If you’ve ever researched marketing technology (martech), you know it can feel overwhelming. With more than 14,000 tools on the market—growing nearly 28% year-over-year—it’s easy to get lost in the options. But just like every car comes with essential components (engine, wheels, brakes), every financial services marketing automation stack needs key elements to run efficiently. Let’s break down the five must-have components to help you build a high-performance marketing engagement engine.

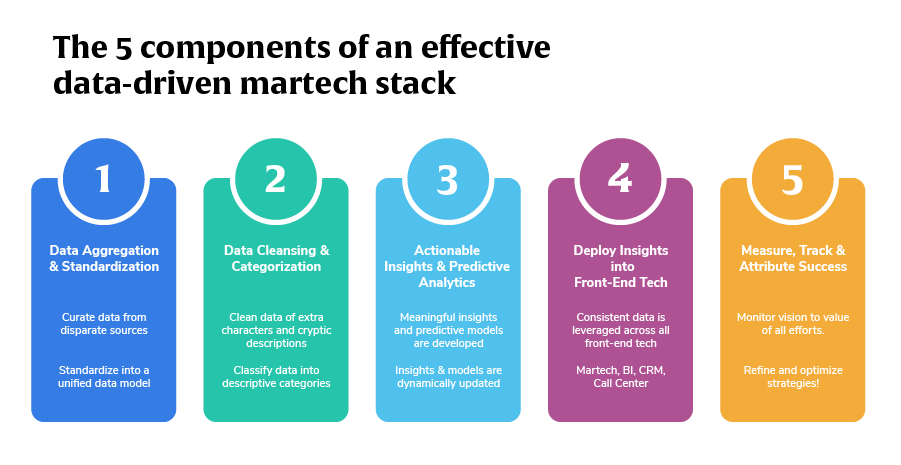

The first step in any strong financial services marketing automation strategy is consolidating data into one unified system. Just as a car needs a chassis to serve as its framework, your martech stack requires a solid base in the form of a unified database. To create the foundation of your database, you need to extract data from third-party systems and your first-party transactions and standardize it for consistent analysis and application. This step eliminates data silos and ensures all subsequent actions and decisions are based on a holistic view of your data.

It’s important to keep in mind that financial institutions cannot use personally identifiable information (PII) for their marketing segmentation. To help manage compliance, select a financial services marketing automation platform that uses PII-free segmentation. Assigning a unique customer identifier enables personalized marketing engagement without relying on sensitive demographic details, ensuring compliance.

Raw data isn’t always usable right away. Once the data is centralized, the next step is like tuning the engine of a car. This phase involves stripping out unnecessary noise and characters from your data, then cleansing and categorizing it to ensure it’s in a usable state. Without this step, marketing campaigns risk being built on flawed data, leading to missed opportunities or ineffective outreach. A well-structured data set allows financial institutions to identify patterns and ultimately craft more precise and impactful marketing engagement.

With Alkami's tools, we've been able to dive deeper into member behaviors, creating personalized journeys that enhance engagement and loyalty.

–Steve Zich, Chief Marketing Officer, Capital Credit Union

Once data is organized, it’s time to put it to work. With a finely tuned ‘engine’ of clean, standardized data, you can now begin to identify trends and patterns, like mapping out the best route for a road trip. This stage is when the real magic happens because actionable insights and predictive artificial intelligence (AI) come into play. These insights can predict account holder behavior, ensuring marketing campaigns deliver the right message at the right time.

Once insights are gathered, the next step is putting them into action. It’s now time to hit the road by deploying these insights into front-end technologies, including your financial services marketing automation. In this step, your marketing strategies come to life, directly impacting your ability to meet your marketing goals. Put all that prep work into action, using your martech stack to report on and drive your marketing goals forward, just as a car’s dashboard provides the driver with vital information about the trip.

Now you can deploy your data-driven marketing engagement across multiple channels, including:

Within your account holder base, you can find an audience of consumers most likely to adopt your products and services. For instance, uncovering that purchasers at Home Depot may have a higher propensity for home equity lines of credit (HELOCs) allows marketers to target with precision. You can also find account holders who may need financial education and provide the support they need to get through challenging financial times. For example, you can find account holders who are likely to default on a loan and provide proactive outreach to maintain their financial wellness.

Finally, no journey is complete without reflection and adjustment, which in the martech world translates to establishing a feedback loop. This essential component allows for the measurement, tracking and attribution of success, providing valuable insights into what’s working and what isn’t. It’s the equivalent of regular car maintenance and adjustments based on performance feedback, ensuring your marketing engine runs smoothly and efficiently.

A built-in financial services marketing automation feedback loop allows you to:

Alkami’s financial services marketing automation empowers you to share your campaign results throughout your institution with automated full cycle attribution reporting. It automatically identifies account holders who were influenced to achieve the campaign goal as a result of your marketing efforts, so you can see the true results of your marketing efforts.

By switching to a data-driven marketing strategy, I’ve been able to prove the value of our marketing messages.

–Chris VanAusdale, Westfield Bank

Creating a data-driven martech stack is about more than just selecting tools; it’s about developing a cohesive ecosystem that transforms raw data into actionable marketing strategies. By focusing on these five foundational elements, you can ensure that your financial institution builds a marketing engine that drives real results.