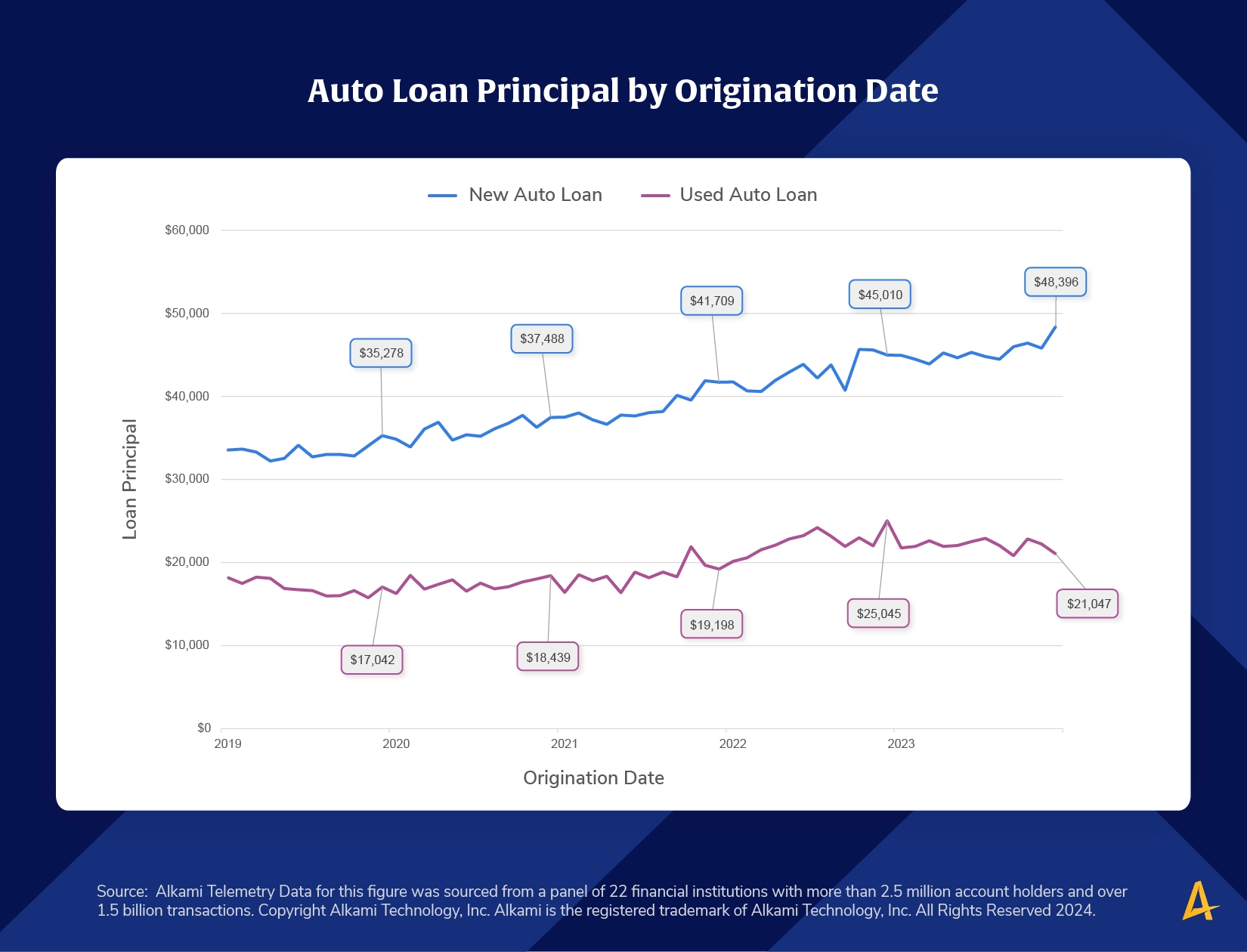

While the price of financing a vehicle via the interest rate has increased, as shown in last week’s chart, so has the cost of the vehicle itself. This week’s chart shows the average initial loan principal, a reasonable proxy for price trends in the auto market, based on origination date. A car buyer, either new or used, in 2022 and 2023 paid a significantly higher price than a car buyer in 2019. Comparing December of 2023 with December of 2019, the average principal on a new auto loan was 37.2 percent higher and the average principal on a used auto loan was 23.5 percent higher. Supply chain issues during the pandemic created inventory challenges in the new car market, affecting both dealers and consumers. Buyers who could not get a new car were pushed into the used car market, increasing demand and driving up prices for those automobiles.

Auto loan payments taking a greater share of consumer budgets could put stress on some account holders’ finances – especially those living paycheck to paycheck each month. Financial institutions should keep in mind that consumers are keeping their cars for a longer period of time. Instead of suggesting a new loan to account holders who recently paid off an auto loan, financial institutions should consider suggesting other uses for that money, such as setting up an automatic transfer to a savings or investment product each month.