See how business banking platforms are helping financial institutions and clients centralize cash and liquidity management for better control and decision-making.

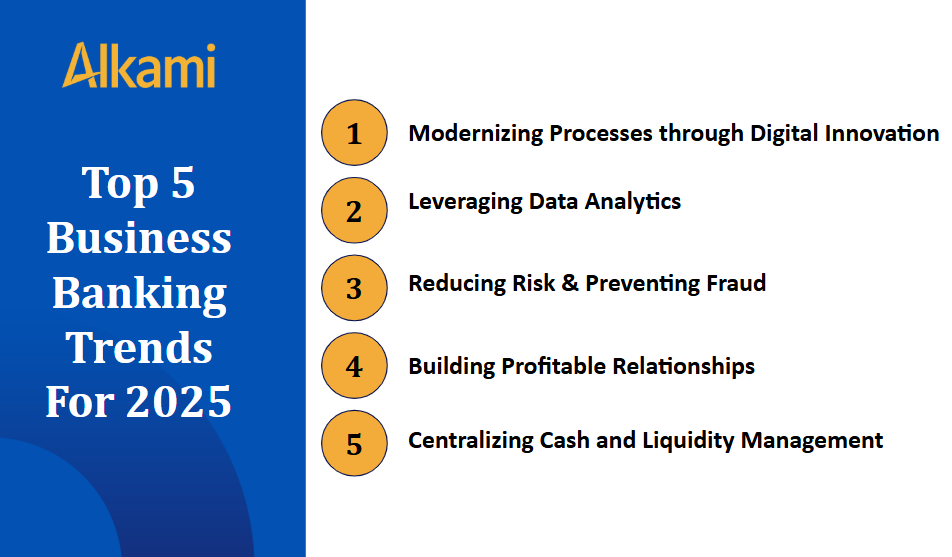

Welcome to the fifth and final installment of Alkami’s Top 5 Business Banking Trends Shaping 2025. After exploring innovation, analytics, fraud prevention, and relationships, we’re closing the series with a trend that ties it all together: centralizing cash and liquidity management.

For both financial institutions and the businesses they serve, this shift isn’t just operational — it’s strategic.

By offering a business banking platform that provides real-time visibility, seamless integrations, and smart automation, banks and credit unions are enabling clients to take full control of their financial position — while positioning themselves as indispensable partners.

Why Centralized Cash Management Matters

Businesses can’t afford to guess where their cash is or how much they have on hand. Whether it’s planning payroll, paying vendors, or responding to market shifts, real-time insights into liquidity are essential.

As Jeff Luczak, vice president of cash management at Landmark Credit Union, explained:

“We offer products like loan sweeps and investment-type sweeps to help members optimize their liquidity. The goal is to keep their cash either earning the most it can or reducing the interest they’re paying on loans.”

That’s the essence of centralized cash management — ensuring every dollar is either working or saving.

For financial institutions, the benefits are two-fold:

- Helping business clients operate more efficiently

- Creating deeper, more profitable client relationships (hello again, Trend #4)

Better Cash Flow Visibility = Stronger Relationships

When business clients can see and manage their cash in real-time through tools that work with their existing systems, trust grows. That’s why institutions like Mountain America Credit Union prioritize compatibility and usability.

Kyle Guest, vice president of business services at Mountain America Credit Union, reinforced this idea:

“Most small businesses use platforms like QuickBooks,” said Kyle Guest. “So syncing our online banking system with their accounting software allows them to reconcile transactions seamlessly. It’s a huge advantage and helps cement our position as their preferred financial partner.”

This focus on integration speaks directly to Trend #1: Modernizing Processes through Digital Innovation. When systems talk to each other, everyone wins — especially busy business owners who don’t have time to toggle between disconnected platforms.

From Manual to Automated: A New Era of Treasury Services

Centralizing liquidity isn’t just about moving balances around. It’s about automating those movements in smart, efficient ways that support a business’s financial goals.

At Landmark Credit Union, tools like same-day ACH, external transfers, and sweep products help clients automate cash flow management. That not only saves time, but reduces errors and increases flexibility.

“We strive to be our members’ primary financial institution—not just one of many tools in their toolbox,” Jeff added.

This philosophy — being essential rather than optional — mirrors the broader shift toward anticipatory banking highlighted at Alkami Co:lab 2025. The idea is to not just respond to client needs, but to predict and proactively support them, using intelligent digital tools.

A Business Banking Platform That Brings It All Together

The need for centralized cash and liquidity tools brings us back to the bigger picture: the power of a business banking platform that is built to evolve.

When evaluating new treasury products, Kyle Guest shared a simple but effective framework:

“We ask if the product saves time, improves efficiency, or reduces costs. If it checks one or more of these boxes—ideally all three—we’re interested.”

This mindset is helping financial institutions build smarter portfolios of services — and it’s only possible when backed by flexible digital platforms like Alkami’s Digital Sales & Service Platform.

This platform enables:

- Real-time integration with client systems

- Automated cash optimization tools

- Seamless onboarding and product activation

- Scalable support across commercial segments

Connecting the Dots Across All Five Trends

Trend #5 doesn’t stand alone — it’s supported by the momentum built in the first four trends:

- Trend #1: Modernizing Processes Through Digital Innovation: Digital banking platforms enable seamless experiences, integrations, and access to treasury tools that were once only available to enterprise-level clients.

- Trend #2: Leveraging Data Analytics: Real-time data informs smarter liquidity decisions and helps institutions recommend the right tools — from investment sweeps to same-day ACH.

- Trend #3: Reducing Risk & Preventing Fraud: Stronger cash visibility reduces the likelihood of unauthorized transactions and helps institutions detect anomalies faster.

- Trend #4: Building Profitable Relationships: Providing value-added services like centralized cash management cements long-term relationships by making the institution essential to a client’s operations.

Now, with Trend #5, everything comes full circle — combining digital tools, real-time data, and strategic advisory into a single, streamlined experience.

What It Means for Financial Institutions

As businesses grow more complex, they need partners who can help them manage their financial lives with clarity, confidence, and control. Centralized cash and liquidity management is no longer a nice-to-have — it’s a competitive differentiator.

Financial institutions that offer a business banking platform aligned with these needs will:

- Increase client retention

- Improve product adoption

- Unlock new revenue through value-added services

- Enhance their role as trusted advisors

In short, they won’t just support their clients — they’ll help lead them.

Final Thoughts: Tying It All Together

Over the course of our five-part series, we’ve explored the key trends shaping business banking in 2025:

Together, these trends are transforming business banking platforms from transactional to transformational — and institutions leveraging modern, integrated solutions are leading the way.

Want to see how your financial institution can centralize liquidity management and deepen business client relationships?