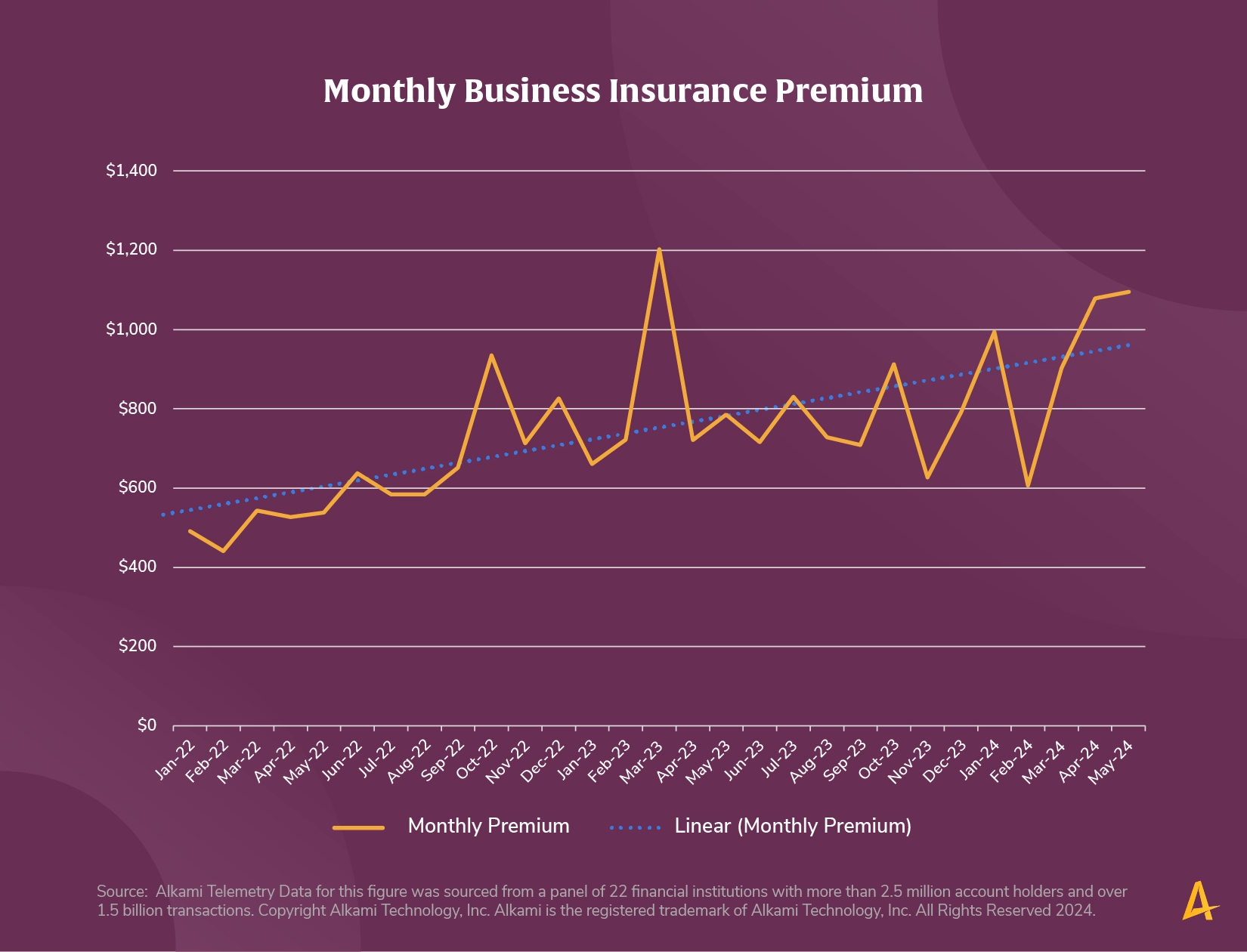

The average monthly commercial insurance premiums, examining both general commercial insurance companies and liability insurance companies, have been on the rise. While there are spikes and valleys in certain months, our trendline, displayed as a dotted line in the chart above, shows that the average amount has risen approximately 74% over the last 30 months.

Financial institutions who have insurance services can reach out to commercial and small business accounts, who may be open to changing providers and price shopping in light of premium increases. Additionally, understanding the types of insurance that businesses are purchasing can give insight into their industry and what additional financial services needs they may have. For example, a business purchasing medical malpractice insurance may also need equipment financing to enable purchase of a diagnostic machine.