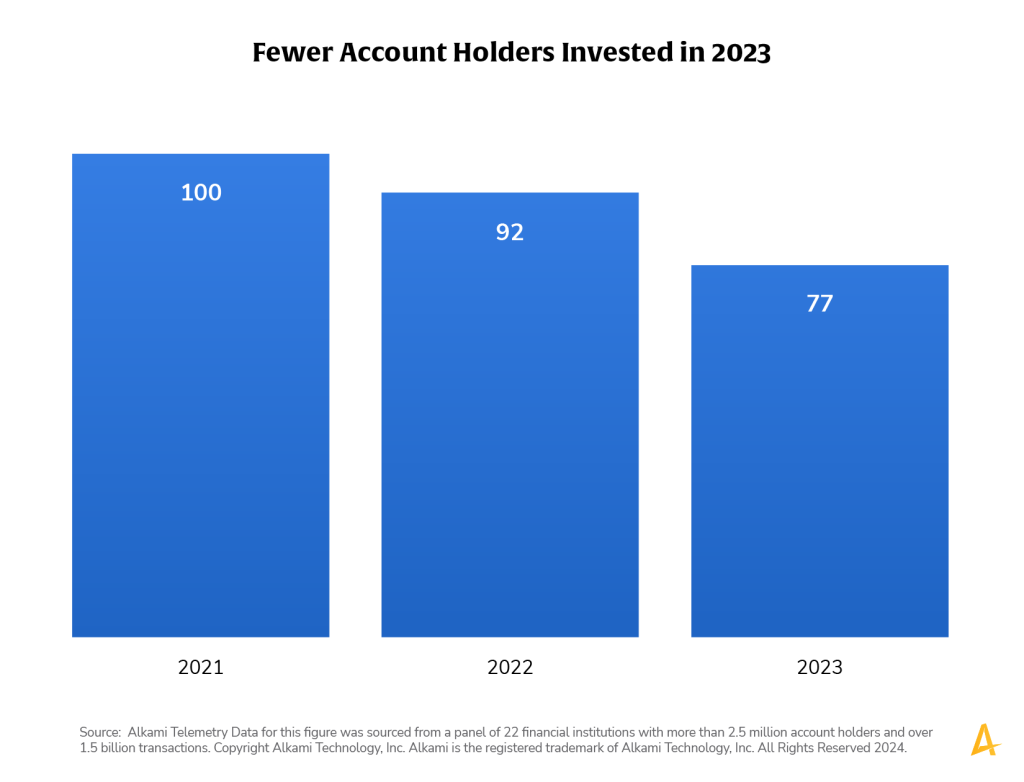

The data panel revealed 16.3 percent fewer account holders sent money to an investment account in 2023 as compared to 2022, continuing a trend where 8 percent fewer moved money to an investment account in 2022 than in 2021. There are two potential factors that could be impacting investing. First, inflation is increasing monthly expenses, like electric and grocery bills, and may be reducing the amount that Americans have available to invest. Second, rising interest rates have made certificates of deposits (CDs) and money market accounts a safe and attractive place to move money. We know that CD openings surged in 2023; consumers can keep money in an FI and earn a nearly risk free return.

Financial institutions have an opportunity to increase retail deposits by promoting CDs. Using transaction data that reveals behavioral indicators can guide a financial institution to target the relevant audience set of account holders for these types of deposit accounts.

Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.