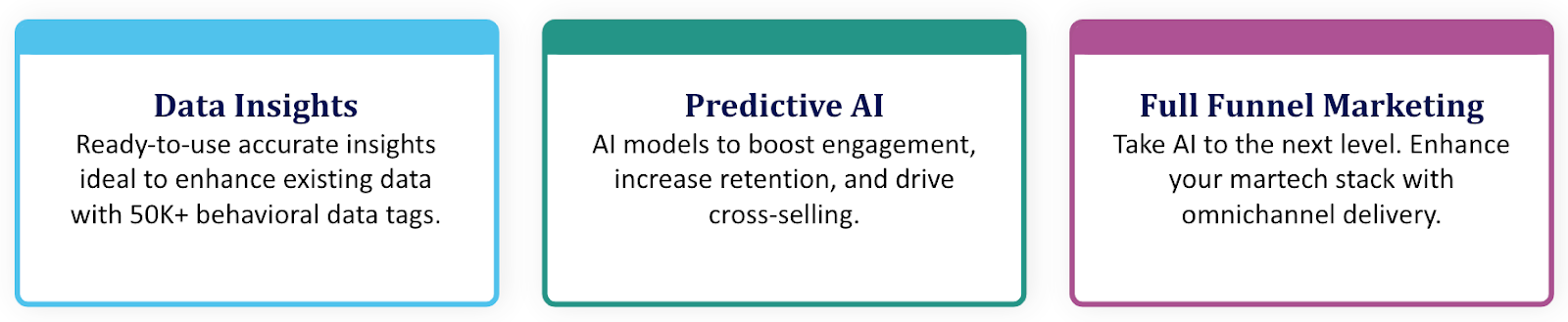

The first step in any data modernization journey is understanding what your data tells you about your account holders. A 2024 survey by the Center for Generational Kinetics found that digital banking Americans who are satisfied with a financial provider’s capabilities to use their data to make relevant product and transaction recommendations are most likely to sign up for other products at the company. Data insights enable financial institutions to identify trends, uncover sales opportunities, and make informed decisions. By analyzing data from various sources, such as transaction data, core data and digital banking data, data insights unlock the power of your dataset across all account holders and activity.

Alkami's data insights have allowed our financial institution to keep pace with the big banks, without adding overhead that would be required for us to do it on our own.

- Senior Vice President of Marketing at a $2.5B regional bank

Alkami identifies every useful data point in the transaction stream that can help us better serve our members.

- Alisha Johnson, Chief Growth Officer at Ideal Credit Union

While data insights provide a snapshot of the present, predictive artificial intelligence (AI) takes it a step further by forecasting what account holders need. By leveraging machine learning algorithms and advanced analytics, predictive AI enables financial institutions to anticipate account holders’ needs and seize new opportunities before they even arise. Imagine knowing in advance which account holders are likely to need a loan, or which ones are on the verge of leaving for a competitor. With predictive AI, you can take proactive measures to meet account holders’ needs, reduce churn, and enhance loyalty. It’s about moving from reactive to proactive—transforming data into a strategic, actionable asset that drives growth.

Alkami's data-driven solutions have allowed us to quickly shift our resources to where they are most beneficial. Solutions like these that allow us to act nimbly will be key to our continued growth.

- Steve Zich, Chief Marketing Officer at Capital Credit Union

Financial services marketing doesn’t stop at predictions—it extends across the entire account holder journey. Full funnel marketing is a comprehensive approach that integrates data at every stage, from awareness to conversion and beyond. Powering marketing campaigns with data insights and predictive AI ensures a seamless and personalized experience that resonates with account holders and drives results. Whether it’s through targeted advertising, personalized content, or tailored offers, full funnel marketing allows financial institutions to engage account holders in meaningful ways. The result is a more efficient marketing strategy that maximizes return-on-investment (ROI) and strengthens account holder relationships.

For instance, full funnel marketing can help banks and credit unions personalize their financial services marketing efforts, ensuring that the right message reaches the right account holder at the right time. This level of precision not only improves account holder engagement but also boosts conversion rates, leading to increased revenue.

We know how many members have mortgages elsewhere and the specific financial institution where that mortgage is held. This has really helped us develop very targeted and measurable campaigns. It’s pretty incredible from a marketing standpoint.

- Cheryl Dutton, Senior Vice President & Chief Marketing Officer at Altra Federal Credit Union

When we wanted to create audiences based on the needs of the market, we would get lists that weren’t accurate due to uncleansed data. We spent a lot of time trying to get the basics. Now with Alkami, we have it all at our fingertips.

- Emily Stewart, Director of Digital Marketing & Analytics at Meritrust Credit Union

Learn how Meritrust Credit Union creates impactful data-driven marketing campaigns with ease.

The financial services industry is at a pivotal moment, where the ability to harness data analytics in banking effectively can make the difference between leading the market and falling behind. By choosing the right strategy for your institution, you can transform data into a powerful tool for growth, innovation, and engagement. The future of banking is data-driven, and by making the commitment for a foundational change, your institution can lead the way. Take this quiz to find the right plan for your financial institution.