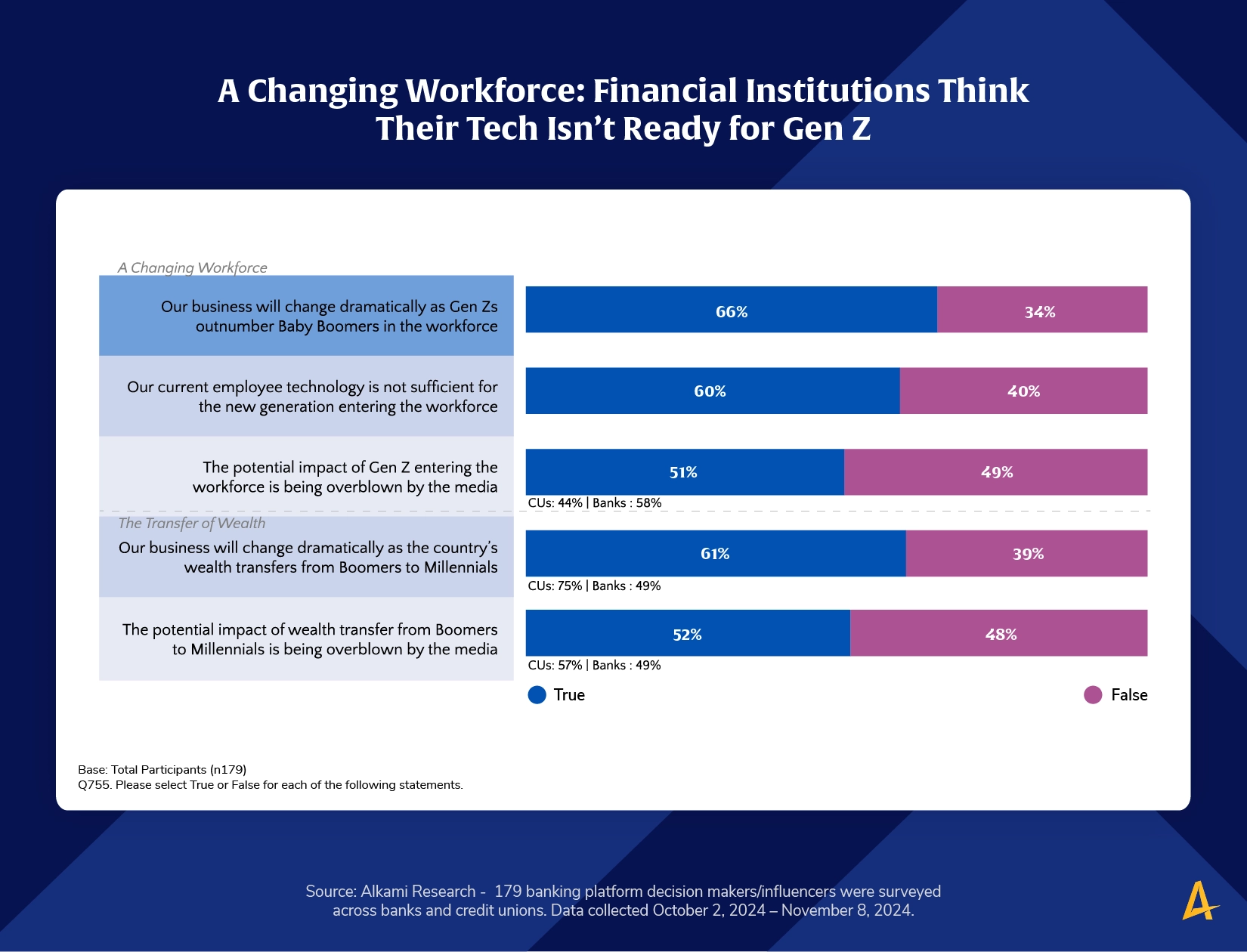

Alkami Research conducted a study that surveyed bank and credit union banking platform decision makers/influencers to explore their digital banking provider perceptions and experience. The results found that the majority of both banks and credit unions agreed that their business is about to change dramatically when Generation Z (Gen Z) begins to outnumber baby boomers in the workforce. Almost as many agreed that when the country’s wealth transfers away from baby boomers to their younger beneficiaries, that too will cause a dramatic change in how their business will operate.

Up to $40 trillion dollars in wealth will be handed down, with women over 60 controlling $8 trillion in liquid wealth assets. As of the second quarter of 2024, Gen Z workers overtook baby boomers (18% compared to 15%). The largest working population now? Millennials at 36%.

Banking leaders must begin to plan for both long term and short-term technology adjustments to ensure their offerings are in alignment with the preferences of their customer and member portfolio. Studying generational preferences in banking and consumer spending trends, and measuring your retail and business banking maturity, will help inform operational strategies.