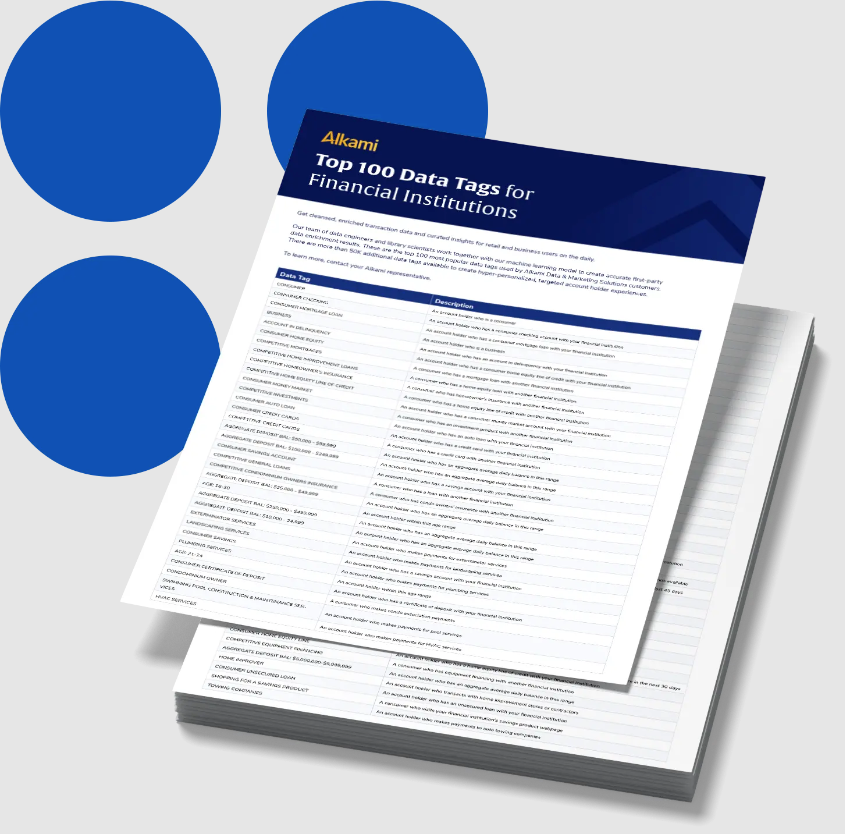

To grow and maintain profitability, banks and credit unions must use every available resource. One of the most powerful tools at their disposal is data—specifically, the ability to leverage first-party data analytics in banking to create personalized, targeted experiences for account holders. However, studies indicate that data scientists spend about 40% of their time aggregating, standardizing, cleansing and categorizing data to prepare it for analysis, leaving less time for generating valuable insights. Alkami’s Data & Marketing Solutions has the easy button for actionable data insights. The team of data engineers and library scientists at Alkami is dedicated to delivering precise first-party data enrichment results in the form of data tags. More than 50,000 data tags are available to design personalized banking experiences for your account holders. The possibilities are truly unlimited.

Read on to learn how data tags can help your financial institution capture deposits, drive lending, boost interchange income, expand commercial opportunities, and enhance account holder engagement.

Financial institutions need durable, low-cost deposits to support liquidity management, financial stability, and profitable lending. Holding the deposit relationship is a key component to primary financial institution status. Data analytics in banking empower you to capture and retain deposits from your account holders by identifying your most engaged account holders, uncovering those with relationships at other institutions, and targeting outreach efforts effectively.

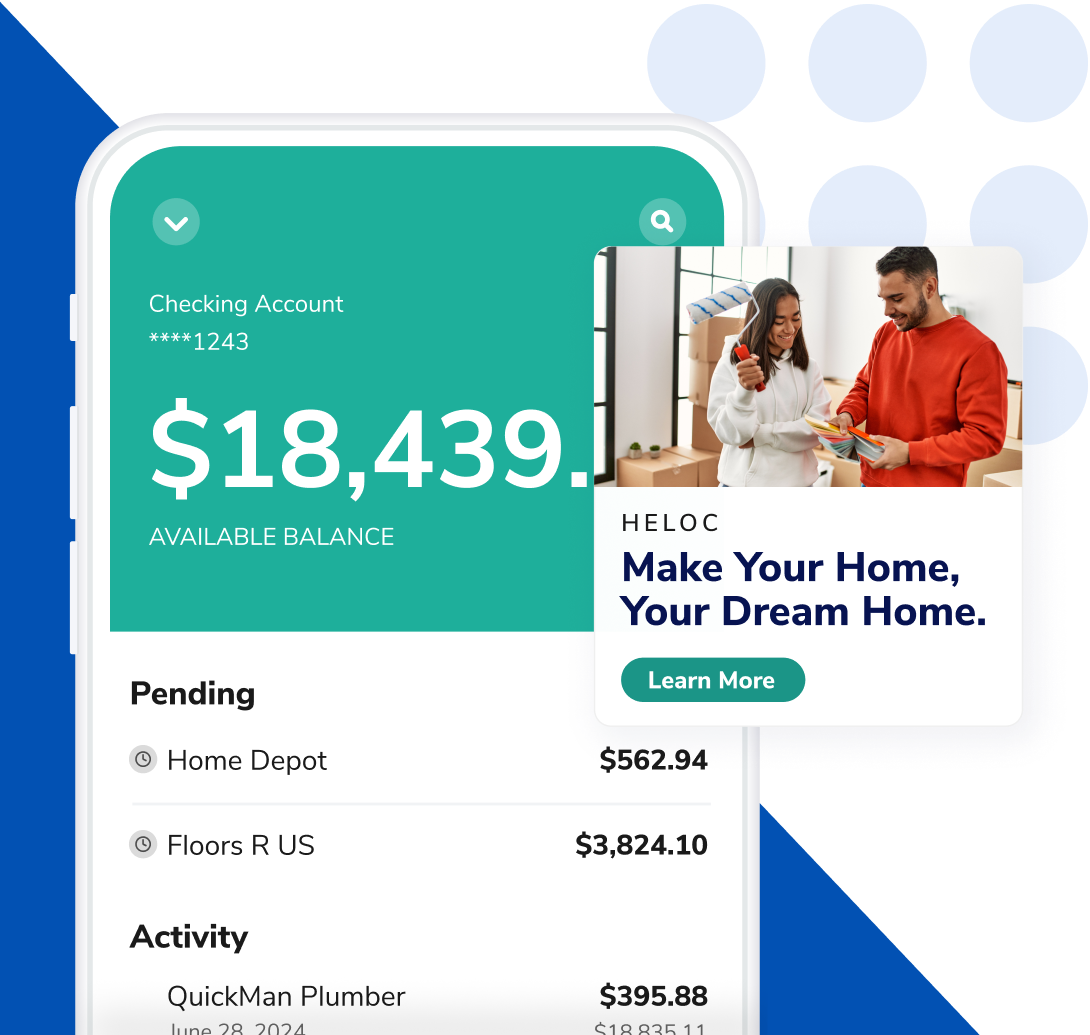

Maximizing profitability often means prioritizing lending, particularly when excess liquidity is available. By analyzing current product holdings and account holder behavior, financial institutions can predict and recommend the next best lending product for each account holder. This data can reveal where account holders are making loan payments, when loans are due, and where there’s potential to encourage greater utilization of products, like home equity lines of credit (HELOCs).

Diversifying revenue streams is crucial for financial institutions, and growing interchange income provides a steady and profitable source of non-fee income. By promoting the use of debit and credit cards, financial institutions can capture more interchange income. Data insights can help identify which cards are top of wallet, highlight key spending categories outside of your institution, and pinpoint recurring payments made via ACH rather than a card.

Financial institutions know that commercial banking relationships are an ideal source of durable deposits and income from higher interchange commercial credit cards. Deepening existing commercial relationships is critical to drive greater profitability.

Qualified opportunities to grow commercial and small to midsize (SMB) banking relationships exist in every financial institution’s data. With data analytics in banking, you can prepare your commercial relationship managers with data insights about the financial relationships that your commercial and SMB accounts hold. This includes data insights for relevant business purchases, like merchant processing, business financing, payroll, and business insurance.

Retaining account holders is vital to maintain a stable account holder base and drive growth. Cleansed, normalized, and analyzed data hold important indications about an account holder’s level of engagement and ultimately, risk of attrition. Equipped with these data insights, financial institutions can contextualize this information with other data tags that describe transaction and financial behavior. Data insights, powered by artificial intelligence (AI) in banking, enable you to pursue deeper relationships with highly engaged account holders and implement retention strategies for those at risk of attrition.

The ability to harness and apply data effectively is a powerful driver of growth and innovation for financial institutions. By leveraging data insights, banks and credit unions can enhance deposits, lending, revenue diversification, commercial relationships, and account holder engagement. See the top 100 most popular data tags used by our customers to drive growth.