With tax season behind us, Alkami Research examined data around giving to charities. Transaction analysis identified monetary gifts to more than 150 different major charities from account holders across our panel from January 2022 through March 2024. According to the IRS, there are more than 1.4 million tax exempt charitable organizations in the U.S.; Thus, our analysis is not identifying all giving, but the major charities found in our analysis are useful for understanding giving trends at large.

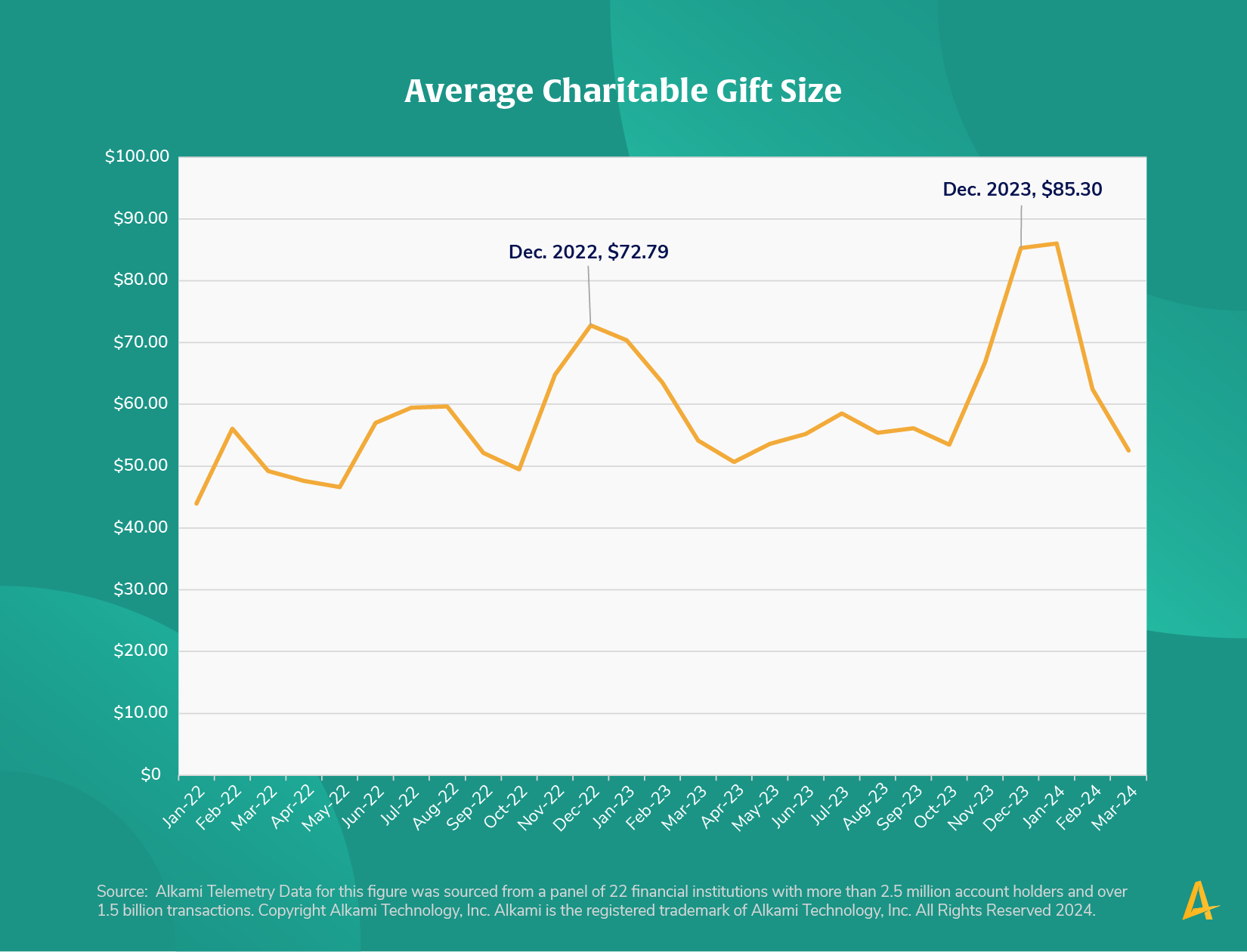

Charitable giving is a way to reduce tax liability, as donations to 501(c)(3) organizations are generally tax-deductible. Many people give donations at the end of the year to maximize deductions for the year. Our analysis shows that the average gift amount is indeed seasonal. In both 2022 and 2023, the average gift peaked in December. In December 2022, the average charitable gift was $72.79, increasing by 17.2 percent to $85.30 in December 2023. Interestingly, the data does not show a similar spike in the number of people giving or the number of times they give in December. We’ll examine that more next week.

As many regional and community financial organizations (RCFIs) exist to serve their communities, so do charities. RCFIs can consider charitable giving as part of any tax planning advice, or supporting charities within their communities with volunteerism. Additionally, there are opportunities to have fundraisers or develop a corporate giving program with employee payroll deduction.