At Alkami, our mission is to provide a digital banking platform that positions financial institutions to remain competitive and successful. The Winter 2026 Digital Banking Release (Winter 2026 Release) offers a significant step forward in providing the efficiency, precision, and autonomy banks and credit unions need to outpace the market.

The Winter 2026 release focuses on three key pillars: accelerating developer velocity, modernizing payment workflows, and providing granular control over business and commercial banking solutions. By streamlining back-office operations and enhancing the user experience, financial institutions can build deeper relationships with their account holders and business clients while reducing operational overhead and risk.

The ability to deploy custom features quickly is a competitive necessity. However, many financial institutions find their innovation cycles slowed by manual deployment processes and complex coordination between teams. Developing code for new features and functionality is only one part of the equation; the other half is the speed of execution.

With the Winter 2026 release, Alkami is proud to introduce the One-Click Software Development Kit (SDK) Manager. This self-service tool is designed to transform developer velocity and provide greater autonomy to your technical teams.

Previously, moving custom code from a staging environment to production often involved coordinated review processes and ticket-based workflows. The One-Click SDK Manager streamlines this experience by giving developers clear visibility and control over the deployment pipeline. With built-in automated validations and dependency checks, each deployment is reviewed for safety and compliance before going live.

Processes that once required extended coordination can now be completed much more efficiently. This empowers financial institutions to innovate at their own speed, delivering distinctive user experiences on the Alkami Digital Banking Platform with greater agility and fewer dependencies on Alkami’s engineering or support teams.

One of the most vital areas of the digital banking solution is the ability for users to manage their own security and identity settings. In the Winter 2026 release, we have completely refreshed the security settings tab to ensure a cleaner design and parity across mobile and desktop.

Banking security for account holders should be intuitive, consistent, and reliable. We have modernized the layout using our unified visual language to provide a unified experience across desktop, mobile web, and the native app.

Account holders now have full control at their fingertips anytime, anywhere. With easier access to key controls, they can manage their username, password, multi-factor authentication (MFA), and registered devices on any channel they choose. This consistency not only improves the user experience but also reduces the support burden on financial institutions by empowering account holders to safely oversee their security credentials.

Account holders now have full control at their fingertips anytime, anywhere. With easier access to key controls, they can manage their username, password, multi-factor authentication (MFA), and registered devices on any channel they choose. This consistency not only improves the user experience but also reduces the support burden on financial institutions by empowering account holders to safely oversee their security credentials.

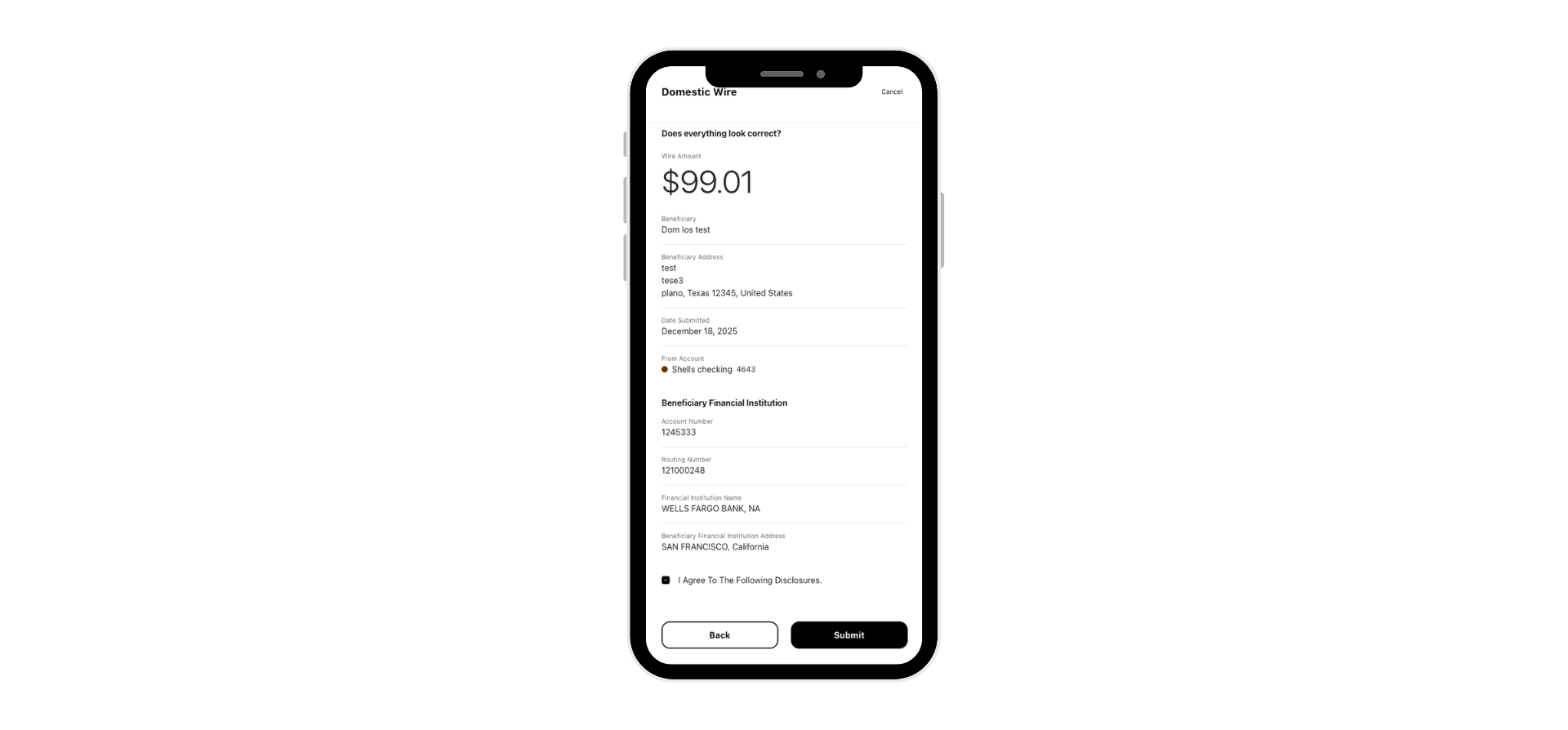

The expectation for efficient, real-time payments has never been higher. To meet this demand, we have significantly expanded our Retail Wires widget through a deep application programming interface (API) integration with Fiserv Payments Exchange.

In previous iterations of wire transfers, many financial institutions relied on manual wire file uploads, which are prone to re-keying errors and operational delays. This new integration enables straight-through processing (STP) for both domestic and USD international wires. By automating the data flow between the digital banking platform and the payment exchange, we remove the friction that often hampers international money movement.

With this enhancement, financial institutions can now offer a modernized payment experience that rivals fintech competitors. This update not only reduces risk through automation but also sets a technical foundation for future real-time foreign currency (FX) wires, ensuring financial institution’s payments strategies remain future-ready and compliant.

Growth on a digital banking platform extends far beyond transaction processing; it is about maximizing the commercial and deposit potential of every user interaction. To scale effectively, financial institutions require a sophisticated ecosystem that transforms the digital channel into a high-performance engine for acquisition, retention, and cross-sell velocity.

The Winter 2026 Release introduces enhancements designed to increase operational agility across both retail and business segments. By delivering the sophisticated controls and data-driven insights that modern account holders demand, these updates empower institutions to capture high-value deposits, onboard complex entities with confidence, and convert digital engagement into a primary driver of sustainable revenue growth.

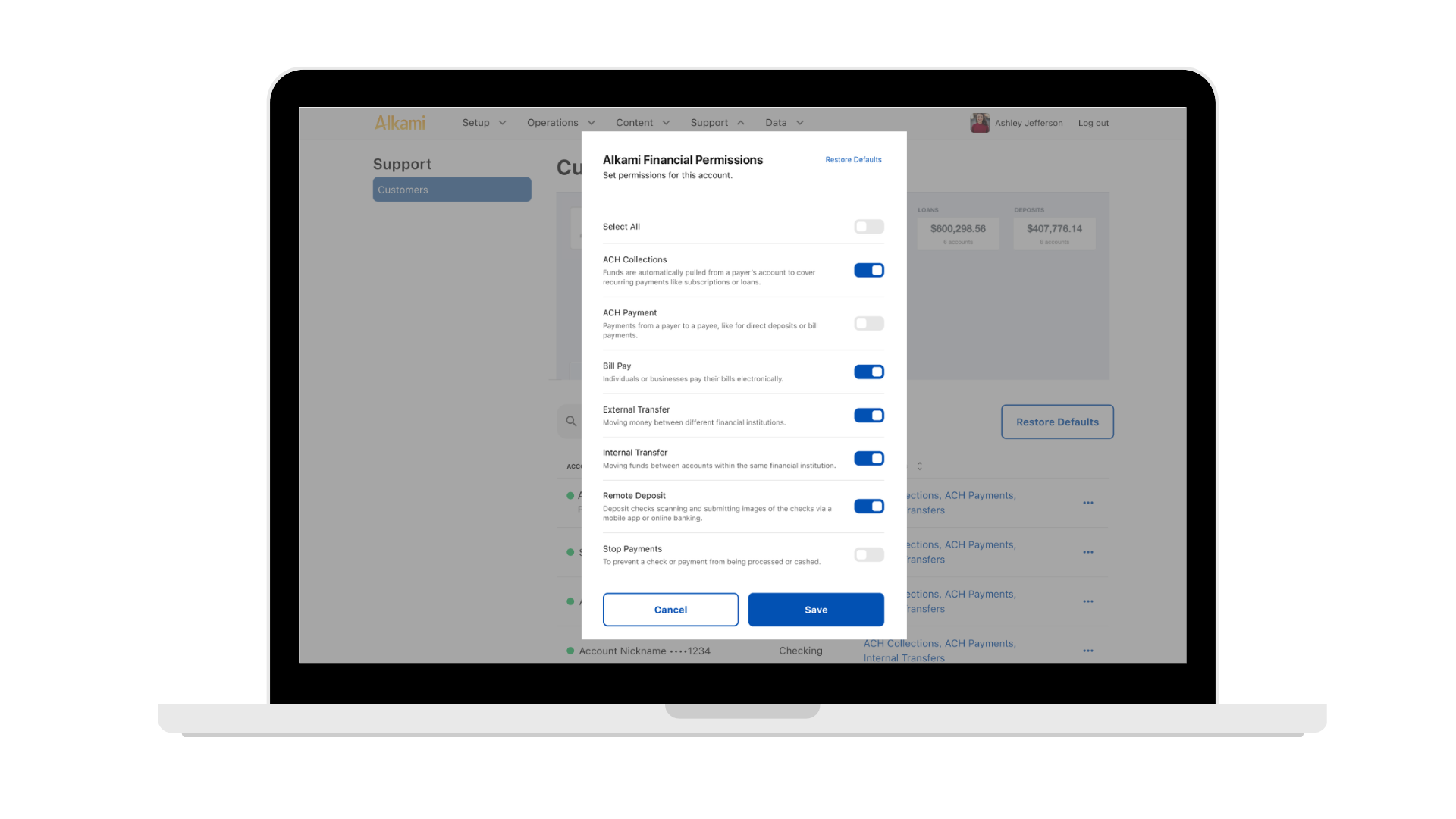

The Winter 2026 Release scales our existing security architecture by introducing Account-Level Business Permissions. While standard systems often rely on generalized access, this update provides the granular precision required to manage today’s sophisticated commercial structures. By replacing broad permissions with targeted, account-level controls, financial institutions can confidently support their most complex clients while strengthening their overall security posture.

Historically, permissions were often managed at the user level, leading to security vulnerabilities. Now, administrators can enable or disable specific features for individual business users. For example, an administrator can allow a user to initiate automated clearing house (ACH) transfers from an operating account while restricting those same capabilities on a tax account.

This granularity significantly reduces risk exposure for financial institutions while allowing primary business users to tailor the banking experience to the specific purpose of each sub-user, ensuring that employees have exactly the access they need.

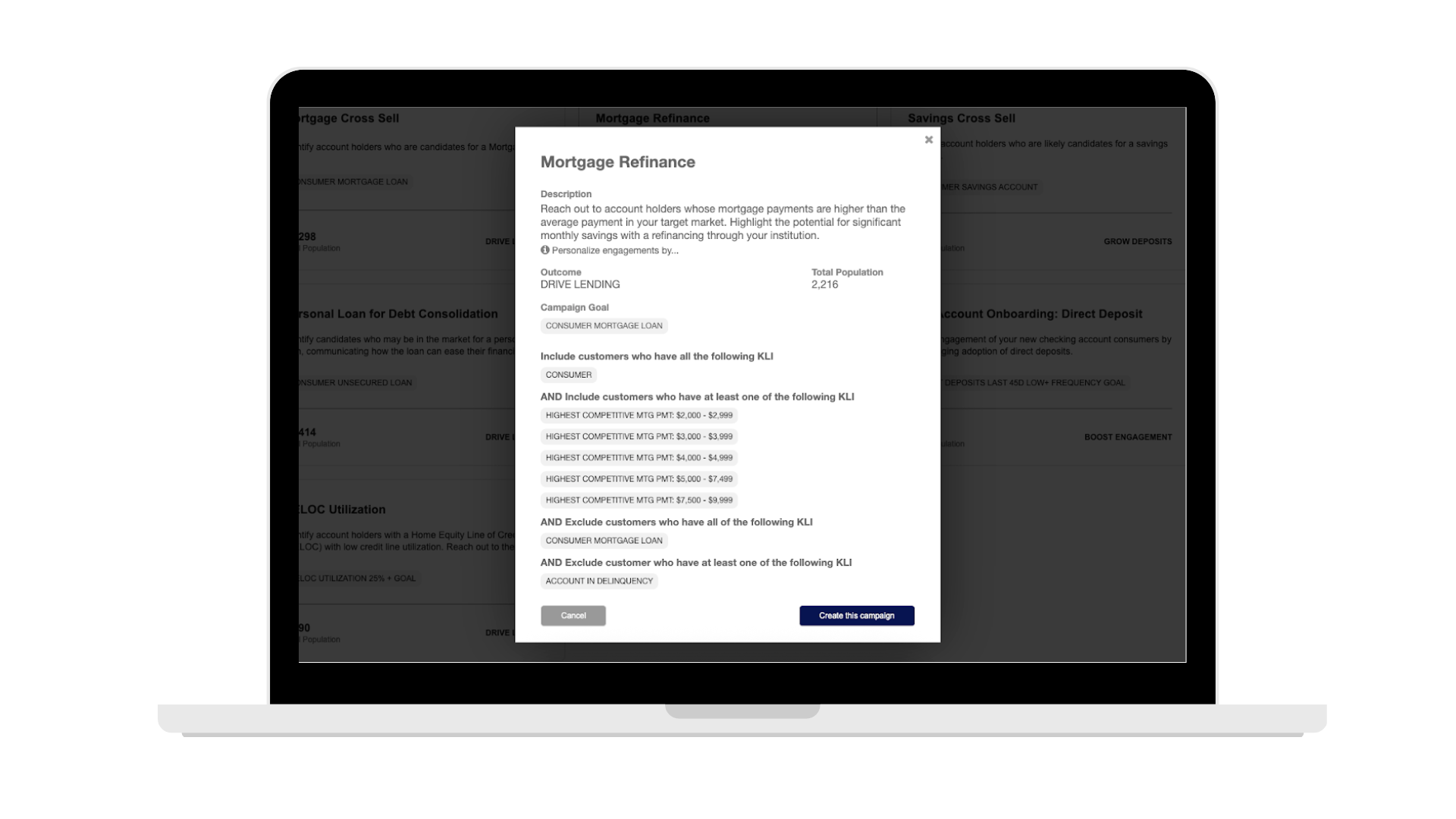

In a shifting interest rate environment, data-driven marketing is the key to deposit growth. Developing account holder segmentation for every marketing campaign from scratch is time-consuming. To solve for that, Alkami’s Data & Marketing Solution has been updated to include a suite of Out-of-the-Box Marketing Campaigns. These campaigns address the most valuable outcomes for banks and credit unions, such as account holder engagement and deposit growth. We have launched the ‘Seize the Rate’ campaigns, specifically optimized for loan growth.

By leveraging pre-built, data-backed campaigns, your marketing team can launch targeted offers in minutes. This drives higher conversion rates on the Digital Banking Platform and ensures your institution remains top-of-mind for every financial milestone.

Efficiency doesn’t stop at the consumer or business user interface; it must extend into the back office and the initial digital account opening experience.

Why it matters:

These enhancements reduce the operational noise that can slow down support teams at financial institutions. By giving administrators better tools to maximize operational throughput, we help lower the cost to serve while providing a smoother experience for the account holder or business client.

As account holders and business clients expand their digital footprint, the volume of data within their profiles scales in complexity. Your digital banking platform should serve as a definitive record of truth, not a source of friction.

Consider a high-stakes moment of tension where a business client is disputing a payment with a property management company. The client knows the funds were sent, but the manager claims no record exists. In that moment, the user turns to their digital banking platform for immediate resolution.

Retrieving that proof must be an intuitive, high-velocity experience. By providing precision search and customizable tagging, financial institutions empower users to resolve external disputes instantly. This level of contextual clarity transforms the Platform into a vital tool for financial advocacy, deepening the trust that drives long-term retention.

We’ve introduced a modernized layout featuring precision account filtering and account tagging for business users. The addition of account search for business and retail customers or members means that account holders can now find any account instantly by searching for a nickname, account type, or the last four digits of an account number.

For business users managing dozens of accounts, the ability to create custom tags is a game-changer. They can now group accounts by project or entity, allowing your business clients to focus on high-value tasks rather than on navigation.

For a complete list of new and improved features, Alkami customers can visit the Alkami Community site.

The Winter release is just the beginning. We are excited to continue these conversations in person at Alkami Co:lab 2026, taking place from April 13-15 in San Diego. Join us at the new Gaylord Pacific Resort to network with industry leaders and discover why Alkami is the preferred digital banking platform for growth-minded financial institutions.