Facing rising interest rates, financial institutions have shifted their efforts from lending to deposits. Meanwhile, the market has become increasingly saturated with attractive offers and flashy interest rates. Neobanks are leading the charge with intuitive technology and competitive offers, capturing 47% of new checking accounts opened in 2023.

This fluctuation has created a liquidity crisis for banks and credit unions. According to a recent survey, 43% of financial institution respondents listed deposit growth as their #1 priority over the next two years.

FDIC reported that banks saw their deposit base decline by $472B in the first quarter of 2023, as measured from the end of the year. That’s a 2.5% drop in the total deposits held by banks.

– (PAYMNTS, 2023)

Concurrently, consumers are also feeling the heat. During the COVID-19 pandemic, the U.S. personal savings rate, “rose rapidly, far beyond its pre-pandemic trend and much higher than in previous recessions.”

However, excess deposits have quickly been depleted and replaced with the looming threat of inflation hitting everyone’s pocketbooks. As a result, increased costs have led to people dipping into their savings accounts to address basic needs.

Combining that pressure with the aftermath of recent bank failures, consumers and businesses realize that they need a financial institution that can be trusted, who supports them and their needs, and delivers a personalized experience in the digital channel. How can financial institutions secure the primary banking relationship and drive deposit growth? To effectively grow deposits at scale, banks and credit unions should create strategies that:

To combat account holder attrition and successfully attract new account holders, financial institutions need to reimagine their account origination process. Think of it as a two-fold approach. Applicants want to quickly open an account, deposit funds, and begin transacting with their debit card. Meanwhile, financial institutions want to digitally onboard new account holders or cross-sell existing users quickly and without manual processes. Points of friction normally occur when entering endless application data, funding the account, signing documents, and processing the application. But what if it didn’t have to be so hard?

New Depositors

Seamlessly onboard new consumers and businesses by following these steps:

Existing Account Holders

Make it easier for existing customers or members to grow their relationship with your financial institution by:

Cultivate highly engaged digital banking users by delivering the most demanded consumer banking solutions they want and need. Per the 2022 Digital Banking Transformative Trends Study, “highly active digital banking users have 1.71x the number of products with their preferred financial institution than those accessing digital banking at least once a year.” Banks and credit unions can leverage everyday features to accelerate deposits by offering seamless direct deposit setup and remote deposit capture.

Seamless Direct Deposit Setup

Traditionally, the direct deposit setup and switching process is slow and filled with friction: the consumer manually submits the payroll change to their employer’s payroll provider. It then takes a couple pay cycles to implement the change. What if there was an easier way?

Now, institutions can empower their account holders to easily update their payroll or direct deposit information within digital banking. This convenience will further position financial institutions as the account holders’ primary banking relationship as the financial institution quickly implements payroll changes, reduces deposit acquisition costs, and protects against identity fraud.

Remote Deposit Capture

Seventy-eight percent of consumers manage their finances via a digital banking solution, while 29% prefer to go in-branch. (Forbes, 2022)

To cater to the needs of all account holders, financial institutions must offer a convenient way for users to deposit their checks and access their funds quickly without needing to visit a physical branch. Remote deposit capture (RDC) gives users the ability to easily deposit checks on mobile and desktop – immediately reducing the time, expense, and inherent risks associated with traditional in-branch and mailed deposits. It also benefits operational teams by streamlining check processing and facilitating low-cost deposit growth by reducing transaction and operating costs.

Financial institutions hold a treasure trove of account holder insights but sometimes lack the tools to turn those insights into action and use them to their advantage. Here’s where financial services marketing automation comes into play. With transaction enrichment used to create behavior patterns, financial institutions can unlock data insights to engage the right account holders with the right message at the right time.

Financial institutions can capitalize on data analytics in banking to prioritize marketing spend, track competitors, compare marketing results to industry peers, and activate the data using marketing automation.

[callout_blue_box source=””]Financial institutions can capitalize on data analytics in banking to prioritize marketing spend, track competitors, compare marketing results to industry peers, and activate the data using marketing automation.[/callout_blue_box]

When combined, transaction and core data paint a holistic view of an account holder. Rather than tasking financial institution teams to review and analyze the data, financial institutions need a tool that takes care of the hard work and identifies new opportunities that financial institution marketers can activate. For example, banking marketing automation could identify trial deposits coming into a financial institution – an indication that a competitive account was opened and that money may be leaving the institution. Additionally, financial institutions could observe that an account holder received an unusually large deposit, which could be an opportunity to cross-sell a certificate of deposit (CD) or money market account.

Seems pretty straightforward. How does it work? Simplify campaign management in 3 steps:

To achieve new money business goals, financial institutions need a platform built to drive sales and service.

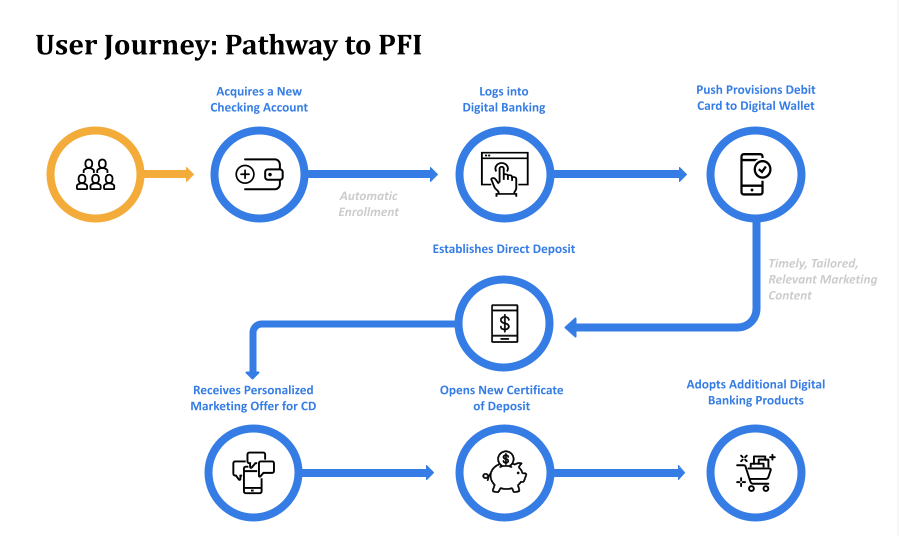

Let’s walk through a scenario, a consumer has just opened a new account. Once logged into digital banking, the user adds their new debit card to their digital wallet and begins using the card. The financial institution then sends the user timely, personalized engagements encouraging them to set up direct deposit – better positioning themselves as the primary financial institution (PFI). The user begins to regularly deposit checks from their mobile device. Based on their transaction data, the account holder seems to have accumulated some wealth, so the financial institution marketers send the user a compelling offer to open a CD account via a streamlined application – increasing product adoption and accelerating deposit growth through multiple channels.

As you work diligently to retain hard-earned banking relationships, amidst a competitive rate environment, you need a partner who is committed to your success and makes your job easier.