Artificial intelligence (AI) in banking isn’t the future, it’s the present. Most industry professionals agree: 87% of financial leaders believe AI will improve banking, up from 85% earlier this year. Though predictive AI continues to bring a lot of buzz, many financial institutions are still struggling to implement it effectively.

What Predictive AI in Banking Really Does

One of the most powerful applications of artificial intelligence in banking is predictive AI modeling. By analyzing data from everyday purchase transactions and the use of financial products and services, banks and credit unions can gain insights that go far beyond what a credit report might reveal. These insights can help financial institutions predict future behaviors and preferences, allowing them to offer relevant products and services at just the right time.

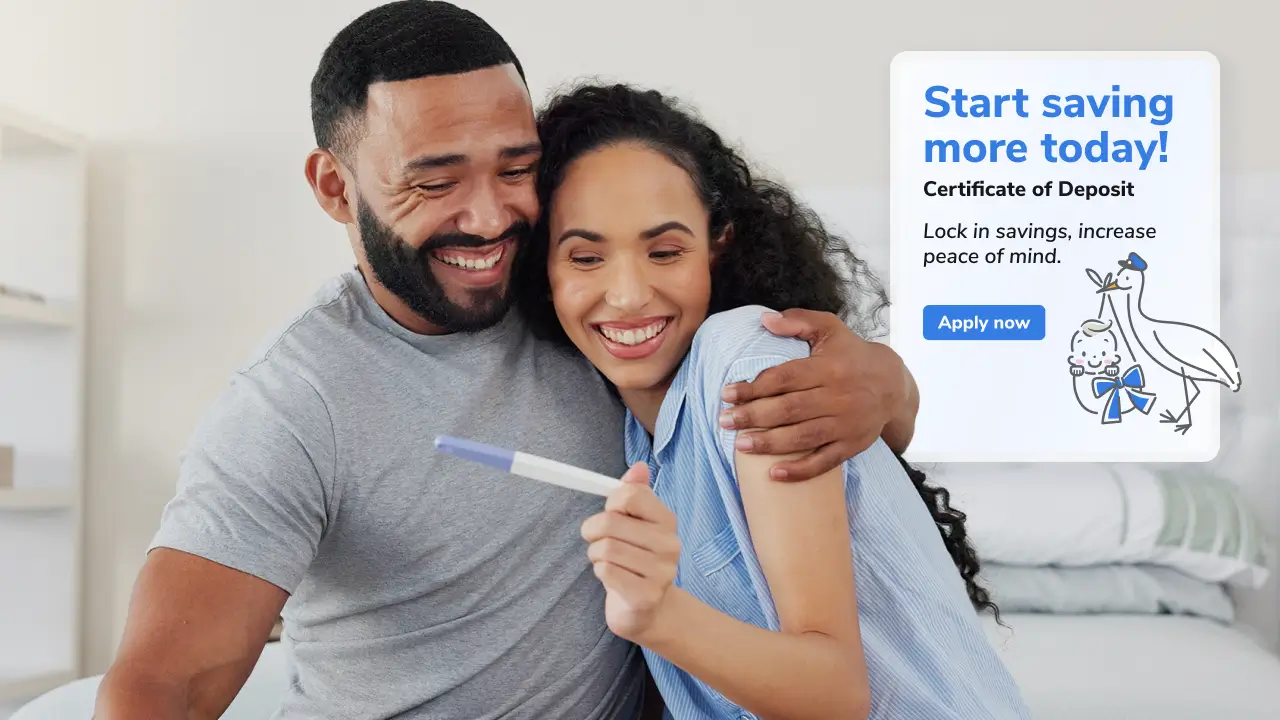

Think of it as a way to anticipate life moments, like buying a car, starting a family, or needing a home equity line, and proactively offering helpful solutions. For instance, by understanding an account holder’s spending patterns, a financial institution can anticipate significant life events and proactively offer tailored financial products.

Predictive AI modeling also enables institutions to create predictive audiences for various business cases, such as identifying account holders who might be interested in home equity products or who have increased funds available to invest. By leveraging historical transaction data and core data, artificial intelligence in banking can help institutions stay ahead of account holders’ needs, deepening the relationship and enhancing the overall experience.

But don’t worry: predictive AI isn’t here to replace human marketers. It works alongside them. While marketing teams bring strategy, intuition, and creativity, predictive AI can sift through huge amounts of data to surface trends and opportunities faster. Together, they make for a powerful team.

How to Keep Account Holders Engaged (and Reduce Churn)

Identifying account holders at risk of leaving and implementing retention strategies is vital to maintain and grow a stable account holder base. Cleansed, normalized, and analyzed data hold important indications about an account holder’s level of engagement and ultimately, risk of attrition.

Armed with an understanding of engagement level, financial institutions can contextualize this information with other data tags that describe transaction and financial behavior. For example, if an account holder has a direct deposit and a strong balance but stops using their debit card, that’s a red flag. With the right data in place, you can quickly respond with targeted offers, timely nudges or personalized outreach to keep them engaged and deepen the relationship with your institution.

Consumer Lending: Beyond Credit Scores

To maximize profitability, financial institutions must prioritize lending when they have excess liquidity. In some cases, pursuing specific types of loans may be appropriate based on a financial institution’s strategic direction, its need to diversify or market conditions. Finally, appropriately supporting the borrowing needs of consumers and businesses in the community is an important function of any financial institution.

Artificial intelligence in banking can be a powerful tool in offering a more holistic view of an account holder’s financial situation related to consumer lending. By analyzing a broader set of data, such as spending habits and transaction histories, AI can paint a more accurate picture of an account holder’s creditworthiness. This approach not only reduces the risk for financial institutions but also opens up lending opportunities for consumers who might otherwise be overlooked by traditional credit scoring models.

By analyzing account holder behavior, financial institutions can predict and recommend the next best lending product for each account holder. Data can show where account holders make loan payments, when loans at your institution are due, and opportunities to encourage home equity line of credit (HELOC) utilization.

Alkami Customer Results: Arkansas Federal Credit Union Uses Predictive AI to Grow Auto Lending

We spoke with Mariah Martz, senior digital marketing strategist at Arkansas Federal Credit Union (Arkansas Federal) about how financial institutions can use predictive AI and first-party data to create personalized marketing campaigns.

To maximize their marketing engagement, Mariah and the team at Arkansas Federal have integrated Alkami’s predictive AI models into their campaign development and targeting strategies. The credit union starts by identifying the product they want to promote, then pulls data from multiple sources—including core banking data, SavvyMoney credit data, and AI-driven insights—to build an optimized audience.

About the Alkami and SavvyMoney partnership

Through Alkami and SavvyMoney’s partnership, financial institutions can support digital banking users on their financial wellness journey with unlimited access to their credit report, real-time credit monitoring, and actionable financial advice. Additionally, banks and credit unions can unlock credit insights to inform their targeted marketing strategy and deliver pre-qualified and pre-approved offers to the right user at the right time, maximizing campaign results for marketing teams.

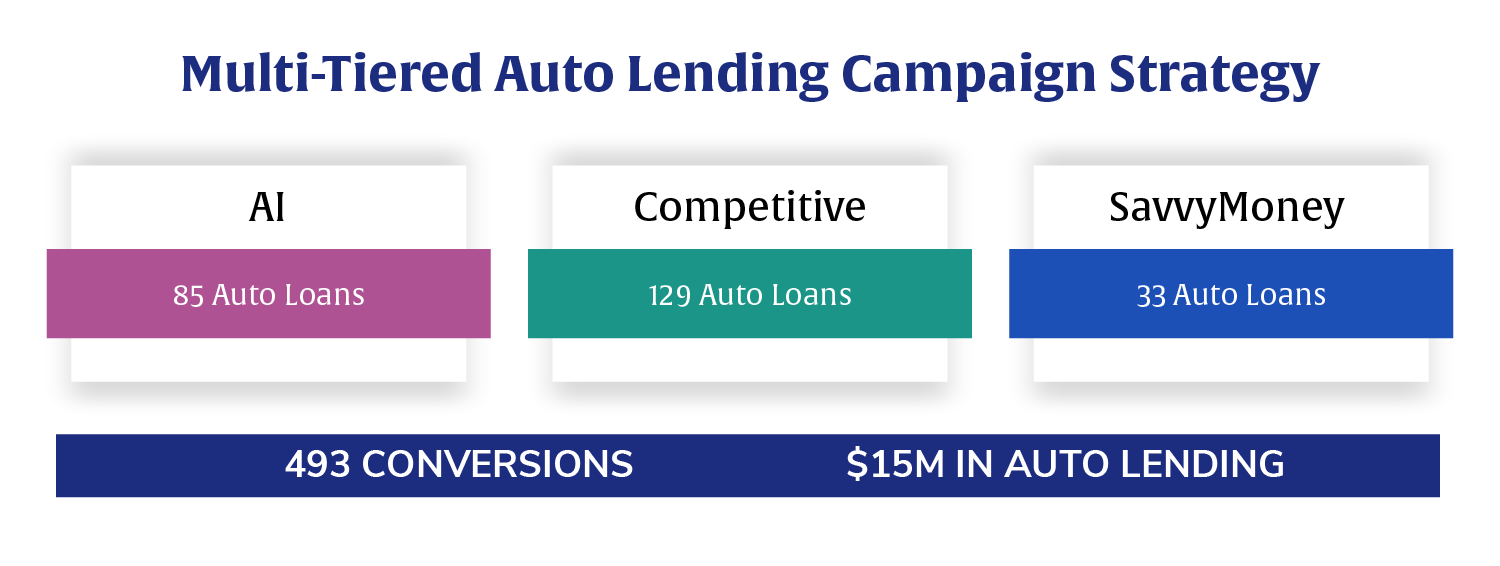

For an auto loan campaign they ran last year using Alkami’s financial services marketing automation, Arkansas Federal created three separate audience segments:

- Predictive AI cross-sell group: Members who resemble current auto loan holders from Alkami’s predictive AI model.

- Competitor auto loan group: Members with an auto loan at a competitive financial institution.

- SavvyMoney group: Members identified through credit bureau data with strong credit scores and existing auto loans.

These groups were targeted using email, push notifications, online banking and digital ads for seven months. By running campaigns to these three data-targeted groups, Arkansas Federal was able to track and compare conversion rates. Ultimately, the seven-month marketing campaign resulted in 493 auto loan conversions worth $15 million, including 85 auto loans identified by the predictive AI model.

“Prior to having the Alkami Data & Marketing platform, in a lot of cases the targeting would just be age range and which products members already have with us,” Mariah said. “The predictive AI cross-sell model allows us to hit members that we probably wouldn’t be able to identify on our own. It works as an easy button to unlock members that we may have missed otherwise.”

Key Takeaways

Predictive AI is no longer just a buzzword—it’s a powerful tool that can help financial institutions make smarter decisions, engage account holders more personally, and grow more efficiently. When combined with first-party data and behavioral signals from financial wellness solutions like SavvyMoney, it becomes even more valuable.

By using AI not just to analyze the past but to predict what comes next, banks and credit unions can meet their account holders where they are, and where they’re going.

- AI enhances but does not replace human decision-making in marketing for financial institutions.

- Predictive AI helps financial institutions identify high-value prospects.

- Combining predictive AI-driven insights with human intuition maximizes campaign success. By leveraging both approaches, financial institutions can maximize engagement, optimize campaign effectiveness, and drive higher conversions.

FAQs

How can financial institutions ensure the accuracy and reliability of predictive AI models?

To ensure the accuracy and reliability of its predictive AI models, Alkami leverages collaborative intelligence, where AI complements human skills with its automation, speed, scalability, and quantitative capabilities. This blend is crucial for leveraging artificial intelligence and data analytics in banking to improve marketing precision and efficiency. In addition, Alkami refines the machine learning algorithms with updated data daily, and incorporates feedback loops to improve model performance.

How can financial institutions protect account holder data when using predictive AI?

Because of the sensitivity of the decisions made by financial institutions, blending predictive AI with human intelligence is imperative. Banks and credit unions help their account holders maintain and grow their wealth, which involves making decisions with empathy and emotional intelligence – qualities that AI alone cannot deliver. This is why Alkami is built for regional community banks and credit unions, ensuring that human oversight and AI work in collaboration to provide the best possible outcomes, while protecting account holder data.

How is Alkami’s partnership with SavvyMoney different from other digital banking platform providers?

By combining Alkami’s digital banking solutions and data & marketing solutions with SavvyMoney, financial institutions can tap into a treasure trove of data to personalize marketing engagements. Financial institutions can gain insights into users’ creditworthiness and support SavvyMoney campaigns with financial services marketing automation.

The future of banking is here, and it’s powered by predictive AI