Participate in Cybersecurity Awareness Month by adopting a behavioral biometric security solution

Save your October scares for Halloween by adopting behavioral biometric solutions that heighten the security of your digital banking platform. Of course, the Alkami Platform includes a goodie bag full of security and fraud protection solutions for banks and credit unions. But to acknowledge Cybersecurity Awareness Month, we’ll drill down on a solution that has online fraudsters spooked.

We live in a digitally dependent world where account holders increasingly use online channels to access their financial accounts. Many users who were used to walking into a branch for simple services now turn to digital channels to satisfy their banking and financial needs via self-service tools.

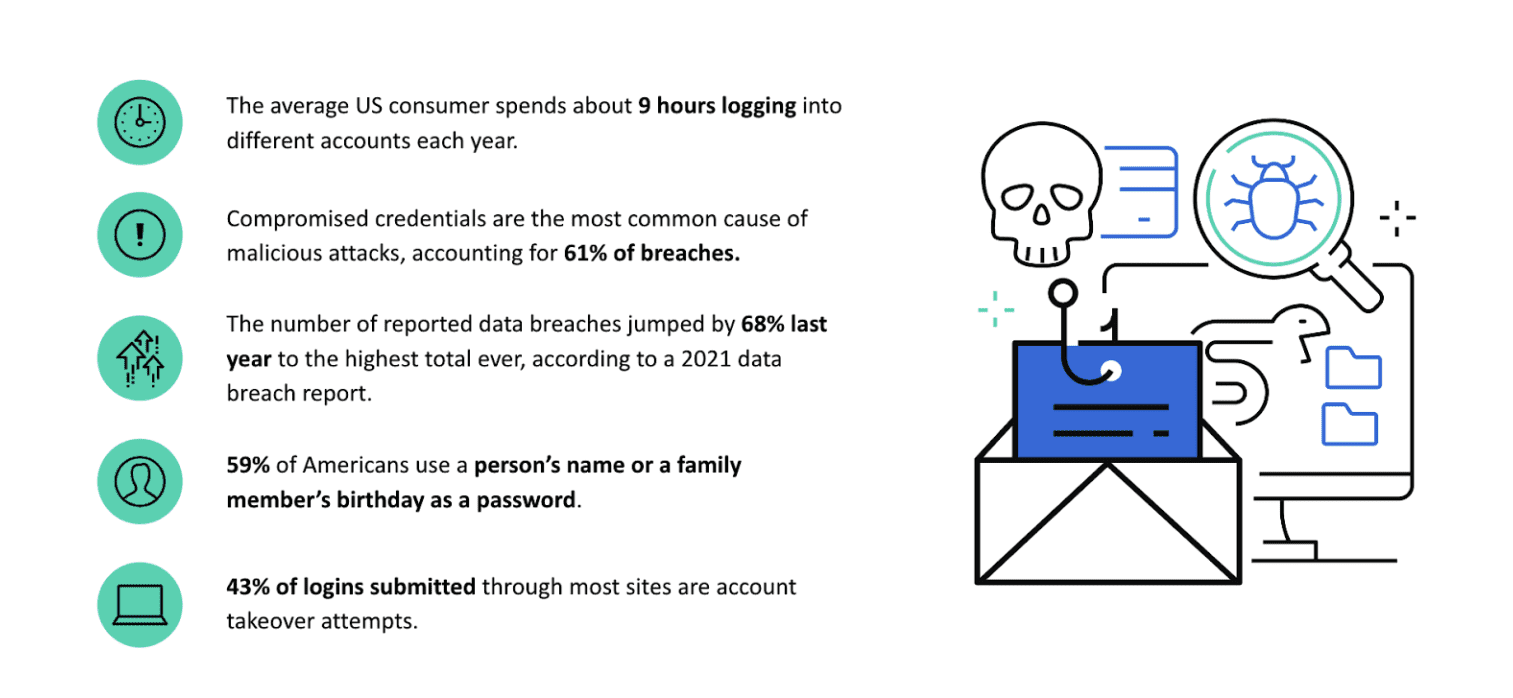

While this is great news for financial institutions (FIs) that have embraced digital transformation, it makes creating strong security protocols an increasingly critical priority. Because as people become more comfortable transacting online, digital fraud attempts continue to grow.

American consumers lost $5.8 billion to digital banking fraud in 2021, up 70% from 2020, according to CNBC research. The average loss per account holder was $500. Fully 25% of online fraud scams led to a financial loss, and 1.4 million Americans have been victims of identity theft in the past year.

On the other hand, 95% of users want a fast, frictionless digital banking experience. Which means that making users jump through more authentication hoops—even though it’s for their own good—can lead to account holder dissatisfaction and turnover.

In addition to bots and malware-infecting computers, FIs face three common fraud threats:

1. Automated credential stuffing

2. Stolen login credentials on the dark web

3. Social engineering and phishing attacks

Cyber fraud is a universal problem that’s now hitting banks and credit unions harder than ever. In the past, when an account holder was duped by fraudsters into giving out a one-time passcode (OTP) designed for user authentication—or any other PII—the user would often shoulder any resulting fraud loss.

But in 2021, the Consumer Financial Protection Bureau (CFPB) issued a compliance update stating that if account holders lose funds to unauthorized fund transfers after being deceived into sharing their OTP or other PII, FIs are now required to reimburse the account holder and take the loss.

With the looming shadow of even higher fraud losses, banks and credit unions are increasingly turning to behavioral biometrics as the only viable method for identifying unauthorized account access via stolen credentials without creating an onerous user experience.

h3>How biometric profiling protects accounts

That’s where the Alkami Platform and our security and fraud prevention solutions come in. Behavioral biometrics works across the digital banking lifecycle, from onboarding to monitoring users’ online sessions and analyzing their physical and cognitive digital behavior to protect their accounts from fraud. Through this process, FIs can leverage actionable insights to take appropriate action to stop data breaches. Trusted by many of the world’s largest FIs, behavioral biometrics technology ensures that the proper users are accessing their accounts without creating friction – dramatically reducing instances of account takeover fraud.

Rather than using intrusive retinal scans and fingerprint checks, let’s walk through how it works. Take a moment to cross your arms. That’s an easy and comfortable process for many of us. Now, try to cross your arms exactly how another person does. That quickly becomes awkward and uncomfortable because everyone does it just a bit differently.

In the same way, we all have unique ways of physically interacting with the online world. The kinds of devices we use, when we use them, and how we execute transactions all add up to behavior that defines us with precision. By collecting insights from this data, FIs can rest assured knowing with great accuracy whether a given user is the actual account holder or a fraudster—all without the user being inconvenienced in any way. Only when fraud is detected do the prevention and authentication measures kick in.

Behavioral biometrics looks at everything from users’ hand-eye coordination, typing cadences, and use of keyboard shortcuts on computers to mobile device usage inputs such as hand tremors, press size, press area, swiping, and scrolling. It logs when you move outside the application and come back to it. It notes your navigation preferences, login frequency, payment velocity and amounts, password resets, platform choices, copy/paste activity, use of autofill, and more.

When the system detects enough deviations in an account holder’s expected behavior, that suggests a change in account control. FI clients can use those red flags to trigger additional authentication steps and other fraud prevention steps.

Because no one else can exactly copy your online behavior, it’s easier to use those inputs to identify potential fraud. And that’s a treat for everyone, except the cyber crooks.