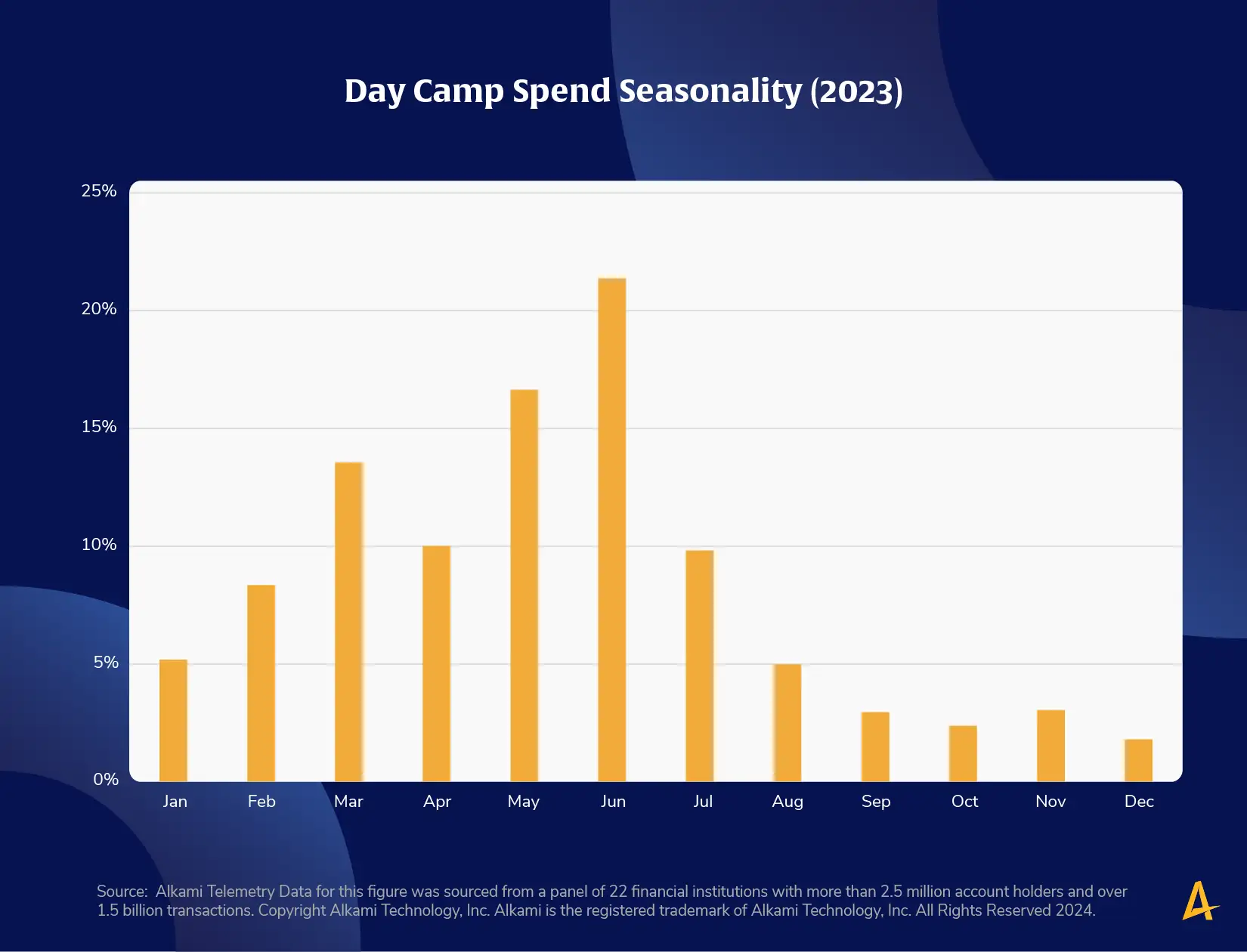

Parents look to keep their children busy and active during the summer and day camps are a popular option. Sports camps, art camps, computer camps, and more keep kids active and engaged. This week’s chart analyzes 2023 data and compares the percentage of annual spend on day camps that occurred in each month. Alkami Research shows that planning for the summer begins early in the year, well before summer begins. From January through April, 37.1% of spend occurs on day camps as parents get a jump on planning their summer. The remainder – 52.8% of the annual spend – happens in the traditional summer months: May, June, July and August with the biggest spike in June.

Banks and credit unions can use day camp spend as a great way to identify the “Has Children” persona within the account holder base. Target parents with relevant financial products like educational savings accounts or a home equity line of credit (HELOC) for access to quick cash.

To capture interchange fees and top of wallet status, financial institutions can build a campaign to remind parents at the beginning of the year to put their children’s day camp fees on its bank or credit union’s debit or credit card. Once the end of summer hits, parents can be reminded to use this same card for back-to-school shopping, school fees or tuition payments. Using the financial institutions transaction data to uncover behaviors and merchant spend, engagement messaging can be relevant to parents for other products and services such as a certificate of deposit or auto loan.