Alkami Research conducted a study that surveyed bank and credit union banking platform decision makers/influencers to explore their digital banking provider perceptions and experience.

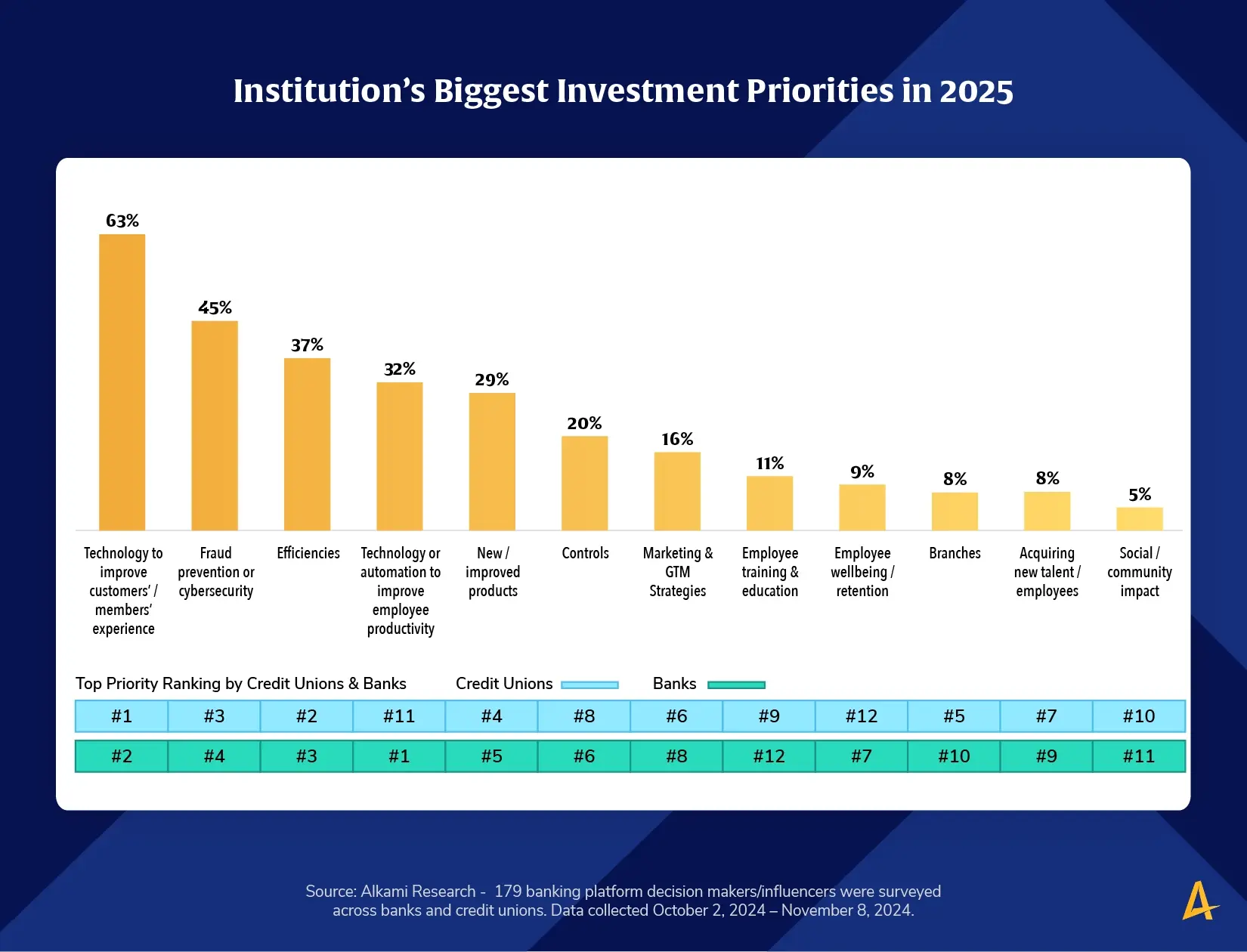

We found that the top investment priority for credit unions in 2025 is technology to improve member experiences (#2 priority for banks), while banks are focusing on technology automations to improve employee productivity.

Financial institutions understand the importance of creating efficiencies, especially with younger generations. These groups expect advanced technology, and in a recent poll, surveyors discovered that among young leaders, 93% of Gen Z and 79% of millennials use two or more AI-powered tools on a weekly basis – leveraging artificial intelligence for routine tasks like drafting emails or capturing meeting notes.

Fraud prevention and cybersecurity are also top priorities. According to the Association for Financial Professionals (AFP), 80% of organizations were victims of payments fraud attacks or attempts in 2023, a 15 percent increase over the previous year.

Banking leaders appear to be allocating budgets to areas designed to outmatch fintech, neo banks and more digitally mature local competitors.

Given the alignment between banks and credit unions on the prioritization of technology to improve customer and member experiences, it is likely these financial institutions are building enhancements to their tech stack. Additionally, focusing on those investments to create efficiencies and build a multi-layer approach to fraud will provide better experiences for both employees and account holders.