As any reputable financial institution (FI) knows, to have a successful deposits program, you must first establish your FI’s Customer Identification Program (CIP). CIP verifies the applicant’s identity, a crucial component of any Bank Secrecy Act (BSA) and Anti Money Laundering (AML) framework.

According to the FDIC, CIP is, “the minimum standard for financial institutions and their customers regarding the identity of the customer that shall apply in connection with the opening of an account at a financial institution.” CIP is an explicit provision under the USA Patriot Act with six general elements. The FDIC defines these requirements as the following:

For every account that is opened, the FI must verify the user’s identity in accordance with the FI’s written CIP policy established by their leadership in compliance with BSA and AML requirements. CIP is performed on all applicants that are opening a new account for themselves, or on behalf of a minor, a person without legal capacity, or an entity. There are two methods of CIP: documentary and non-documentary customer identification.

This requires applicants to prove their identity through the use of documents. The FI must define what types of documents are deemed acceptable for use. Stated by Cornell Law School, “these documents may include:

Documentary CIP can be cumbersome for the applicant as well as for FI back-office teams. Looking to alleviate friction, FIs may wonder what alternatives they have besides document-based verification?

A modern identity verification method has emerged in recent years, non-documentary customer identification. This requires little effort on the user or the FI. Instead, this process relies on user information and data validation to perform the verification on the FI’s behalf. So long as the method is explicitly stated as the FI’s CIP method, the FI can verify the applicant’s identity in a variety of ways, including:

With Documentary CIP, the user has to provide a photo ID or other identity documentation via scan or upload. Alternatively, the applicant would physically bring their documents into a branch, which is much more of a hassle for the applicant. The more friction a user experiences, the more abandonment rates increase.

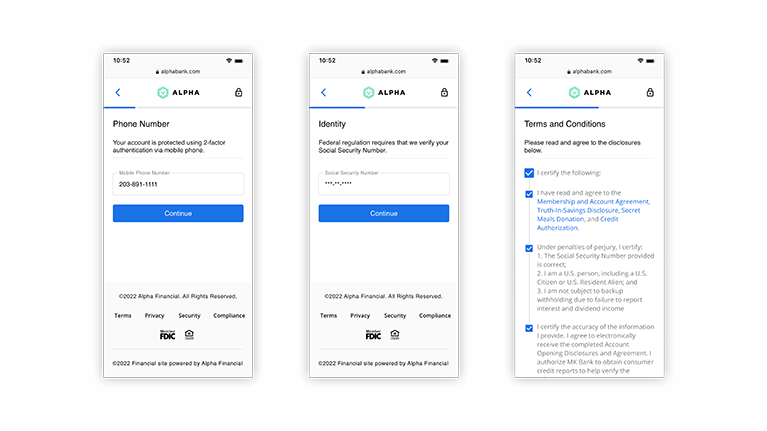

The largest benefit of non-documentary CIP is that it significantly reduces user friction by simplifying the data inputs required for the application. While completing their mobile-first application, the user inputs basic personal information: name, address, phone number, date of birth, and social security number.

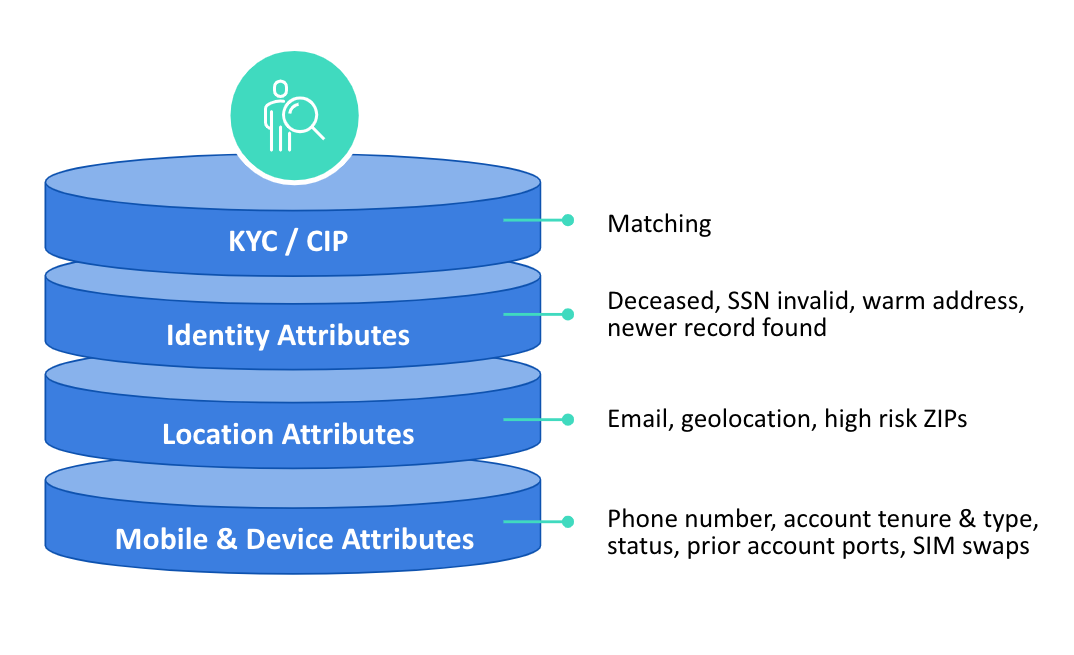

Once the application has been submitted, Alkami runs the users’ personal information against our integration partners’ third-party databases, IDology, TransUnion, FIS ChexSystems, Equifax, and Experian. These partners cross-reference the information submitted in the application against public records and credit profile data, ensuring that the information is accurate – and protecting the FI from fraud.

By eliminating documentary processes, FIs can build efficiencies for their back-office. Alkami’s digital account opening solution allows the FI to reduce paper and create a digital file which improves recordkeeping; compliance with BSA, Know Your Customer (KYC), and AML requirements; and document storage. Non-documentary CIP reduces application review time tremendously as it eliminates manual review processes by automating identity verification. In addition, it creates consistency across their internal identity risk assessments.

Gain access to more accurate risk profiles and drive escalations only when needed.

Some FIs are still wary of non-documentary CIP because they worry about potential fraud or compliance risks. How does Alkami ease that concern? Physical documentation can be faked with advancements in today’s modern and widely available technology. Non-documentary identification makes it incredibly difficult for fraudsters to launch a successful threat because it references the applicant’s transaction history and runs rules-based decisioning against bank account data. Additionally, Alkami performs fraud prevention by reviewing the user’s email address, phone number, IP address, device ID against databases and government watchlists for known fraudulent devices or bad actors.

Ultimately, non-documentary CIP will help FIs increase the volume of successful applications. Bypassing documentary CIP methods encourages users to complete their applications. This best-of-breed solution minimizes user friction, reduces application completion times, and maximizes conversions. Besides supporting the user, Alkami empowers FI staff with the tools to strengthen their back-office operations with real-time identity verification, fraud prevention, and an improved compliance stature.