Maintaining strong relationships with account holders has never been more crucial for financial institutions (FIs). New competition from fintech threatens consumer and business account holder retention, while other changes in the industry have started to erode wallet share for many traditional FIs.

Thankfully, FIs sit on a mountain of transaction data that can be used to strengthen banking relationships. But making sense of that data and turning it into actionable insights is a challenge, to say the least. Core systems make it difficult to extract meaningful reports, and information often gets siloed within departments. FI leaders must find ways to execute on internal data to deepen user relationships and build profitability and institutional loyalty.

Here are four ways FIs can improve data actionability, stay competitive with better data organization, security, and automation, and nurture relationships with account holders through personalized engagements.

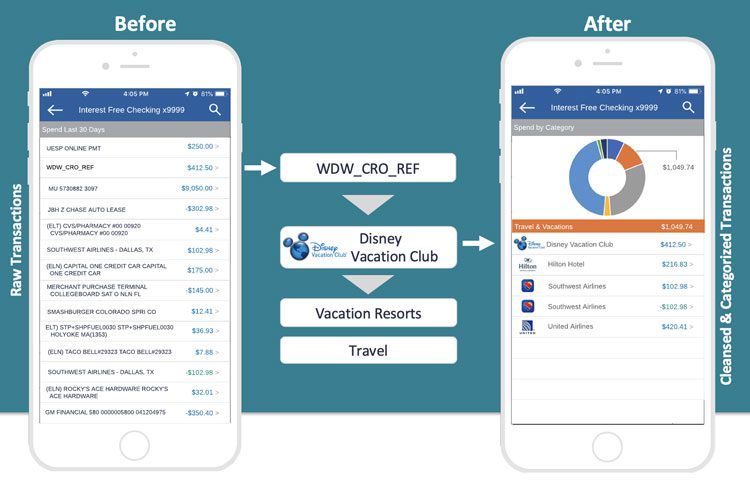

An account holder’s transaction data can be the key to understanding their behaviors and priorities in life — crucial information FIs can use to develop experiences and offerings that strengthen loyalty. But transaction data in its raw form is basically a nonsensical string of numbers and letters. Cleaning that data using a merchant payment cleansing service is the first step and can immediately:

In the long term, FIs can use clean transaction data in aggregate to build predictive models for account holder behavior. AI-powered tools like attrition modeling or cross-sell modeling can help FIs respond proactively to account holder needs and deliver experiences that drive engagement. Financial Wellness Modeling, for example, can be utilized to identify users who may be experiencing financial stress, before it’s too late. Knowing which account holders may be struggling will allow for efficient and targeted outreach.

Transferring large volumes of transaction data to a third party for cleansing increases both cost and security risk for FIs. The more prudent route is to use a cloud-share application for merchant payment cleansing that eliminates the need to move data between systems. Because data stays within the cloud-share environment, personally identifiable information (PII) is always protected. The added bonus is that this data infrastructure provides seamless access to transaction enrichment solutions while saving time and money for FIs. By leveraging a single solution, FIs can cleanse, contextualize, store, analyze, and act on their account holders’ data.

FIs often want to partner with third parties for various operations like marketing automation and call center services. But account holder data inherently includes PII that requires special protection under today’s data security regulations. That means FIs need to find a way to make account holder data accessible and shareable while meeting compliance standards.

This is where tokenization can be a useful data security strategy. Tokenization assigns a data value, or token, to take the place of an account holder’s sensitive data within a digital environment. That token can then be transferred and used by authorized third parties without exposing PII. In this way, FIs can pick and choose the fintech vendors they want to work with while continuously protecting account holder information.

Acting on account holder data means connecting with them in meaningful ways. To do that efficiently, FIs need to take the insights learned through merchant payment cleansing and integrate that data with a turnkey email marketing solution to deliver the highest level of targeting efficiency and relevant messaging. Most importantly, digital use cases can accelerate revenue generation for both current account holders and new user acquisition campaigns.

Automating delivery to this channel increases the capability for on-demand quick campaign building, closing the time gap for most marketers while delivering a conversion-rich form of digital marketing. For example, spend analysis could indicate that a particular account holder has started making mortgage payments to a competing FI. A marketing integration could take that information and target that account holder with a relevant refinancing offer. In other use cases, where individuals may be identified as outdoor enthusiasts based on their purchase history, marketing photography can be curated to reflect those interests and create a stronger connection with the user.

The key is to achieve alignment between data insights and marketing automation to deliver account holder experiences that are compelling, timely, and relevant. By pairing marketing automation with a digital banking platform, FIs can target their account holders with personalized engagements and offers directly in the FI’s mobile banking app.

How do these steps effectively build a strong user retention and acquisition strategy? Establishing primacy is easier said than done. In today’s market, leaders at FIs need to find ways to strengthen account holder relationships and build loyalty to stay top-of-mind and top-of-wallet. The 2022 Digital Banking Transformative Trends Study found that, “digital banking users who access their mobile app and/or online banking multiple times per day have 1.71x the number of products with their primary financial institution (PFI) than those accessing digital banking at least once a year.” The key takeaway for banks and credit unions is to focus their efforts on higher product penetration, adoption, and engagement to achieve user loyalty and growth objectives. By combining merchant payment cleansing with topflight data security and storage that provides seamless integrations for business operations, FIs can turn unintelligible data into insights and actions — enabling FIs to achieve their institution’s strategic goals.