At Alkami, we are continually working to improve and enrich the experience of our digital banking solutions. This spring, we are excited to share updates, product enhancements, and new features that have been thoughtfully designed to take your experience with Alkami’s digital banking platform to the next level of personalization, introduce youth banking and financial wellness solutions, and support Federal Deposit Insurance Corporation (FDIC) regulations.

For a detailed and comprehensive look at our release and planned roadmap, customers are encouraged to visit the Alkami Community site. These updates are intended to empower your financial institution to increase efficiency and boost your end user satisfaction. Continue reading to explore what’s new and uncover opportunities to take advantage of these enhancements to take your digital banking solutions to the next level.

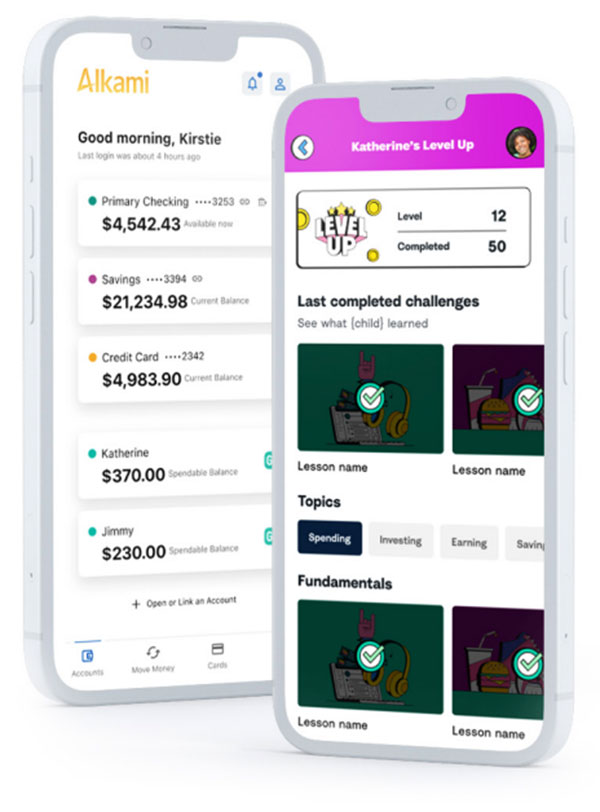

These days, kids are influenced by an overload of information, especially on social media. Parents are looking for a way to ensure their children have access to banking tools and education that kickstarts their financial wellness journey in a way that is safe but effective. That’s why Alkami is excited to announce that we partnered with Greenlight to offer youth banking seamlessly integrated into your digital banking mobile app.

Building a comprehensive youth banking experience is cost prohibitive for a majority of financial institutions. However through our partnership with Greenlight, you can offer a best-in-class experience that supports deposit growth. By engaging younger generations while delivering increased value to families, your financial institution can attract and retain customers or members with family-focused banking.

The platform offers a wide variety of tools and services to parents that includes:

With Greenlight, you can build the foundation for a lifelong banking relationship with the next generation of account holders.

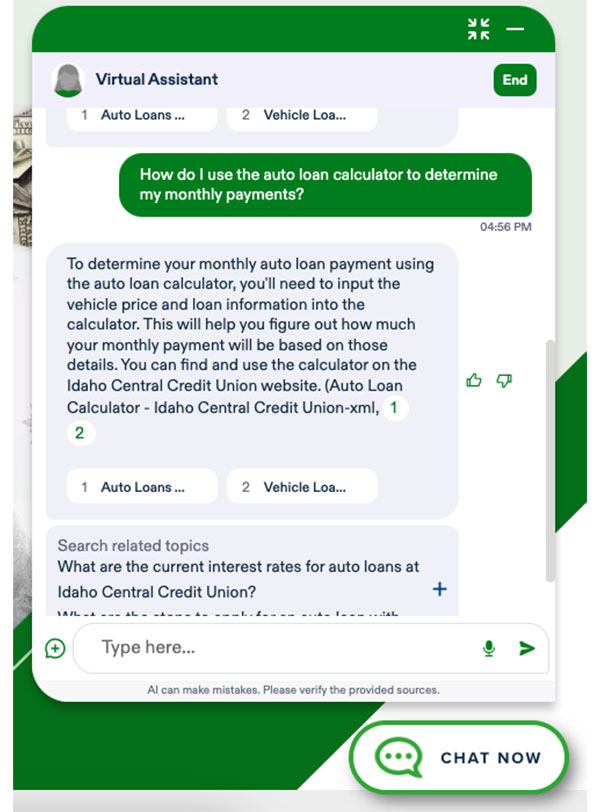

Account holders expect to engage with their financial institution in a variety of channels and methods which has led to increased adoption of chat outside of traditional bots via the web. To support increased usage and better performance and proficiency, Alkami has expanded our relationship with Eltropy to enhance the user experience across all chat channels. With improved artificial intelligence (AI) tools and more engagement options via SMS/text, secure chat, video banking and voice, support teams can ensure a frictionless resolution to chat inquiries and improved efficiency.

The addition of conversational intelligence supports the AI agents within the chatbot and allows financial institution admins to have improved tools for virtual lobby management while supporting admin SSO integration. End users can utilize remote deposits within the Eltropy ecosystem via their preferred engagement option whether they are in-branch doing video banking, digitally, or on their mobile device via SMS/text or chatbot.

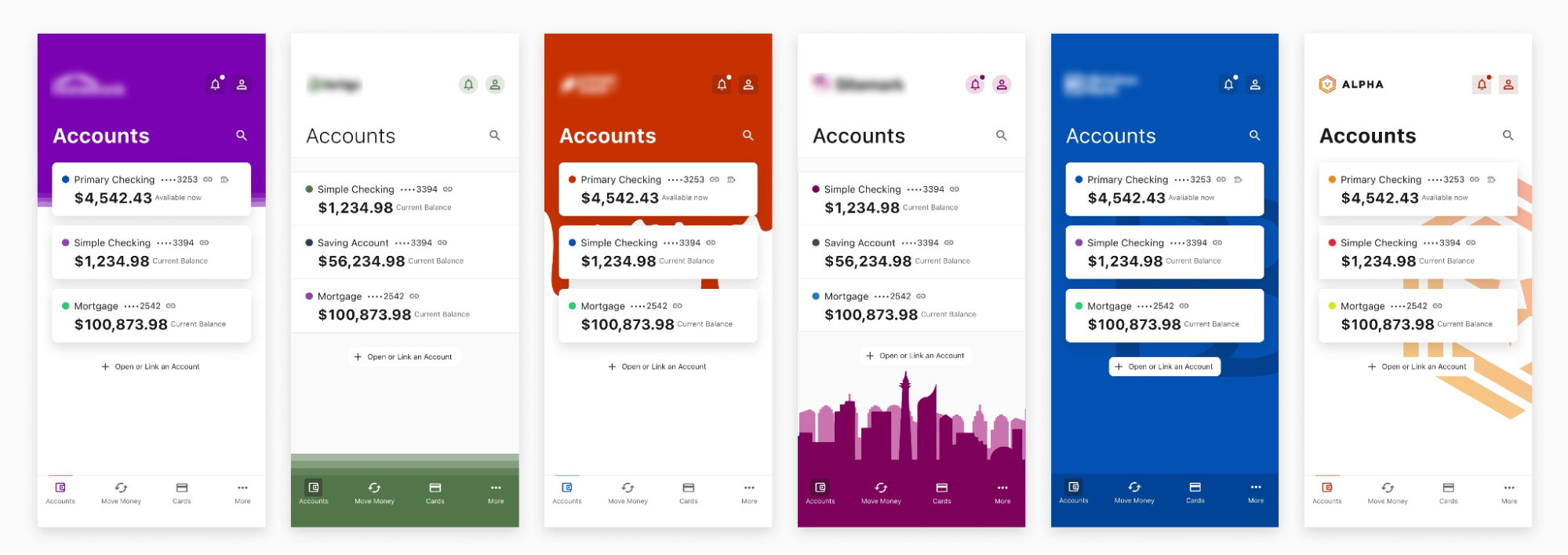

In alignment with Alkami’s 2025 plan to increase options available to financial institutions to curate their account holder’s experience, we are excited to share our latest expansion of Theme Builder. Financial institutions can now customize the Accounts landing page and the global shortcut bar of the mobile apps to support increased brand awareness and a cohesive end user experience.

The Accounts page is the central hub of the mobile experience—it’s where users land after login, and is also seen pre-login if the Snapshot feature is enabled. This plays a huge role in both first impressions and everyday engagement. You can now add background images, choose between two account list styles, and update the top bar’s appearance. These enhancements also pair with new color options now available in the global shortcut bar, creating a unified look that feels like an extension of your brand.

The result: a seamless, more branded experience from the very top, to the very bottom of the screen, for both pre- and post-login views—building trust, familiarity, and connection with users every time they open the app.

This is the next step in our larger financial institution customization journey which will continue to be seen in future enhancements to achieve a more unified and seamless end user journey from online banking to mobile.

Learn more about guidance and guardrails within Alkami’s Theme Builder here.

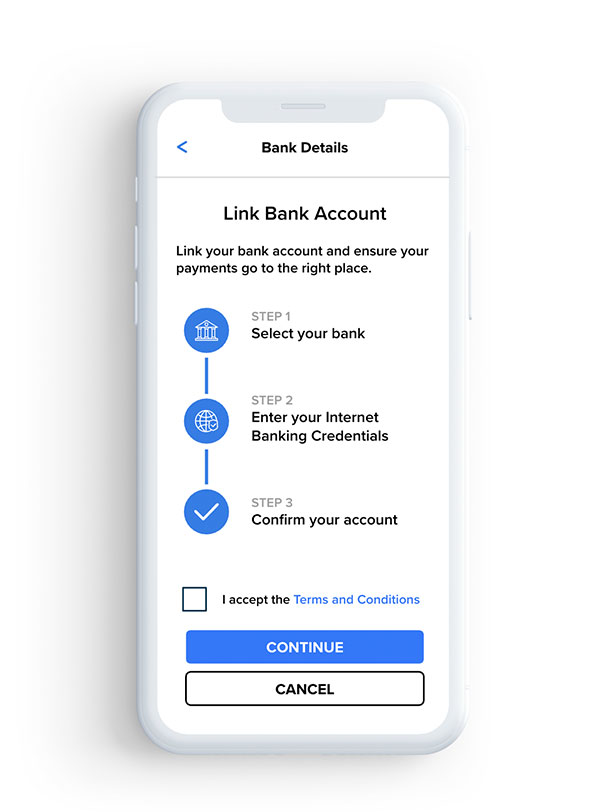

Account holders now manage a growing number and variety of financial accounts, each tied to its own app. These end users place a high value on ease and convenience to access financial information so we have partnered with Yodlee to implement the Financial Data Exchange (FDX) API Integration. The FDX API will streamline and standardize account data gathering in alignment with industry standard processes and added control for financial institutions to manage what data is shared with third party applications.

With improved reliability, this enhancement will reduce end user issues when linking third party applications, ease the workload for support teams, and boost overall account holder satisfaction.

It’s seamless for them and efficient for you.

The FDIC rules, published in 2024, require financial institutions to adhere to new guidelines regarding digital signage. This ruling is intended to regulate how insured depository institutions (IDIs) advertise across digital and mobile channels. Further clarifications on how FDIC digital signage is used aims to avoid scenarios where customers or members can be misled about when they are conducting business with an IDI and whether their funds are protected by the FDIC’s deposit insurance.

Following this release, you will have the ability to turn on and off the appearance of new FDIC Signage in a variety of ways to implement the new rules as you see fit.

We’re providing early access so you’ll have ample time to prepare and ensure compliance. This means no last-minute rush and a seamless transition for your financial institution.

Alkami is committed to continuously improving our platform to ensure all digital banking solutions are reliable, efficient, and utilizing the most effective technology. To support our goals of maintaining a modern platform with seamless and secure user experiences, we have introduced enhancements to our Secure Messaging feature within the Secure Message Center with the addition of RESTful API endpoints that will replace legacy endpoints. This enhancement will result in:

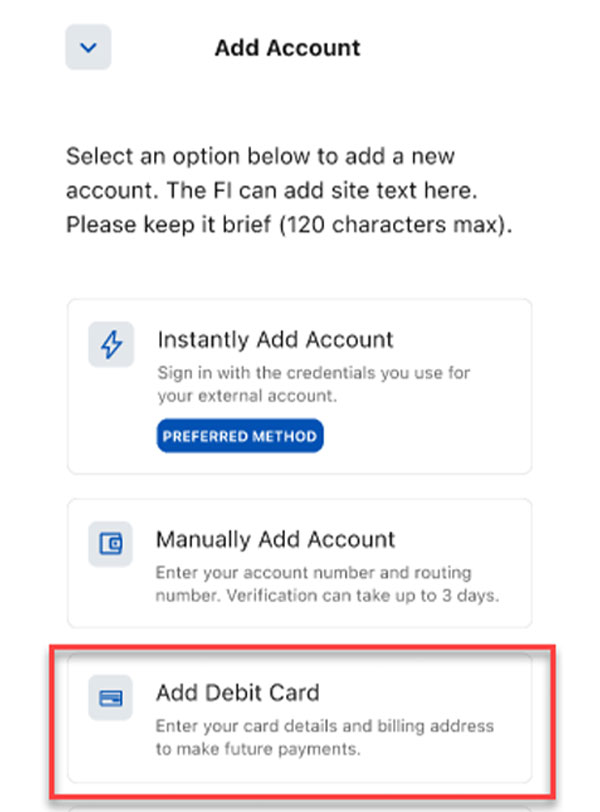

Through our seamless integration with Alacriti, within the Transfer Widget, users can now make one-time electronic deposit account funding capabilities by pulling funds directly from an external Visa or Mastercard debit card. This enhancement will allow financial institutions to give end users a variety of ways to fund their accounts in a way that is simple, reliable, and convenient.

With this enhancement, account holders can effortlessly link their debit cards through the Add an Account screen, and once linked, end users can pull funds directly from the account by selecting the card within the ‘From’ dropdown within the Transfer Widget.

With funds settling for financial institutions within just two business days, this feature empowers financial institutions to provide multiple account funding options. At the same time, ensuring account holders have a frictionless option when managing their finances.

We’ve expanded our existing integration with BioCatch to go beyond protection from fraud via account takeover to now offer Mule Account Detection. Mule accounts are used by fraudsters to evade detection while cashing out stolen funds, laundering money. This form of fraud is often missed until it is too late.

By using advanced behavioral biometrics and machine learning, BioCatch’s Mule Account Detection platform can analyze user behavior to detect anomalies and identify if the account is being used as a mule. This proactive approach is employed across all stages of the account lifecycle to keep your account holders protected from any fraudulent mule activity.

For a complete list of new and improved features, customers can visit the Alkami Community site.