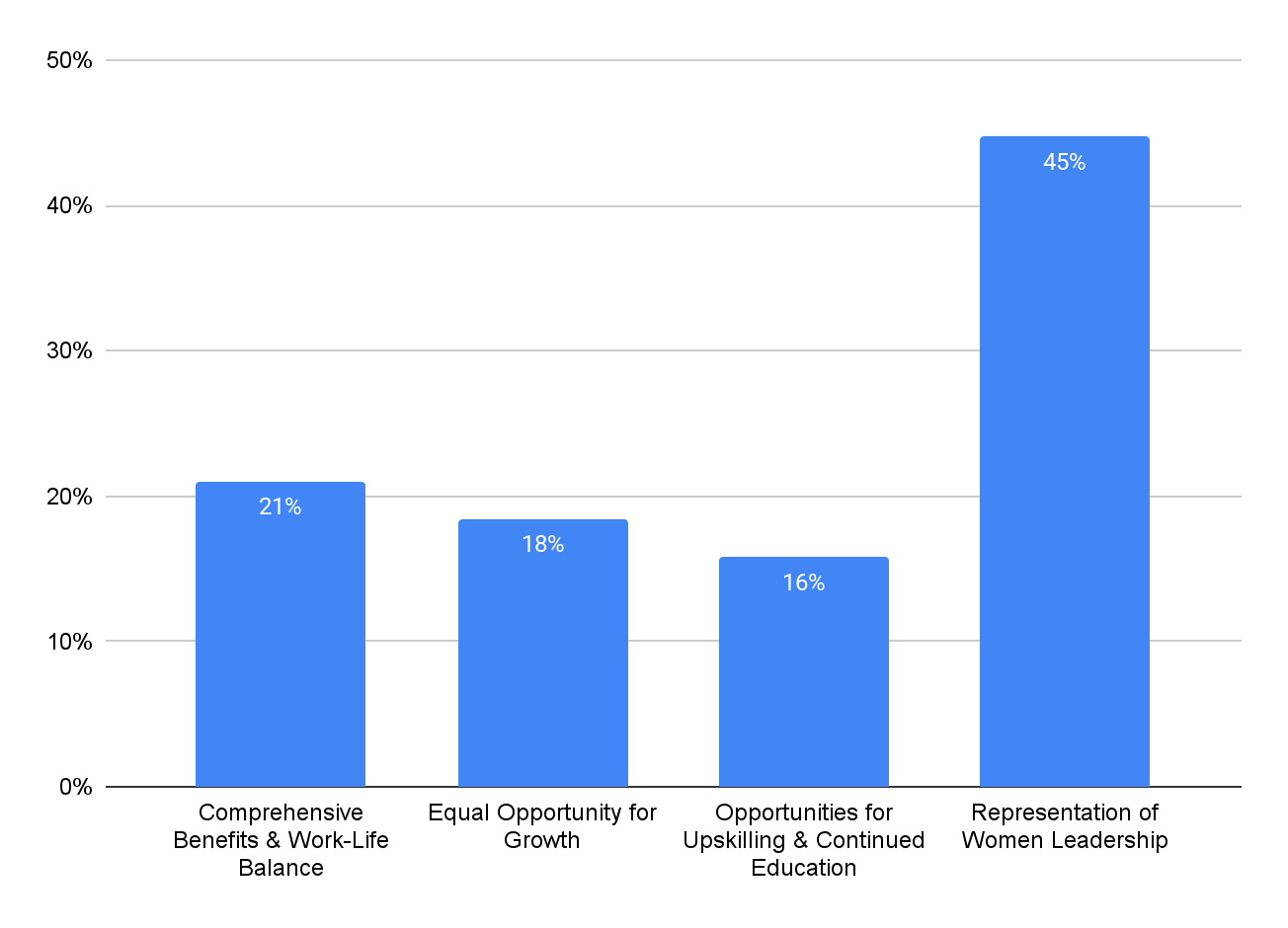

Over the next 5-10 years, which theme is most critical for Women in Banking in the workplace?

Which theme is most important for Women in Banking from a personal development standpoint?

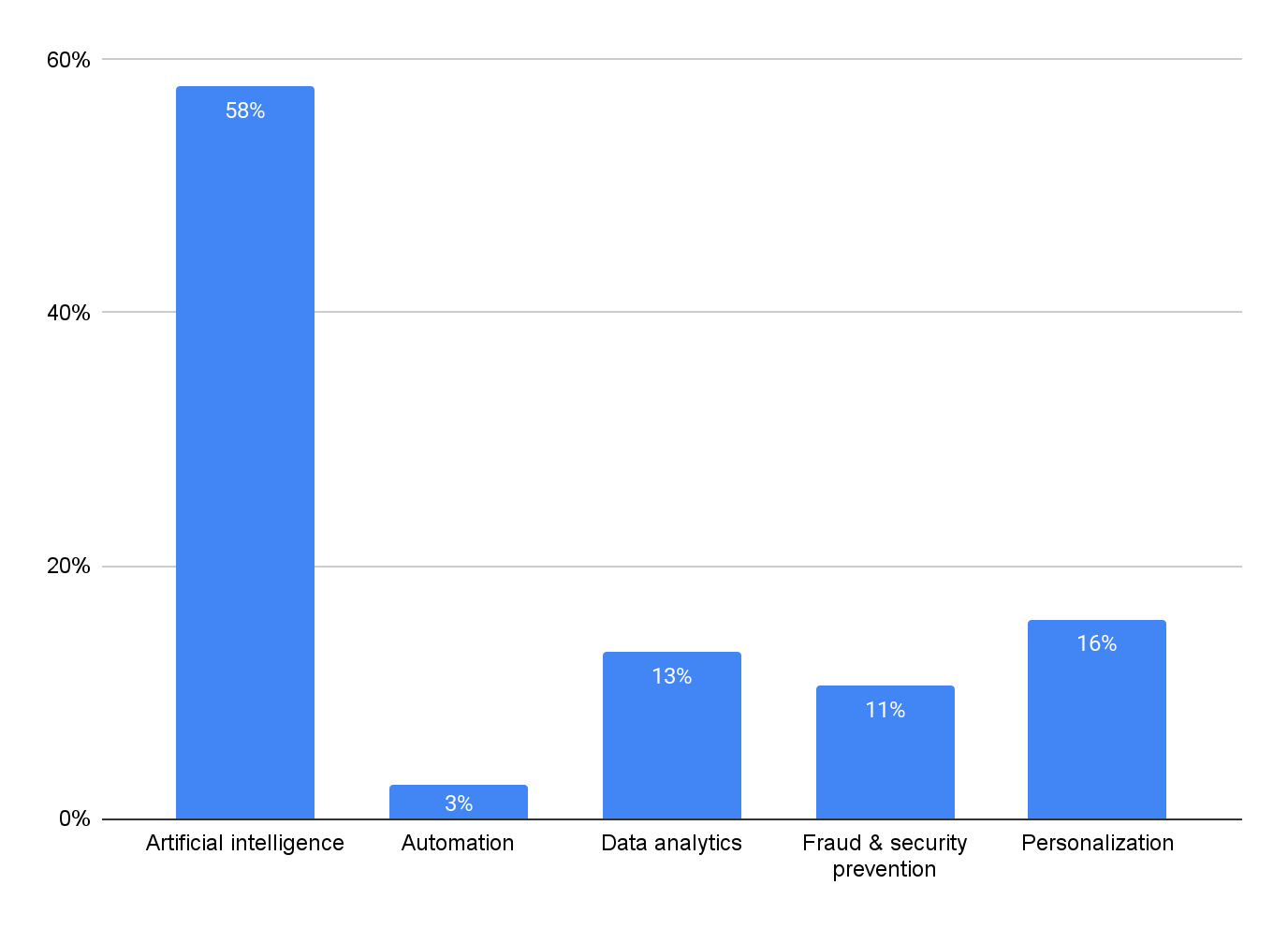

What technology do you think will make the greatest impact on the banking industry in the next 5-10 years?

When asked “what does the future of Women in Banking mean to you?”, one attendee said it best:

It also means opening doors for the next generation of women. It’s not just about representation; it’s about transformation. I see a future where women lead with both strength and empathy, using data, technology, and human insight to build financial systems that are more inclusive, responsive, and visionary. Most importantly, it means we don’t wait for a seat at the table—we bring our own.”

Coming out of these lively conversations, one thing was clear – the industry is evolving across every lane whether that is technological advancements in artificial intelligence to shifts in the workplace lending to greater representation in leadership roles. Women are making significant strides in driving innovation and fostering accessibility for all account holders. Their influence in banking is only expected to grow; reshaping the workplace with enhanced creativity, empathy, and collaborative skills. From promoting mental and physical well-being strategies to leading discussions on the importance of work-life balance, financial institution leaders are creating workplaces that are not only more equitable but also beneficial for their bottom line.