Alkami survey reveals what banks and credit unions are doing now to set themselves apart

As the financial services industry moves to a digital-first world, traditional perceptions of what “banking” means are changing in sync with the evolving expectations of customers and members who increasingly conduct business digitally. In response, banks and credit unions are quickly increasing their adoption of new technologies and processes. Alkami surveyed executives at 152 financial institutions to learn about their digital transformation efforts and how they are using it to set themselves apart from the competition. Their answers revealed five trends that are shaping the digital banking landscape. Here we explore two of these trends.

A century ago, the account or “tab” was a form of cashless transaction. It was followed by the personal check, and, eventually, the credit card. Each of these transaction mechanisms replaced a traditional coin and paper currency with a stand-in form of payment.

Today, nearly 80% of the financial institutions we surveyed said their account holders’ use of cashless transactions has increased in the past two years, undoubtedly accelerated by COVID-19’s shelter-in-place mandates. Of those, approximately 60% said those cashless transactions increased in volume by more than 20%. (Exhibit 3)

Cashless and contactless payments are increasing bank interactions

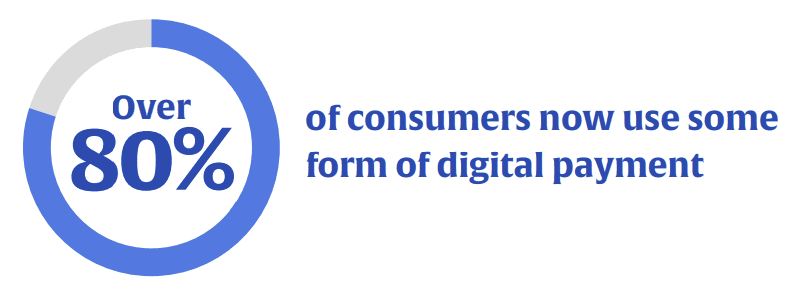

Financial institutions and consumers alike overwhelmingly want to engage in cashless and contactless transactions, so much so that they are becoming the default in many interactions. More than 80% of consumers now use some form of digital payment.1 The onset of the COVID pandemic further accelerated a movement that was already underway.

At many financial institutions, member and customer engagement now centers almost entirely around online features, with a dramatic decrease in ATM usage and an almost vestigial customer base still writing checks. Instead, they are self-serving from home or wherever they are by moving money through their Digital Banking platform.

Paradoxically, engagement has increased in the cashless environment

Concurrent with declining in-person banking, more banking experiences are being conducted via mobile or online platforms. While it may seem intuitive, a closer look at the numbers shows some surprising behavioral changes are at play. Not that long ago, most personal banking account holders interacted with their banks once or twice a month when they visited their local branch. Those interactions increased to several times per week when online banking took off. Although customers and members are less likely to set foot in a branch, device-based banking has led them to engage with their banks significantly more often—usually on a daily basis, and often several times per day.2

Once considered fringe outfits that captured only a small segment of personal banking clients, fintech organizations are rapidly developing products to serve small business accounts, lending, and investment services. This is posing an enormous competitive threat to the mainstream banking industry.

Fintech’s focus on putting the member or customer at the forefront, lowering costs through a streamlined infrastructure and offering innovative products and services has forced traditional banks and credit unions to rethink how they operate.

Following the lead of fintech

While there is no single fintech that dominates the market, their proliferation and popularity among consumers offer many lessons to established banks and credit unions. Fintechs take advantage of increased digitization, heightened member and customer expectations, and operational efficiencies. This redefinition of demand has forced banks and credit unions to consider new business models. By zeroing in on the ways their customers and members were already connecting, they have been able to provide that connected community the ability to transfer money. This has given rise to the integration of transactional technologies with social media sites, a move that bypasses traditional banking institutions.

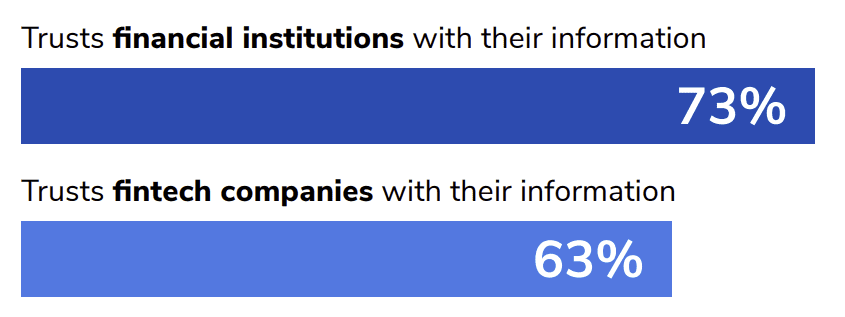

Established financial institutions do have some competitive advantages over fintechs. For example, they still have a level of trust and familiarity with their account holders, and they retain the infrastructure to connect and distribute information to their clients and users. One survey found that 77% of the overall population trusts financial institutions with their information, compared to only 63% for fintech companies.3 Nevertheless, the success of fintech companies indicates the trust advantage alone is not enough to remain competitive in the evolving market.

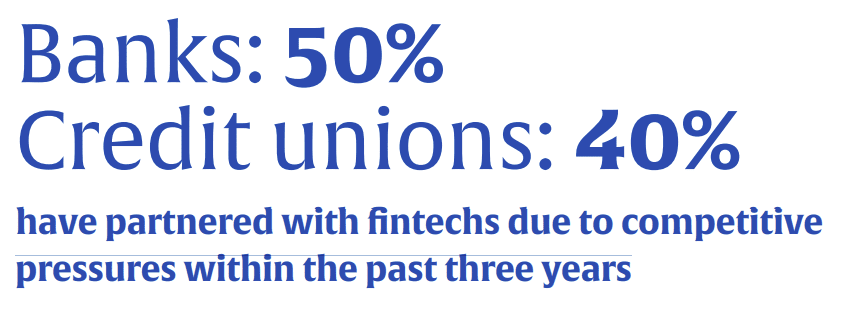

Rather than trying to go head-to-head with fintechs in an environment where they already have an established advantage, some banks are partnering with fintech players. One survey found competitive pressures have led half of banks and two out of five credit unions to partner with fintechs within the past three years.4

Some financial institutions are profitably white labeling fintech products on their application program interfaces (APIs) to let third-party developers build their own financial products with existing architecture. Others are skipping that process altogether, allowing fintech apps like PayPal or Venmo to establish digital wallets on their site. In doing so, they can maintain a relationship with those account holders even as they leverage what might seem like a competitive product. The assumption is that by embedding the fintech product on their website or app, the account holder will be open to other opportunities presented by the hosting financial institution.

Some banks and credit unions with the resources to do so are buying fintech properties outright. While this option is relatively costly, it presents some attractive opportunities. For example, the purchase of a fintech gives a financial institution access to an existing customer base, the user experience, the advanced capabilities of the technology, and the experience of the fintech’s employees. Those not in a position to acquire a fintech company are creating their own fintechs or attempting to transform internal operations to align with fintech advantages. While both options require investment in innovation and talent, a bank that combines the speed and responsiveness of a fintech with the existing assets and trust of an incumbent institution could be well positioned to succeed.

Despite the opportunities that lie ahead, banks and credit unions still have further progress to make in their digital transformation. To capitalize on the current trends in the financial services landscape, financial institutions need digital banking solutions that enable them to leverage analytics, support third-party integrations, and enhance the member and customer experience.

The insights we’ve explored here are only a preview of the data in the full report. To get more insights on how banks and credit unions are adapting to the evolving digital landscape, download the full report today.