Financial institutions that tailor their engagement marketing to individual account holder needs can build stronger relationships and ultimately increase conversions. Chad Gramling, assistant vice president of business intelligence at 3Rivers Federal Credit Union (3Rivers), joined us at Alkami Co:lab 2025 to share how the credit union has taken this approach to the next level by leveraging data analytics in banking and financial services marketing automation to create personalized account holder experiences.

To understand account holder behavior on a granular level, 3Rivers has taken a deep dive into transaction data. They are able to determine which account holders use buy now pay later (BNPL) services, maintain business accounts at other financial institutions, and even receive trial deposits from fintech companies—all signs that they may be exploring alternative banking options.

One of the most effective uses of transaction data for 3Rivers has been identifying account holders who are splitting their financial relationships between multiple institutions. An account holder might consider 3Rivers their primary financial institution (PFI), yet still have credit cards, loans or investments elsewhere. This insight allows the credit union to create highly targeted campaigns to recapture those relationships.

At 3Rivers, personalization goes beyond addressing an account holder by name. A personalized banking experience requires timely, relevant and meaningful engagement that acknowledges their unique financial journey.

For example, when an account holder unexpectedly needs an auto loan due to a sudden car breakdown, traditional engagement marketing , like direct mail, may not be fast enough to meet their needs. By analyzing behavioral data, 3Rivers can identify members searching for auto loan information and proactively offer financing options at the right moment.

One of the things I marveled at when we launched Alkami Data & Marketing Solutions was our ability to identify microniches, even to the person level if we wanted to.

- Chad Gramling, Assistant Vice President of Business Intelligence, 3Rivers Federal Credit Union

3Rivers has also used transaction data to build highly specific account holder personas.

Chad said, “In one of my presentations, I have a slide titled, Have You Met Tina? Of course, Tina is a fictional person, but the data that I teased out is real, and that is an actual member.”

With data analytics in banking, 3Rivers can determine which financial institutions she uses and whether her engagement with 3Rivers is increasing or declining.

“We can even go deeper into the psychographics to know her hobbies and where she shops,” Chad said. “We can identify her favorite restaurants, infer that she travels a lot for work and so much more.”

This detailed level of insight allows 3Rivers to serve messaging and offers that match account holders’ real interests and needs. The goal isn’t to be intrusive, but to provide value at the right time with the right offer.

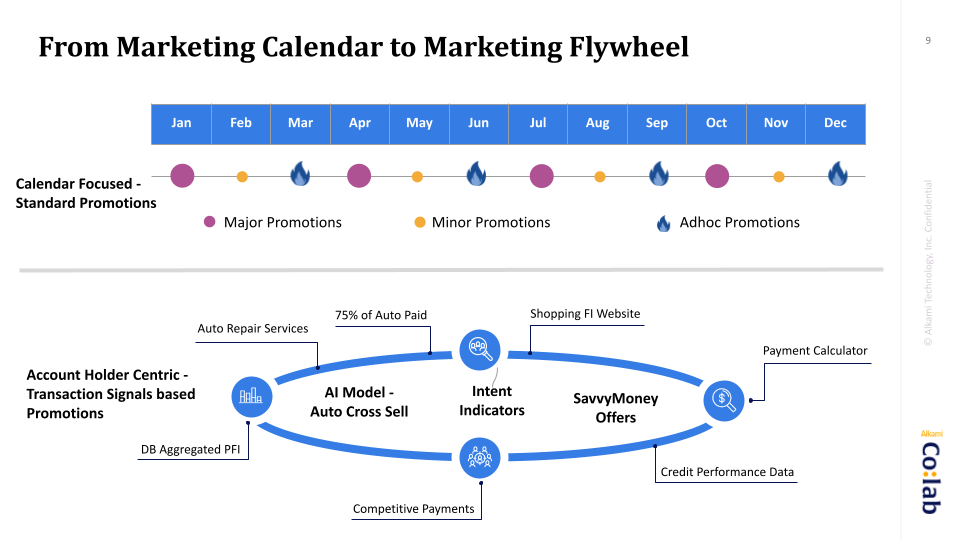

Traditionally, financial institutions have followed a seasonal marketing calendar, promoting specific products at set times, such as mortgages in the spring, credit cards in the fall and so on. While this approach ensures a steady promotional cycle, it doesn’t always align with when account holders actually need these products.

3Rivers has evolved to an always-on marketing flywheel, where campaigns are triggered in real-time based on actual member behavior. Before implementing data-driven marketing engagements, 3Rivers relied heavily on manual processes. Their teams had to pull account holder lists, segment audiences and execute campaigns manually. Now, financial services marketing automation has transformed how they operate. Audience triggers and automated workflows launch campaigns the moment members meet the right criteria.

For example, if an account holder pays off most of their auto loan, they may receive a pre-approved refinancing offer. If an account holder visits the credit union’s auto loan webpage, they can receive a personalized follow-up with relevant financing options. This strategy ensures marketing messages aren’t just appearing when it’s convenient for the financial institution, but when they are most relevant to the account holder. It can help to eliminate wasted marketing spend on campaigns that may not reach account holders at the right moment and instead focuses on personalized engagement marketing.

Data-driven personalization will continue to be the driving force behind successful marketing strategies in financial services. By harnessing transaction data, behavioral insights and automation, they can create marketing experiences that resonate with account holders.

When building personalized marketing engagements for your account holders, remember to: