Financial services marketing automation has evolved for good. Gone are the days of “spray and pray” engagement marketing , when financial marketers could simply put up a billboard and expect account holders to file into the branch. Banks and credit unions need tools that help them launch targeted, personalized campaigns, without spending weeks getting the data just right. That’s why we’re excited to introduce out-of-the-box campaigns, embedded in the Alkami Digital Sales & Service Platform. This powerful enhancement helps financial institutions build effective marketing campaigns faster, backed by data insights from thousands of successful marketing engagements.

We talked with the team behind this project to get the low-down.

The idea for out-of-the-box campaigns first started taking shape with real feedback from our customers. At the time, our client success team was constantly being asked: “Which campaigns should we run to meet our goals?”

We also realized something important during customer interviews: financial institutions wanted more than just faster setup; they wanted to see the size of their opportunity at a glance. Which campaigns would reach the most account holders? Where could marketers make the biggest impact?

“Every customer that I talked to said, ‘You have a relationship with hundreds of other financial institutions. Please share what you learn and what the other institutions’ successes are,’” said Joan Clark, director of product management at Alkami.

They trusted us to help them learn from the collective success of hundreds of financial institutions. Out-of-the-box campaigns are our answer to that trust.

Creating the first set of out-of-the-box campaigns wasn’t something we rushed. We tapped into more than 15 years of marketing engagement data and knowledge across the Data & Marketing team, pulling in expertise from:

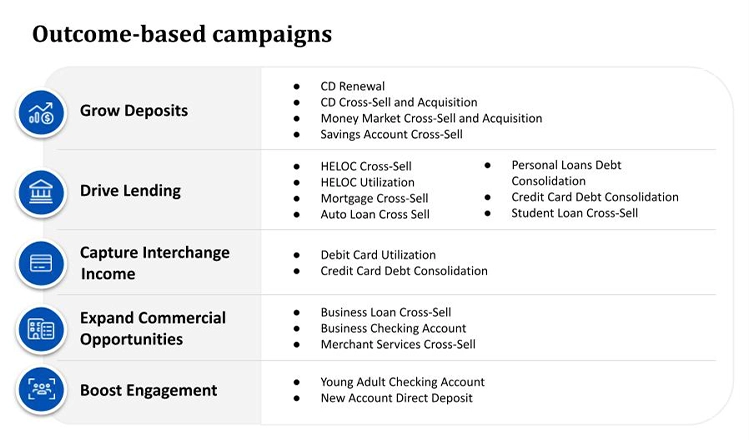

Together, we curated a set of campaigns aligned to five key outcomes to help banks and credit unions grow deposits, drive lending, capture interchange income, expand commercial opportunities, and boost engagement.

We knew that if out-of-the-box campaigns were going to deliver real value, the experience had to be intuitive. So we partnered closely with our user experience (UX) research team to design something simple, clear and effective. Through a series of discovery conversations, the UX team built mockups, validated them with marketers, and tested usability in depth.

Jules Ochoa, senior UX researcher at Alkami, said, “The customers got a lot of value out of doing usability sessions because they feel like they’re incorporated into the product development life cycle. They always feel very fortunate to be able to influence our decision-making and make sure that we’re going in the right direction, for them.”

One critical insight emerged from our UX research: marketers needed a way to see the population each campaign would target at a glance. Without this, it was hard for them to prioritize which campaigns to run first. Incorporating this simple data point helped make out-of-the-box campaigns a real discovery tool, giving marketing teams immediate clarity on the best opportunities to pursue.

Members of the engineering team collaborated with our UX team and observed the user research sessions to see how real users interacted with the mockups in real-time. This gave our engineers a personal understanding of marketers’ pain points, expectations and emotions, helping them build the solution with marketing teams in mind from day one.

“Partnering with the UX research team allows us to ensure we’re building the most effective solution for marketers,” said John Redmond, product manager at Alkami. “From a product manager perspective, it was nice to have a tried-and-tested UX mockup that the engineering team could go build right away.”

This tight collaboration also helped us move quickly and confidently into production. Because the designs had already been validated through extensive testing, the development team could build exactly what was mocked up, speeding time-to-market.

With out-of-the-box campaigns, marketers at banks and credit unions can now:

“Marketers want us to curate the experience for them as much as we can so that they can then build off of that,” Jules said. “We had time estimates of people saying it would decrease their workload by about 30-40%, which is pretty incredible just by first time estimates.”

Financial institutions are expected to move fast, personalize every interaction and compete against both traditional players and digital-first disruptors. Out-of-the-box campaigns help level the playing field, giving banks and credit unions a running start backed by proven data, best practices and smart design.

We’re excited to launch this enhancement in May and see how marketers use this new feature to drive even stronger results. And we’re committed to evolving it even further, based on the feedback and partnership that made it possible in the first place.