By: Marla Pieton, Sr. Director, Influencer Marketing and Research

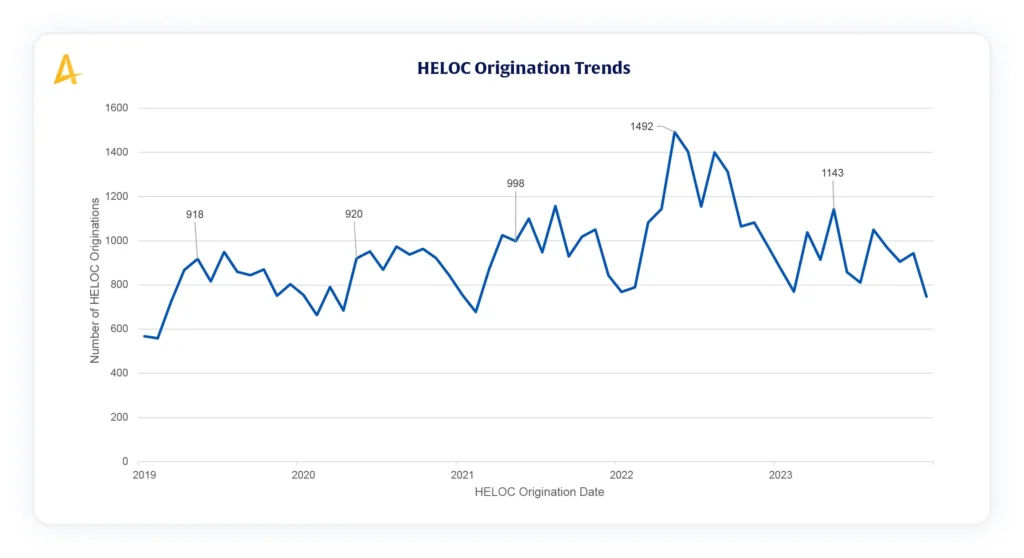

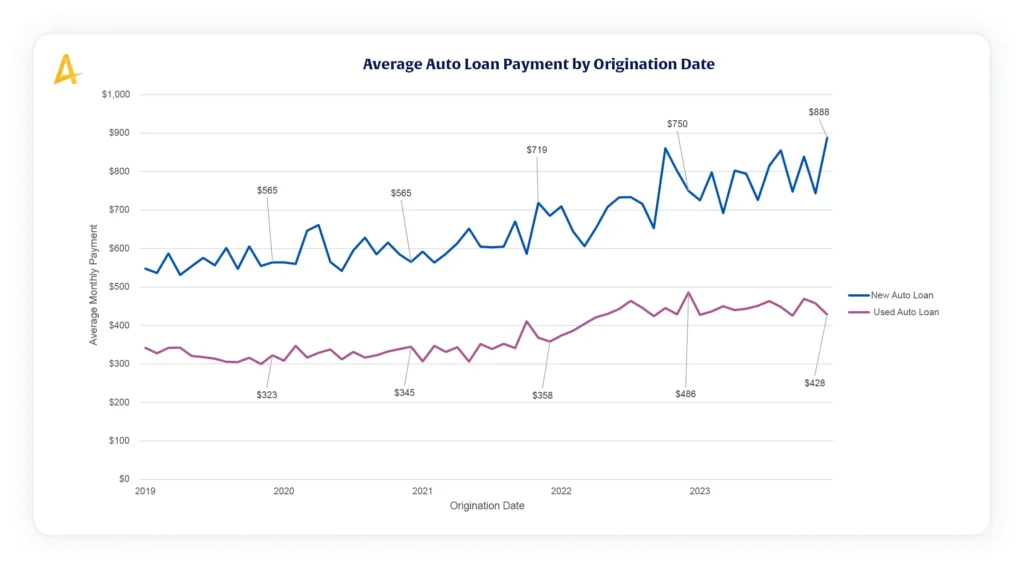

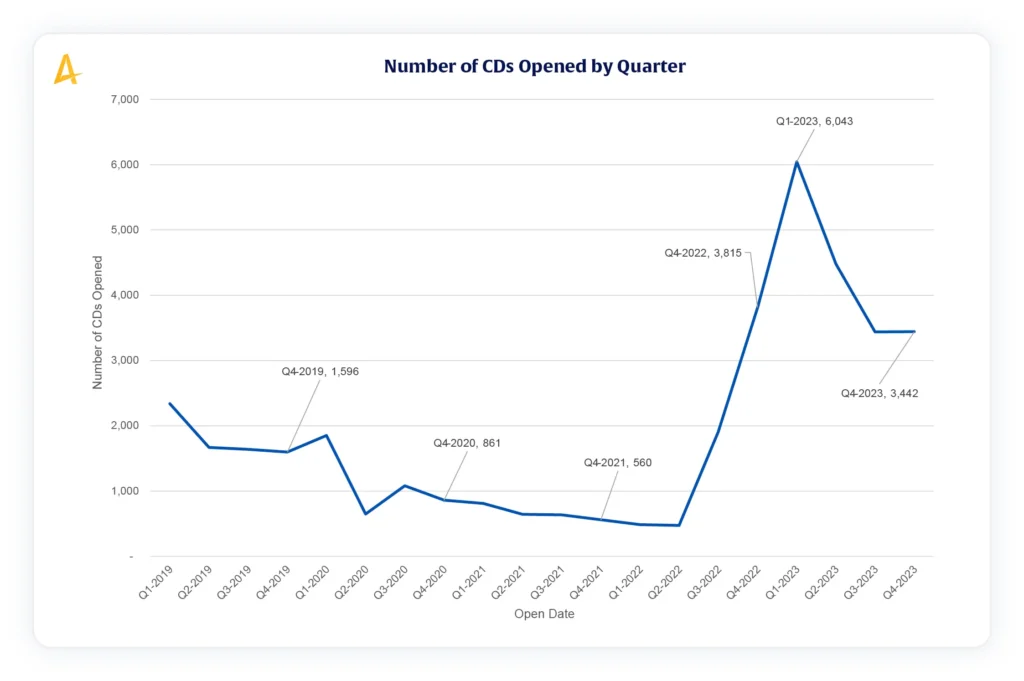

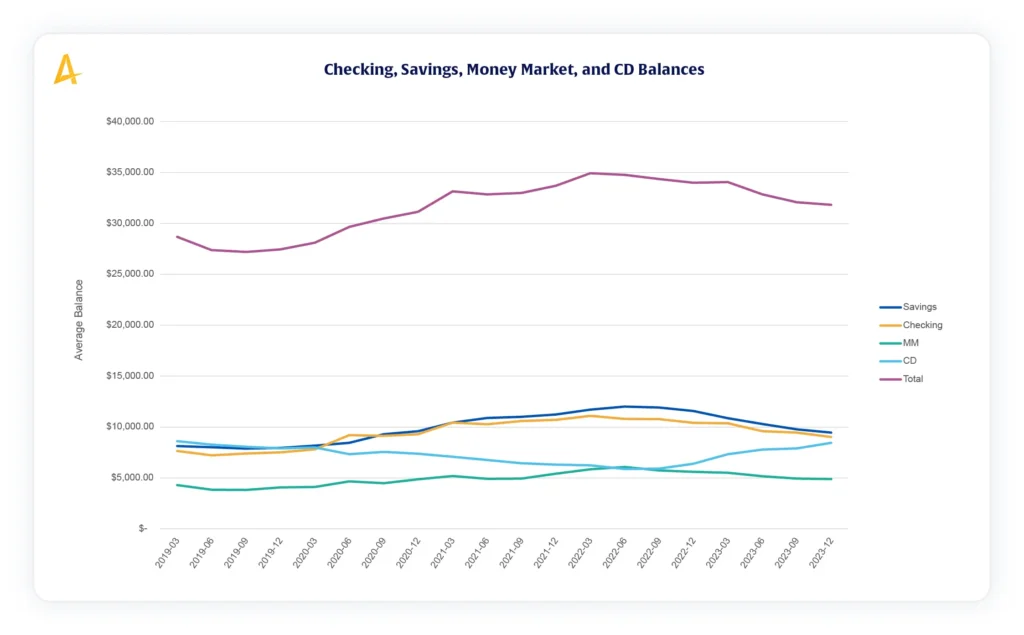

The 2024 Alkami Telemetry Data Report, The High Interest Rate Environment and its Impact on Consumers and Financial Institutions, highlights multiyear trends in key deposit, loan, and payment products, drawing from an aggregated panel over 2.5 million account holders.

As financial institutions and consumers alike face challenges presented by the fluid interest rate environment, this report provides industry benchmarks and trends in consumer behaviors, and the actions that regional and community financial institutions (RCFIs) can take to gain intel through transaction enrichment, and insights derived from transaction data.

Bank and credit union leaders can leverage data analytics in banking to inform strategies related to business decisions, marketing campaigns, product gaps and innovation.

Additionally, a recent study was commissioned by Alkami and conducted by The Center for Generational Kinetics, surveying 1,500 digital banking consumers in the U.S. to reveal the current attitudes and perceptions of the various generations and how their financial journeys are being impacted by the macroeconomic environment.

The data analyzed by Alkami Research revealed the following insights taken from the 2024 Alkami Telemetry Data Report:

Recent research commissioned by Alkami shows that 67% of digital banking Americans say the rising interest rate environment has had a significant impact on their standard of living and 59% are living paycheck to paycheck.

With the economic pressure being felt by financial institutions and consumers, banks and credit unions are positioned to differentiate themselves from the competition through insights derived from transaction data – data already sitting in their ecosystem.

The transition to becoming a data-informed digital banker will empower financial institution leaders to lead strategic decision-making with knowledge-based intel and make messaging and engagements relevant for their account holders’ financial journey through personalized banking.

According to the Financial Brand, chief marketing officers across the industry have identified revenue growth as their top mission-critical priority for their department over the next 12-18 months. Bank and credit union marketers can deliver on this priority by focusing on intel to transform into a data-informed digital banker.

Account holders’ transaction data found inside the core is the catalyst for this strategy, which after transaction enrichment, apprises leaders with behavioral insights on how the market is impacting consumer financial decisions.

Financial institutions can use these insights derived from transaction data to then identify:

The data-informed digital banker is a mindset, where banks and credit union leaders can change the narrative of consumer perception. According to the same recent research mentioned above, 64% of digital banking Americans feel like too often financial providers don’t pay enough attention to the needs of their account holders, while 83% think their primary financial provider will continue to be their most important financial provider in the next year.

Financial institution members and customers have diverse banking needs, and using transaction data to gain the intel on individual spend and money movement behaviors will give bank and credit union leaders the opportunity to provide a concierge-like service through their interactions.

A data-driven strategy is built on the foundation of transaction data, and can be the catalyst to guide a financial institution to digital maturity. A recent research study, the Retail Digital Sales & Service Maturity Model, found that the most digitally mature banks and credit unions in the market have a data modernization strategy and report up to twice the annual growth as the least advanced.

This strategy not only guides the journey toward digital maturity but also supports key business decisions in navigating fluctuating interest rates, driving product innovation, and enhancing marketing tactics for individualized offers and personalized banking.