The business and commercial banking landscape is evolving rapidly. In this blog, we’ll explore Alkami’s top five trends shaping the future of the business and commercial banking sector. This is an update to last year’s trends list.

In 2024 financial institutions will be, or should be, focusing on strategic treasury management solutions (particularly fraud protection), artificial intelligence (AI) automation, real-time transactions, lending, and even redefining commercial banking solutions as a whole.

These trends not only empower the business owners and operators, increase utilization and stickiness of accounts, but they also enhance the security and efficiency of the financial institution itself.

Businesses and their banking technology partners are placing a renewed emphasis on strategic treasury management solutions. What exactly is ‘strategic treasury management’? The approach is packaging up offerings that fundamentally improve payment processes, enhance working capital efficiency, and strengthen compliance and continuity measures. Key pillars of this strategy include:

Learn more about the many available security and fraud prevention solutions available to financial institutions.

The use of AI in commercial banking solutions is becoming increasingly prevalent. Small businesses are already feeling market shifts and are open to using artificial intelligence automation, data and online experiences as a result of digital transformation. In 2024, the industry will see an increased use of artificial intelligence in banking across various domains:

Real-time transactions are becoming a norm. In 2024, businesses want 24/7 payment capabilities and seamless fund transfers across accounts and institutions. Speed of payments is essential. Research shows that speed is ranked very high on small businesses’ list of banking priorities*, but their satisfaction with the current speed of their banking has ranked low.

Financial institutions should evaluate the types of electronic funds transfers including instant payments, breaking down their fees, limits, speed, and typical use cases to give businesses the flexibility and efficiency they need.

Due to the state of the economy, holding onto business accounts will involve engaging with them on what their unique lending and investment needs are. This means using outreach as well as transaction behaviors to uncover what is important to them, on a case by case basis, then providing personalized offers based on that data.

2024 will bring further focus on the following, when it comes to lending:

This year we expect to see more marketing efforts made to promote business and commercial banking solutions. New businesses in the U.S. have been trending up since 2010, and new business startups are only increasing.

Business owners today are more tech savvy, younger, are more concerned about saving money and banking securely. According to Bloomberg, the average age to start a business is 34, meaning we can expect an increase in Millennial-owned businesses this year. Appeal to this audience of startup founders and operators first with comprehensive treasury management solutions that address the needs of complex, multi-entity commercial businesses with an approachable user experience to accommodate businesses of all sizes.

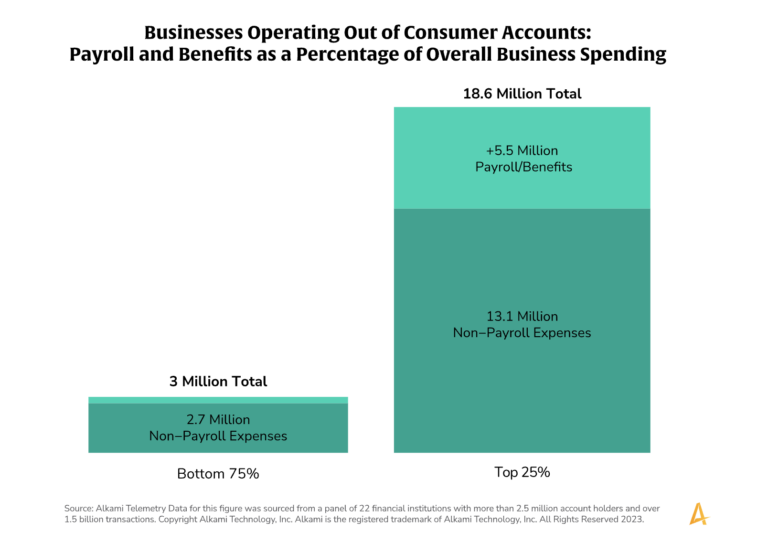

Alkami telemetry data identified an adoption gap between small business owners and business or commercial banking products. Many are managing their finances out of consumer accounts.

The amount of business transactions, such as payroll expenses, being processed through retail or consumer accounts highlights the need to increase awareness through marketing and education.

Strategically engaging with this audience could include offering online and in-person events allowing local business leaders the chance to learn commercial banking best practices. Financial institutions should consider creating website and email content sharing the benefits of untangling their business from their personal finances by opening a full-service operating account with your institution. Or, showcasing local business success stories and finding local business banking account holders to act as influencers on your bank or credit unions’ behalf, to increase understanding and appreciation for why these products and solutions are built to help them succeed.

Digital banking experiences are getting more sophisticated. In 2024, there will be an increased focus on intuitive user interfaces that cater to the diverse needs of business users. Whether it’s through mobile apps or web platforms, the goal is to make banking more accessible, convenient, and user-friendly.

What is the best use case for the year ahead? Personalizing offers and products to each unique business operator. Small businesses want their financial institution to reach out with relevant offers*. 86 percent reported wanting suggestions for loan products and pre-approved loan offers, and 88 percent would appreciate financial wellness tips based on the financial institution’s understanding of their financial health and needs. The market is there, waiting for you to take advantage of it.

These trends highlight a dynamic shift in how businesses interact with their financial institutions. Strategic treasury management solutions, AI integration, real-time transactions, enhanced digital experiences, and fortified cybersecurity are not just trends but necessities in the modern financial landscape. As we navigate these changes, the focus remains on efficiency, security, and innovation, ensuring that commercial banking solutions continue to evolve to meet the needs of businesses today and in the future.

• Download our 2024 Business & Commercial Banking Trends Infographic

• Watch our Webinar ‘4 Tactics for Business Banking Success‘ featuring Datos Insights

• Learn more about Alkami’s Business and Commercial Banking Solutions

*SOURCE: Alkami 2023 survey included participants from 400 small businesses in the U.S., all of whom worked full-time or were self-employed at businesses with fewer than 300 employees and who were involved in the company’s lending and banking decisions