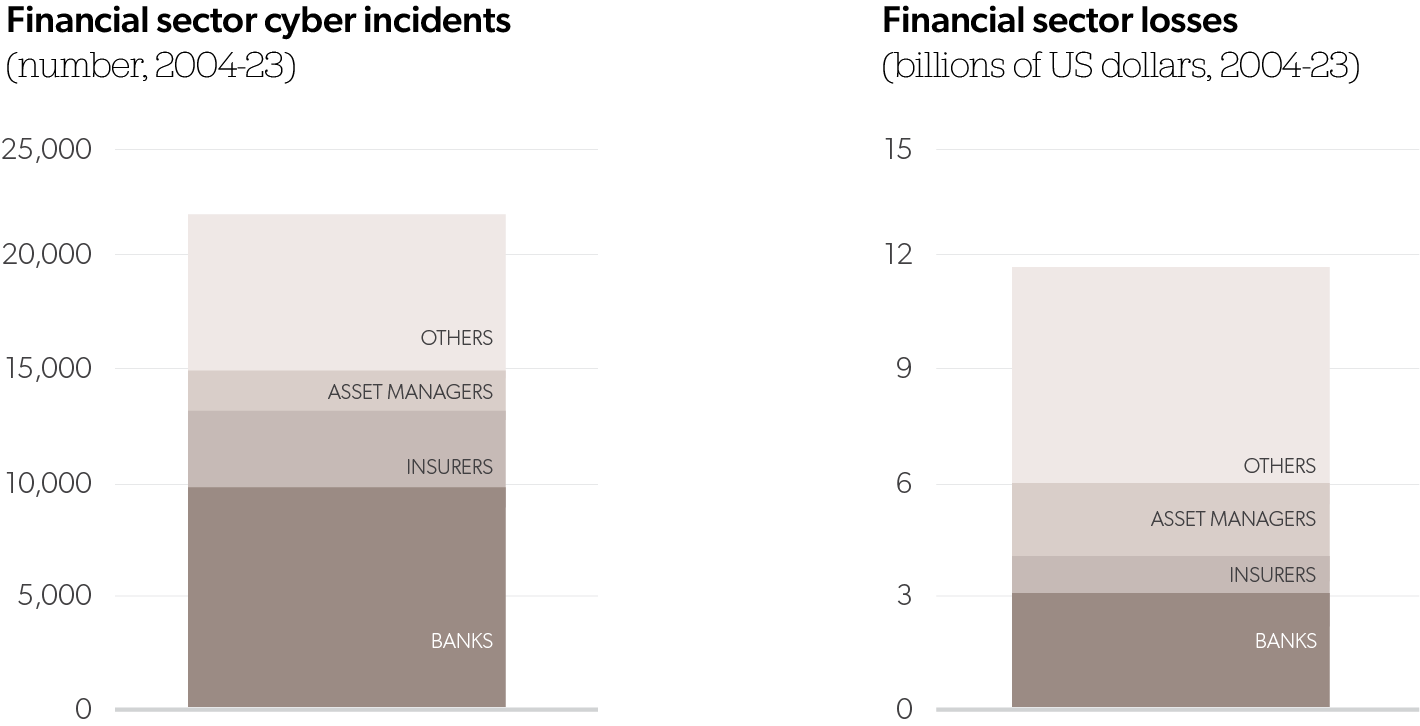

According to the International Monetary Fund’s 2024 Global Financial Stability Report (GFSR), nearly 20% of reported cyber incidents from 2004 to 2023 impacted the financial sector, with direct losses nearing $12 billion. As cyber fraud continues to rise, traditional security solutions are no longer enough. According to the recent Fraud Beat: Strategic Perspectives for the Financial Industry report, compiled by Appgate, the need to protect digital banking solutions and financial transactions has never been more critical.

This blog analyzes the key findings of the report and outlines how financial institutions, prime targets for both cybercriminals seeking financial gain or nation-state actors aiming to disrupt global stability, can stay ahead of fraud in online banking platforms.

The report highlights several factors driving the increase in fraud within the financial sector:

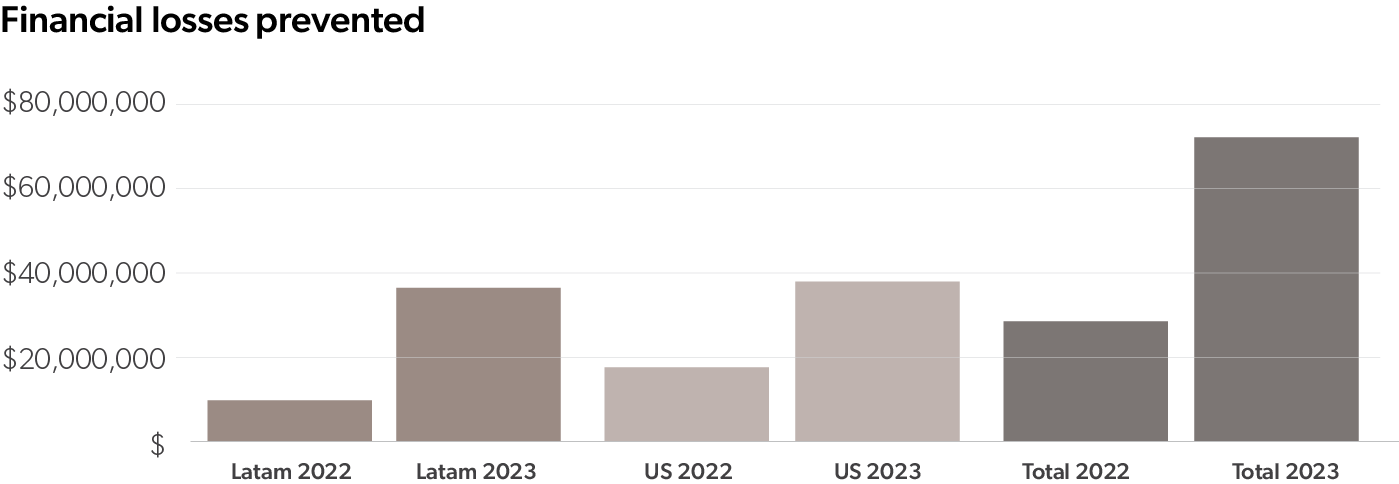

AI-driven solutions are revolutionizing fraud detection in digital banking solutions by analyzing vast amounts of transaction data in real time, enhancing both security and operational efficiency. One prime example is Appgate’s Detect Transaction Anomaly (DTA), which uses AI to monitor billions of transactions to identify fraudulent patterns and proactively mitigate threats. According to Appgate data, in 2023, DTA analyzed over 2 billion transactions and prevented $73.5 million in fraud. This represents a notable 37% increase in analyzed transactions and a 177% rise in fraud loss prevention compared to 2022.

This AI-powered approach not only detects fraud more effectively but also reduces the number of false alerts, allowing fraud prevention teams to focus on critical cases. In Latin America, DTA lowered daily fraud alerts to an average of 45, significantly cutting operational costs.

Appgate’s comprehensive fraud prevention framework is designed to be iterative and adaptive, guiding financial institutions through four essential stages that ensure the strength of their defense mechanisms against evolving threats in their online banking platform.

As financial institutions increasingly embrace digital banking to enhance customer or member experiences, strengthening cybersecurity measures becomes paramount. Implementing advanced AI-driven solutions like those from Appgate detects fraud in real time and enables institutions to quickly adapt to emerging threats. Appgate’s AI-driven systems also ensure that institutions stay ahead of regulatory changes, which is essential for maintaining account holder trust and avoiding penalties.

Additionally, developing proactive risk management strategies is critical in reducing the likelihood of incidents. Rather than merely reacting to attacks, financial institutions should anticipate potential risks and strengthen their defenses before breaches occur.

The collaboration between Alkami and Appgate exemplifies how innovative partnerships can provide cutting-edge, AI-powered solutions tailored for fraud prevention in digital banking solutions. By integrating Appgate’s DTA, financial institutions benefit from more than just fraud protection—they gain a competitive edge. Continuous monitoring and learning capabilities allow these solutions to stay ahead of emerging threats, adapting in real-time to safeguard both operations and account holder trust.

To learn more about Appgate’s DTA solutions and how it integrates with Alkami’s Digital Banking Platform, request a demo today.