Financial services marketers are always in search of the best ways to target and engage their account holders effectively. One increasingly popular approach is utilizing artificial intelligence in banking, such as artificial intelligence (AI) predictive models, which provide banks and credit unions a flexible method for identifying and connecting with their target audience.

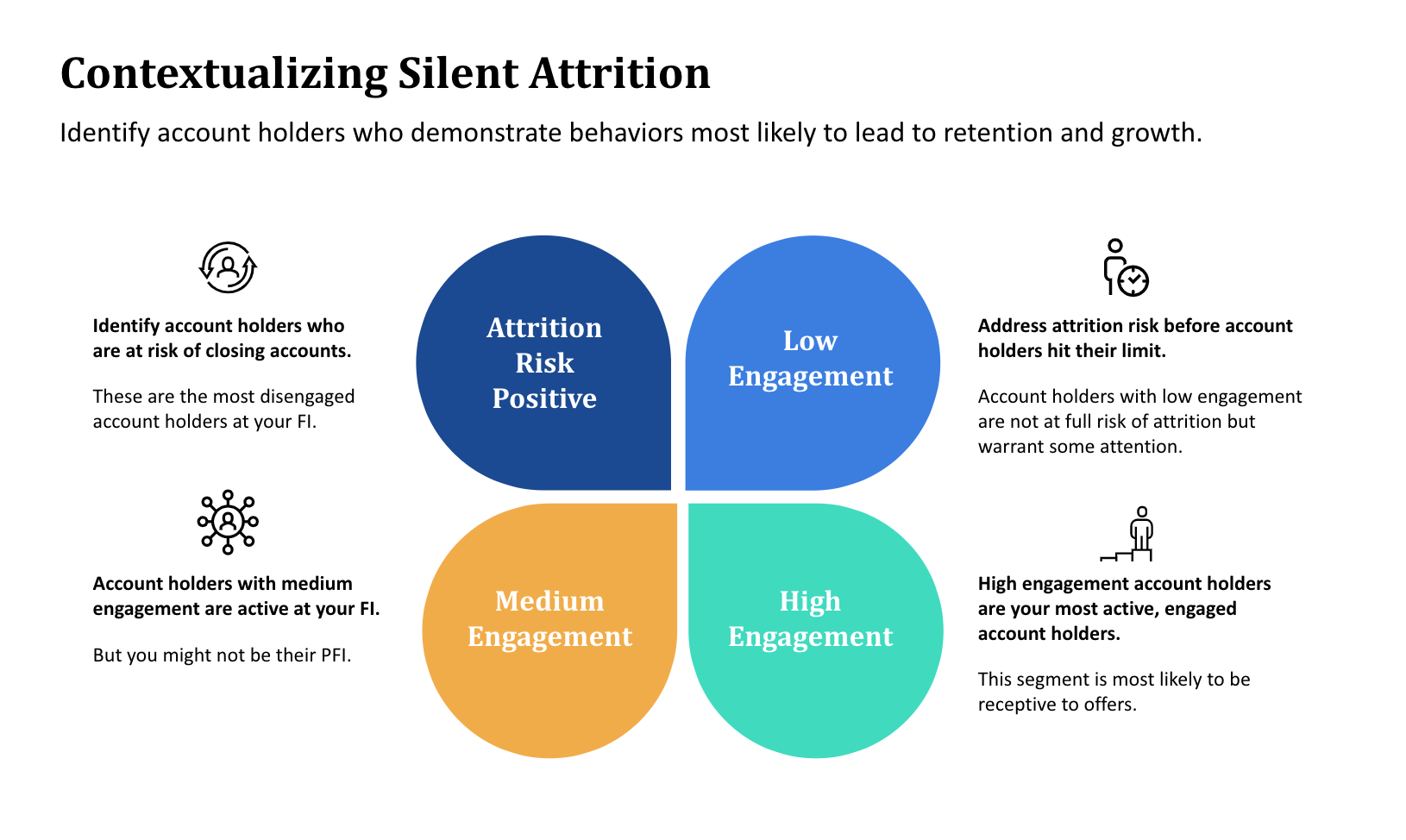

With AI predictive models, you can identify account holders who demonstrate behaviors most likely to lead to retention and growth.

#image_title

In this post, we’ll cover how Capital Credit Union embarked on a 6-month trial to enhance their financial services marketing efforts and drive tangible results with Alkami’s AI Predictive Models.

With data analytics, financial institutions can leverage clean, tagged transaction data to uncover actionable insights. Alkami Customer Insights allows financial marketers to use these insights to deeply understand account holders, all without receiving personally identifiable information.

Capital Credit Union started their auto loan campaign with Customer Insights. They focused on a targeted audience with competitive loan or lease balances, along with individuals with a significant portion of their auto loans paid off. This approach aimed to capture members before they considered alternative financing options, ultimately resulting in 392 loans worth $9.5 million.

Curious to learn if artificial intelligence could improve upon these results, they then used the auto loan cross-sell AI model. It captured prospects that wouldn’t have been found otherwise: an additional 226 new loans worth $5.2 million.

At Capital Credit Union, we really like the AI cross sell models as it helps target the members that we may have missed with the initial list. The AI cross sell models almost act as a safety net. Without this AI Model, we would’ve missed out on those prospects.

-Will Johnston, Marketing Analyst, Capital Credit Union

Upon reflection, Capital Credit Union underscored the flexibility and effectiveness of Alkami’s cross-sell AI Models in pinpointing account holders with a high likelihood of adopting new products. These models can serve as a valuable backup to capture missed prospects, help prevent attrition, and power niche marketing initiatives. Looking ahead, Capital Credit Union plans to align their AI model selection with organizational goals, leveraging AI predictive models to drive targeted campaigns and engagement.

In an era defined by data-driven decision-making, AI cross sell models emerge as a powerful tool to optimize financial services marketing. Capital Credit Union’s experience emphasizes the importance of leveraging predictive analytics to identify and capitalize on growth opportunities within the financial services landscape. As the industry evolves, embracing innovative solutions for artificial intelligence in banking will be key to driving sustainable growth, retention, and member satisfaction for banks and credit unions.

While student loans were gearing up to resume after the payment pause, Capital Credit Union created a home equity loan campaign focused on individuals with student loans and mortgages, anticipating the end of payment pauses due to COVID-19.

The AI predictive cross-sell models generated 52 prospects totaling $2.6 million, demonstrating a performance 4X superior to the human-curated list alone. These prospects would have been missed without the support from artificial intelligence in banking.

When we had the opportunity to test this and take the human element and go up against AI - we made it a game and saw it as a competition - can we beat the AI? Where does AI fit to help us capture what we missed and how do we leverage both and get as much out of it as possible?

-Steve Zich, Chief Marketing Officer, Capital Credit Union