Year-over-year, fraudsters get more creative with their threats and fraud continues to rise – impacting account holders and institutional reputation. In fact, 80% of organizations reported attempted or actual payment fraud.

Alkami Research conducted a study revealing distinct segments of business banking digital maturity. Among financial institutions that offer business banking solutions, the majority of institutions enable businesses to self-serve automated clearing house (ACH) fraud remediation – some at a cost, others that are free to the user. By empowering businesses with 24/7 access to greater security controls, financial institutions can introduce a preventive approach to fraud and improve operational processes. However, only 29% of U.S. financial institutions are satisfied with their current positive pay adoption rates.

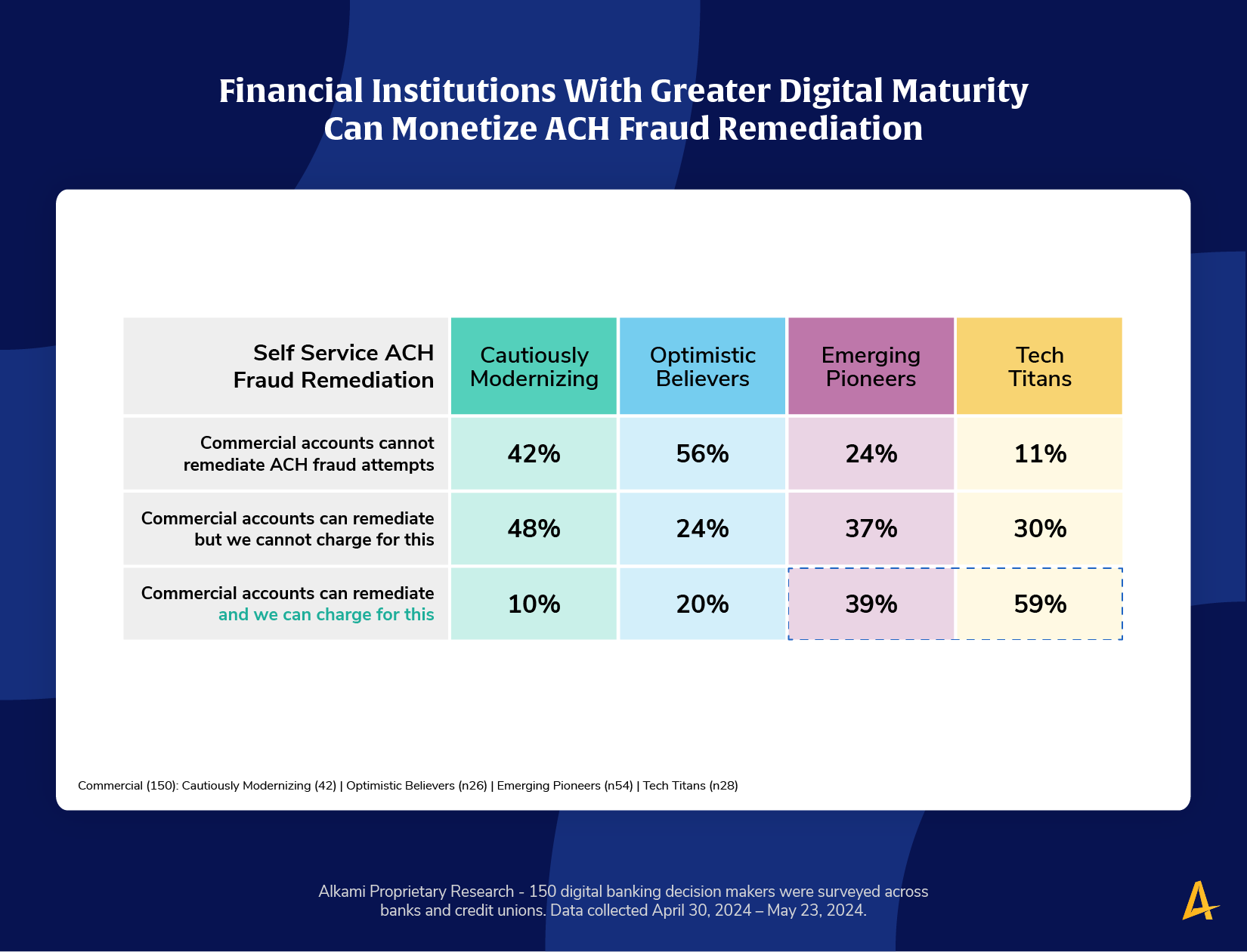

The most mature organizations can differentiate themselves by elevating the user experience with self-service ACH remediation – making it easier for businesses to act swiftly to fraud attempts. There is still an opportunity to implement and charge for this service as shown in the chart – leading institutions (39 percent) and least mature organizations (59 percent) alike.

Financial institutions aiming to elevate their business banking digital maturity should focus on their fraud prevention and security strategy. Leading institutions are leveraging ACH fraud remediation as a revenue stream, rather than a cost center. To achieve the next level of business banking digital maturity, financial institutions should: