Industry experts predict the number of digital banking users will surpass 200 million by 2022. That’s 77 percent of the adult population, making for a large and ever-growing market that’s attracting investors from well-known names to new-comer disruptors. Meanwhile, Big Tech companies and major retailers continue to grow their digital banking capabilities, developing increasingly personalized mobile and desktop experiences that community and regional credit unions and banks don’t have the resources to keep up with on their own.

So what does this mean for members and customers? Are digital experiences impacting who they bank with? Would they leave their current financial institution (FI) for another with a better user experience (UX)? Would they bank with a tech company that’s invested heavily in UX?

To answer these and other questions, in June 2021, Alkami conducted primary research among 795 digital banking customers and members in the United States to better understand their expectations when it comes to an exemplary user experience and compared those findings with the perceptions of 150 regional and community financial institutions aspiring to deliver the same.

To qualify for the double-blind study, consumers aged 18-75 admitted to online or mobile banking at least once per month. These consumers were well represented as customers or members from multiple types of financial institutions, including megabanks, neobanks, and regional and community financial institutions. Financial institution respondents had between $200 million to $100 billion in assets and 10,000 to 2,000,000 customers or members. Each respondent was involved in digital banking decisions, with two-thirds in senior or executive management.

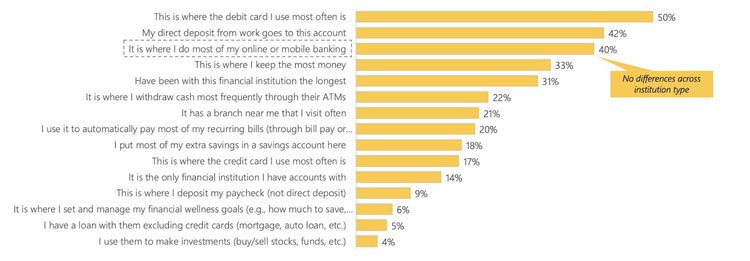

Users have come to expect so much from UX in their digital lives that financial relationships have had to evolve along with the digital banking experience. Digital banking users are now defining their primary FI by where they do most of their online or mobile banking.

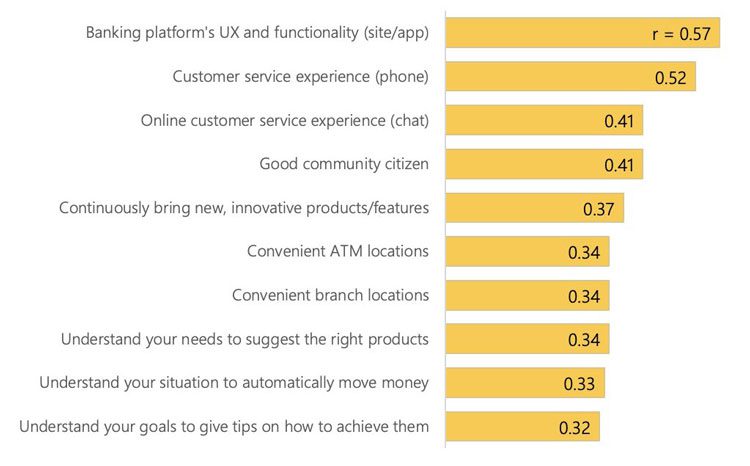

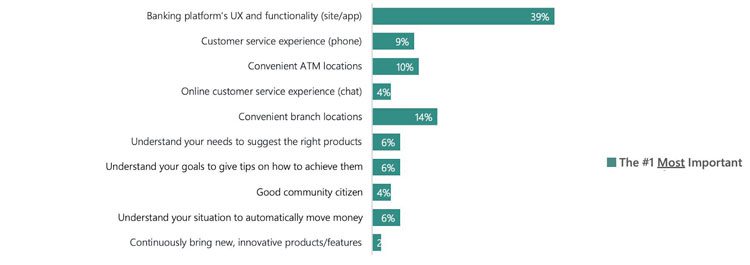

Overall FI satisfaction relies on UX as well, outranking ten attributes to overall bank or credit union satisfaction, including customer service, product innovations, and branch and ATM locations.

Consumers are also three times more likely to cite the digital banking experience as the most important aspect of banking, again outranking customer service experiences and convenient branch and ATM locations.

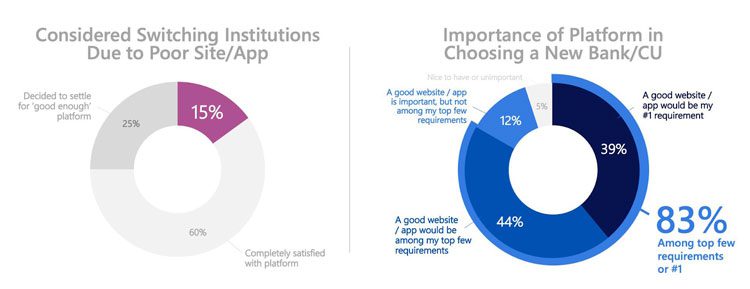

The quality of an FI’s UX will impact their customer or member base. One in seven digital banking users has considered switching primary FIs because of a subpar digital banking experience. Additionally, over 80 percent of consumers cite a quality online or mobile banking experience as their top requirement when choosing a new FI.

Digital banking consumers recognize the differences between what constitutes UX and user interface (UI) despite the two often being confused for one another.

UX is how users interact with and experience a product, system, or service, and includes perceptions of utility, ease of use, and efficiency. UI is where interactions between humans and machines occur. Together, UX and UI create the digital experience and how users interact with it.

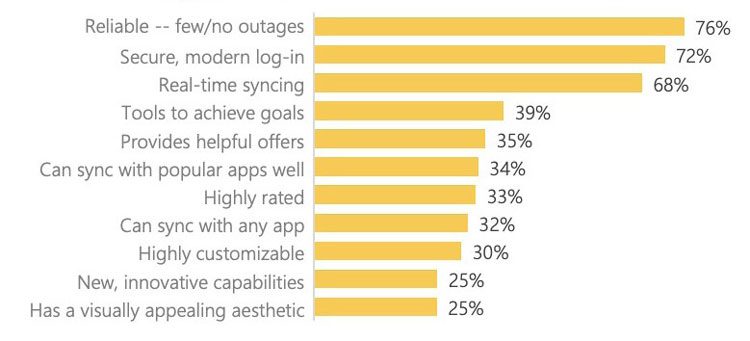

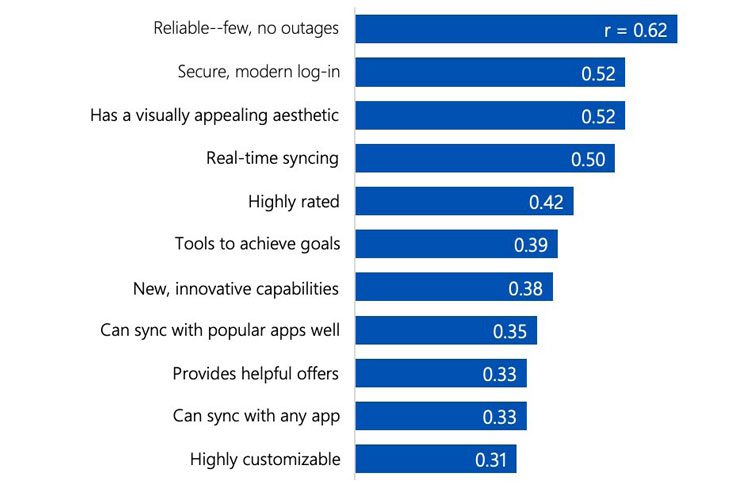

The differences seem clear to users, as the essentials of a digital experience are what they favor among eleven attributes, including reliability, security, and real-time syncing of data. Coming in last: having a visually appealing aesthetic.

Despite long-held beliefs that baby boomer, millennial, and gen z users have different standards for digital banking, this study shows that no generational gap exists among generations regarding how fun, relevant, or powerful consumers prefer their experiences to be. In fact, boomers were more likely to want a fun, evolving, and multifunctional experience than younger generations.

Consumers of all ages and stages appear interested in a more intuitive, engaging digital banking experience, as no more than 40 percent are satisfied with how their digital banking experience provides helpful offers or innovates new capabilities. This impacts how users view their FIs: less than 40 percent of consumers are satisfied with their FI’s understanding of their financial situation, needs, or goals.

The number of digital banking users is growing, and they expect a mobile or online banking experience that connects them to their finances. How FIs execute digital banking impacts the user relationship, and, as the competition for user loyalty expands into the realms of big tech and fintech, consumer expectations are rising. From the data in this report, it should be clear to FIs that UX is central to their future success. To make a winning UX, FIs will need to turn to their users for where to improve or innovate.

Quantitative studies on user preferences are just one way to understand what users want. Qualitative feedback throughout the design process can also inform the user experience. The System Usability Scale, a proven methodology that assesses the user experience across ten simple questions, is also helpful. The scale is a reliable, tested tool for evaluating a wide range of products and systems, and has been correlated with net promoter score (NPS), giving FIs a means to link user experience with loyal promoters. Whether the digital banking platform is developed in-house or provided by a technology partner, FIs will need a methodical, continuous approach of testing, learning, and iterating to craft a UX to fit the only opinion that matters: the user’s.