During the 2025 Alkami Co:lab conference, Erin Rahaim from Alkami, Grace Pace from Quontic Bank, and Theodora Lau from Unconventional Ventures had an informative conversation about the current risk environment of artificial intelligence (AI) in banking. During this breakout session, the group provided a framework for risk mitigation and answered the crowd’s most urgent questions.

In 2024, Alkami conducted two studies which surveyed financial institution platform decision makers and influencers regarding their expectations of AI and the benefits it can deliver. The survey was conducted twice to measure changes in perceptions over the course of the year.

Between January 2024 to October 2024, there was a 12-point increase in financial institutions that believe AI benefits larger financial institutions more than smaller institutions. However, when asked whether the financial services industry would improve as a result of AI’s use, an already overwhelming majority (85%, increasing to 87%) answered yes.

In the same year, 1,500 banking consumers were surveyed about their perceptions of artificial intelligence, and its applications in their banking experience. The Application and Consumer Perception of Artificial Intelligence in Banking Report states:

While 73% of financial institutions are convinced that AI can significantly enhance digital account holder experiences, apprehensions about AI’s impact on account holder trust are significant, with 54% expressing concerns over potential negative effects. The concern seems valid, as less than half of consumers feel comfortable with their financial data being processed by AI, even if it gives them a better digital banking experience (45%).

Millennials are the most comfortable with their data being used by AI to deliver a better digital banking experience, with 51% agreeing to the same, statistically higher than all other generations – Generation Z (Gen Z), Generation X (Gen X), and baby boomers.

Eighty-two percent of RCFIs believe that AI will have had more of a positive than negative impact on the industry overall in five years. Conversely, consumer sentiment on AI’s benefits within financial services is markedly reserved. Only 48% of consumers believe AI will predominantly impact the industry positively over the next five years. This cautious stance can be attributed to concerns over data privacy, the impersonal nature of AI interactions, and a general lack of understanding about how AI functions and benefits them directly.

There is a lot of uncertainty surrounding AI use in banking – this is a natural and healthy response to rapid technological advancements. Hesitations in our highly regulated industry are being exacerbated by the lack of clear regulatory guidance.

But as Theodora Lau says, “Just because something is new and risky doesn’t mean that we should completely shy away from it, either. After all, risk management cannot be about risk avoidance alone. As an industry, we must learn to evolve with the changing world; we need to be able to understand the technology and proactively manage and resolve the threats that might come our way.”

When speaking with financial institutions about what gives them the most concern for adopting artificial intelligence tools to improve their business operations, most will answer that not knowing who will operate it, be accountable for it, or govern it are at the top of their list.

This session identified today’s top risks associated with artificial intelligence’s use in banking as:

Alkami’s AI Compliance Officer, Erin Rahaim, has this to say about preventing private company data being input into public AI models:

It is not too late (or too early) to develop an AI Policy and Governance Process, as part of your overall data governance practice. Employees of your organizations need to know which use cases and tools are approved in order to best mitigate risk.

I caution you not to simply declare that all AI tools are off limits. That could lead to employees using their personal devices for work-related projects, putting vital data at risk. I highly recommend investing in a subscription to a private model – one that protects the institution’s data and will not use proprietary information from your organization for mass market models.

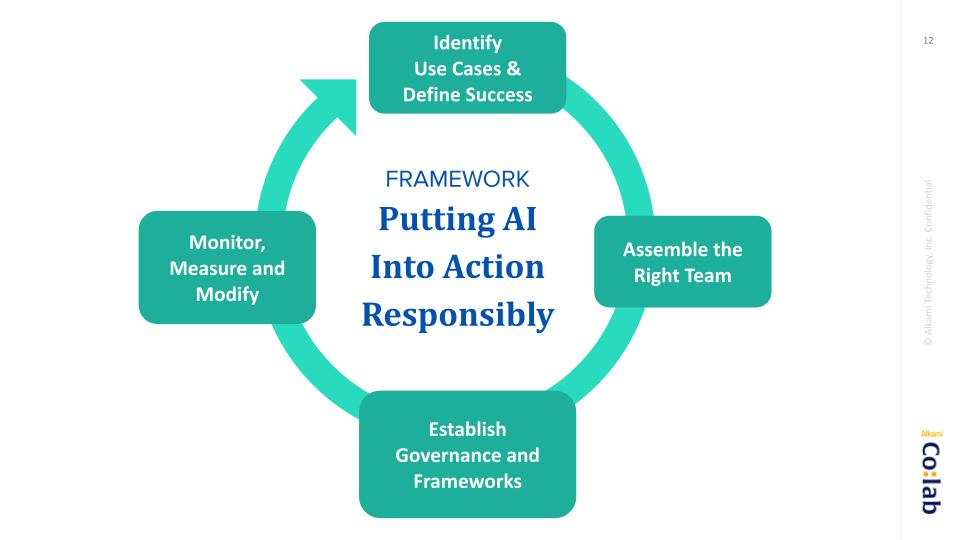

The above framework was presented in session to guide financial institutions in their responsible use of artificial intelligence in their bank or credit union. When getting started, risk and compliance officers should begin by alerting their organization that they are developing an AI policy, and establish strict “dos” and “don’ts” for AI engagement in the interim. Then consider the following steps as an ongoing cycle, removing pressure to get everything perfect on the first draft. The most important thing is to get started.

Read more by Theodora Lau about this topic

Achieve more with artificial intelligence predictive modeling