Housing affordability impacts those who don’t own homes and their ability to access the mortgage origination market. It also impacts existing homeowners, their propensity to move, and the financial products they want to consume. Despite higher interest rates, consumers are now heavily relying on home equity lines of credit (HELOCs) as a way to create liquidity from higher home values.

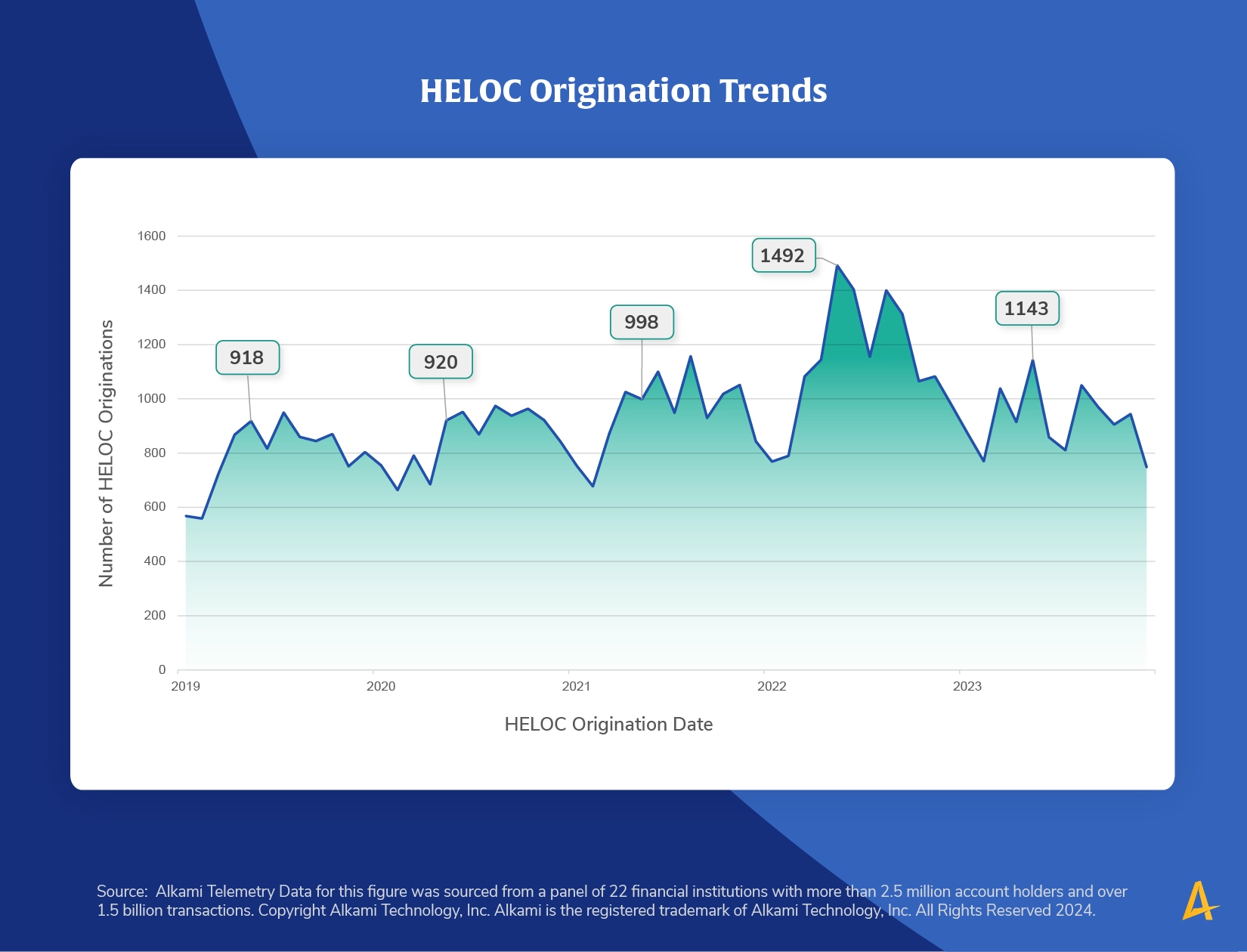

HELOC originations trended slightly upwards from 2019-2021. As interest rates began to spike in early 2022, so did HELOC originations, confirming that homeowners desired a substitute for cash out refinances in order to access home equity. HELOC openings in May 2022 were 49.4% higher than in May 2021. May 2023 HELOC openings declined year-over-year, but were still 14.5% higher than May 2021.

Download the 2024 Alkami Telemetry Report, The High Interest Rate Environment and its Impact on Consumers and Financial Institutions to read more insights about how the housing market is impacted by high interest rates.