If you’re looking for a marketing customer information file (MCIF) vendor to help you make sense of your account holder data, you’re on the right track. It’s smart to invest in technology that helps you understand your customers and members better. But if you stop at an MCIF, you may be leaving a lot of revenue opportunities on the table. When MCIF systems first came onto the scene, they were a big deal. For the first time, financial institutions could pull data together from across their ecosystem and generate reports that actually helped them make informed decisions. But that was 10, maybe even 20 years ago. Today, an MCIF is more of a starting point than a full financial services marketing automation solution.

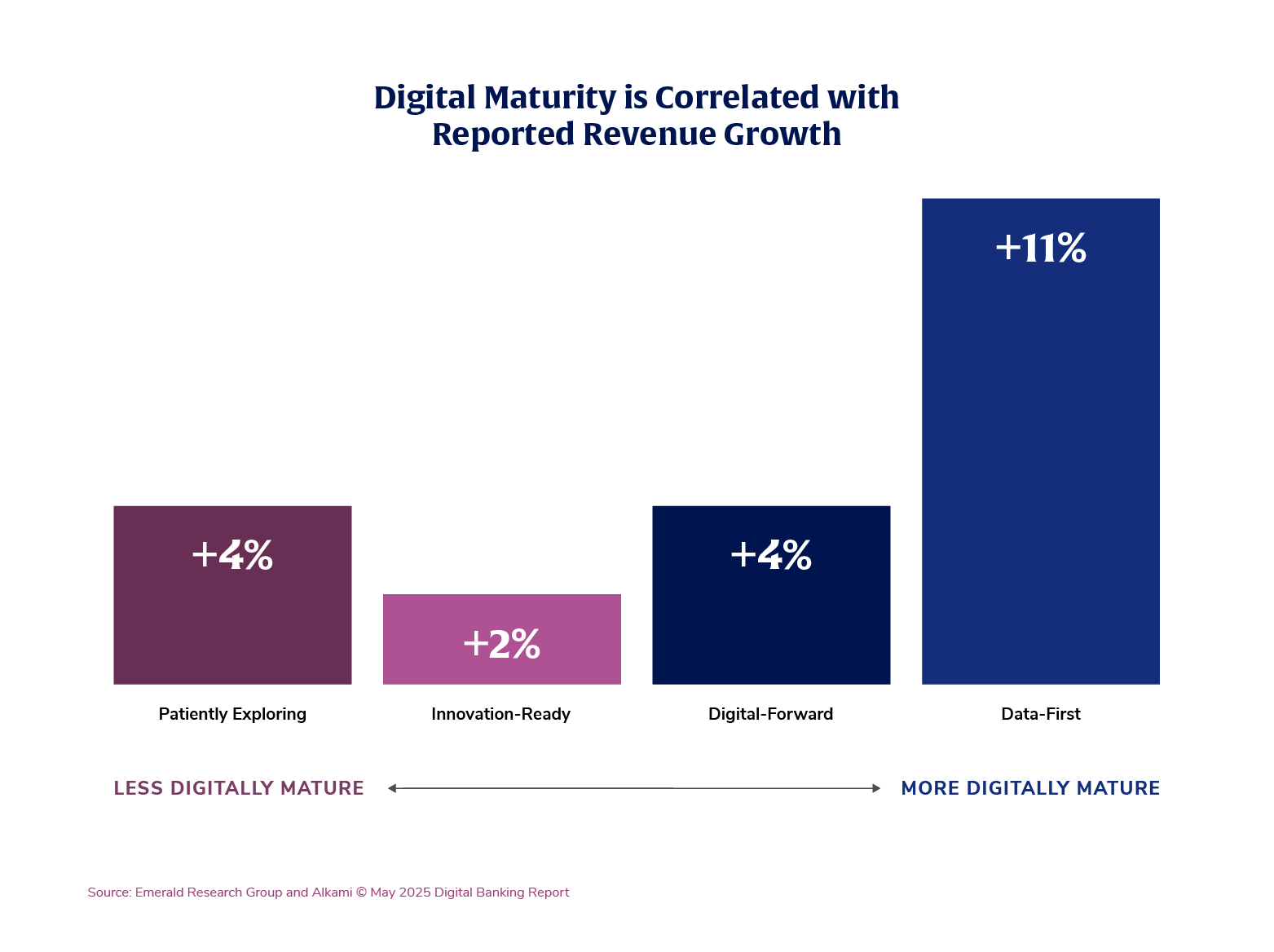

Now, marketers at banks and credit unions can leverage data-driven engagement marketing tools to provide personalized messaging that’s relevant, not random. The result? Marketing that makes a real impact on revenue. Research shows the most digitally mature segment (those that have the most effective use of data for marketing) reported annual average annual revenue growth up to 5X higher than their peers.

Read on to learn more about the differences between an MCIF and a data-driven financial services marketing automation solution and their potential impact to the growth of your financial institution.

If your goal is just organizing your data so you can run a few static reports, an MCIF might still work for you. But if you’re hoping to use that data to actually connect with your account holders, you’ll need more than basic reporting tools. And that’s because customers and members expect more now. They want experiences that feel personal. They want financial advice and offers that actually make sense for their lives. And that’s not something an old-school MCIF system can deliver.

Financial services marketing automation offers everything an MCIF does, plus a whole lot more. And here’s the kicker: if you are making an investment, you can get a platform that doesn’t just show you your data, but actually helps you act on it. That means you can build meaningful campaigns, deliver messages through multiple channels, and actually track the results, all in one place.

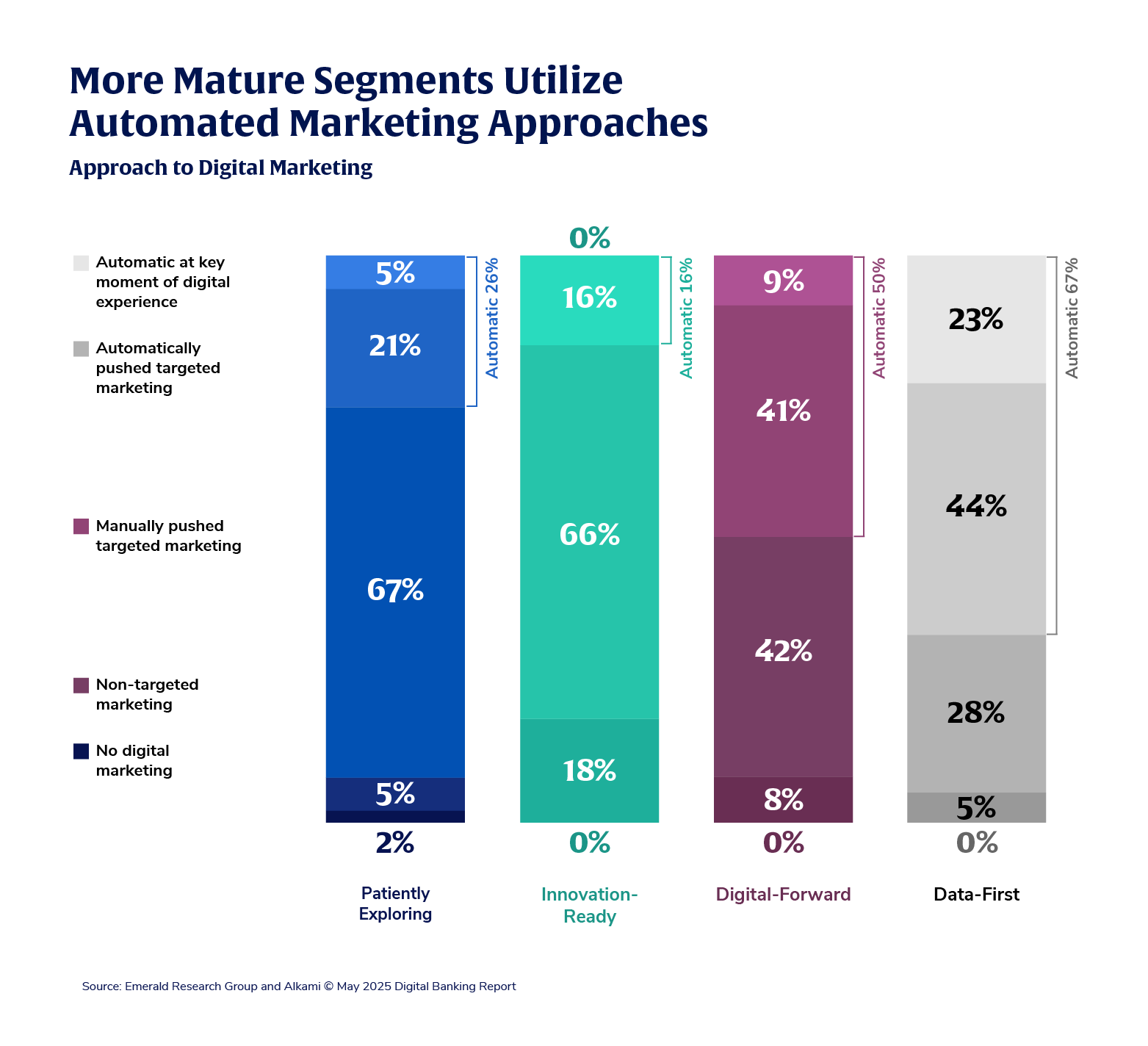

Research shows that financial institutions with higher digital maturity are more likely to leverage financial services marketing automation for their engagement marketing efforts. Of the most digitally mature banks and credit unions, 67% of these institutions can automatically push targeted marketing to their account holders, saving marketing time and resources from having to manually manage their marketing campaigns.

Let’s break it down. Here’s how a traditional MCIF stacks up against a data-driven financial services marketing automation solution:

| Features | Financial Services Marketing Automation Solution | Traditional MCIF System |

| Sources |

|

|

| Security | Protects privacy by not storing, transmitting, or accepting personally identifiable information (PII) | Replicates core PII to external repositories, increasing risk |

| On Demand | Insights update daily for real-time decisioning and messaging | Data may be days or weeks old, risking missed opportunities |

| Insights |

|

|

| Intelligence |

|

|

| Goals |

|

Most systems don’t support ROI tracking or campaign attribution |

| Targeting |

|

|

| Channels | Delivers through over a dozen integrated digital, traditional, and assisted channels | Requires exporting lists to external vendors to deliver campaigns |

| Reach | Supports 1:1 digital ad targeting using first-party data | Typically can’t support digital acquisition or retargeting campaigns |

| Automation | Real-time triggers keep campaigns always-on and responsive | No native triggers or integrated channels, causing delays in campaign execution |

| Reporting |

|

Reporting is limited in demonstrating engagement, ROI, or forecasting behavior |

| Exports |

|

Most exports require manual cleanup or reformatting to be useful elsewhere |

With a financial services marketing automation platform, you’re not just organizing your data—you’re putting it to work. Send a personalized offer when someone logs into their mobile banking platform. Or recommend a product based on someone’s spending patterns. You can even set up full funnel marketing campaigns to run automatically based on account holders’ real-time behavior. Best of all, you can see exactly what’s working, so you can do more of it.

It’s great that you’re thinking about how to use your data better, but don’t settle for a tool that was built for a different era. Now financial institutions need tools that help them connect with people, not just organize spreadsheets.

Financial services marketing automation gives you everything you need to make your data actionable, from deep segmentation to omnichannel delivery to real-time insights, all in one secure digital sales and service platform.