The future of banking isn’t just about digital, it’s how these digital experiences are connected to each other. And at the heart of this transformation are banking APIs (short for Application Programming Interfaces). These behind-the-scenes tools are the connective tissue that enable your favorite apps, digital banking platforms, and fintech experiences to talk to one another in real time. But for many financial institution leaders, the concept of APIs still feels technical, abstract, or out of reach.

This guide is designed to change that.

As someone who’s spent over a decade delivering API-driven digital banking solutions, I’ve seen firsthand how powerful APIs can be when financial institutions understand how to harness them. From enabling open banking integrations to launching secure, high-adoption features, APIs are no longer just technical assets; they’re strategic drivers of agility, innovation, and account holder satisfaction.

Whether you’re a credit union executive exploring ways to modernize your tech stack, or a bank leader interested in creating fintech-like experiences without a heavy development lift, understanding banking APIs is a crucial first step. Let’s break down what they are, how they work, and why they matter now more than ever.

Banking APIs are sets of rules and protocols that allow different software applications to communicate with one another. In the context of banking, APIs allow core systems, digital banking platforms, and third-party applications to share data and functionality in a secure and standardized way. This means that they follow industry-accepted protocols for authentication, encryption, and data formatting to ensure sensitive financial information is protected and exchanged consistently across systems.

Put simply, APIs act like bridges. Just like an ATM lets you access your bank account without going inside the branch, an API allows one software system to access features or data from another, instantly and behind the scenes.

There are several types of banking APIs:

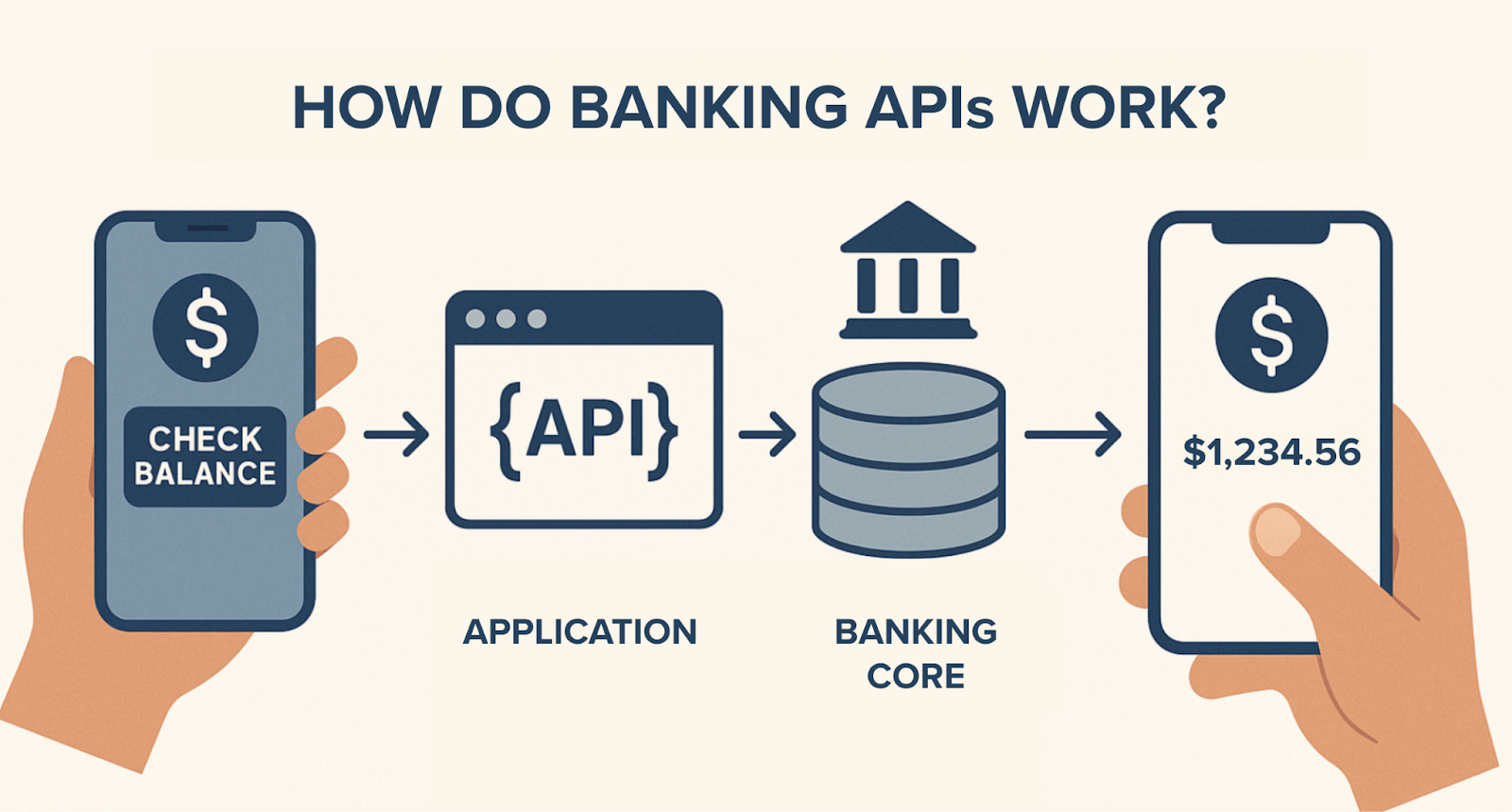

At a technical level, banking APIs rely on standard web technologies (like REST) to send and receive data. When a user initiates an action such as checking their balance or making a payment, an API request is sent to the banking core, which responds with the relevant information or action.

Here’s a simplified flow:

This all happens in milliseconds. APIs handle data validation, encryption, authentication (often via OAuth 2.0), and error handling to keep things secure and seamless.

So why are banking APIs such a big deal? Because they unlock capabilities that go far beyond technical convenience. They create business value, drive innovation, and support better member and customer experiences.

APIs give banks and credit unions the flexibility to partner with fintechs and deploy new services without starting from scratch. Want to add credit monitoring, automated savings, or crypto trading? APIs make it possible to plug into these services quickly and securely.

Banking APIs power the personalized, always-on experiences today’s users expect, from push notifications to linking your data to other payment platforms. And because APIs enable systems to work together, your digital banking platform can deliver more meaningful insights and interactions.

Instead of building every feature in-house, financial institutions can use APIs to integrate best-in-class solutions for fraud prevention, call center support, data analytics, and more, saving time and reducing complexity.

Regulatory movements in the U.S. and globally are pushing toward open banking, where consumers have more control over how their financial data is shared. Open Banking APIs are the foundation of this model. Getting API-ready now positions your institution for future compliance and competitiveness.

Across the financial services industry, banking APIs are enabling practical, high-impact use cases:

Adopting a modern API strategy isn’t without hurdles, especially for banks and credit unions tied to legacy core systems. Key challenges include:

That’s where smart platform partnerships come in, giving you the extensibility of APIs without the heavy lift.

Choosing the right banking API providers play a critical role in overcoming these challenges. A strong provider doesn’t just offer technology, they act as a strategic partner who supports your integration journey with scalable infrastructure, reliable documentation, security protocols, and a clear roadmap. For many institutions, partnering with an experienced API provider can dramatically reduce the time and resources needed to launch new digital capabilities, while ensuring alignment with compliance and security standards.

The next era of banking APIs is about more than connectivity. Open Banking APIs, in particular, will play a pivotal role in democratizing access to financial services and creating new competitive opportunities for mid-size and community institutions.

Banking APIs are the infrastructure powering modern digital experiences and future-ready business models. For financial institutions looking to compete in an increasingly tech-driven world, APIs offer the flexibility, speed, and control you need to deliver value in every digital interaction.

As someone who’s seen the impact of banking APIs with my clients firsthand, I’m continually inspired by the ways financial institutions are using them to unlock smarter, more efficient use of data. From powering real-time insights to personalizing digital experiences, APIs are enabling banks and credit unions to deliver more relevant, compelling services than ever before.

Whether you’re just starting to explore APIs or actively building your strategy, one thing is clear: financial institutions that embrace API-driven architectures today are laying the foundation for more connected, innovative, and future-ready experiences tomorrow.