Eighty-five percent of business leaders say the most important factor when choosing a banking partner is whether the financial institution (FI) offers real-time payments (RTP) capabilities, according to Citizens’ annual payments and treasury survey. RTP is also growing in importance with mid-size FIs. According to Cornerstone’s What’s Going On in Banking 2022 study, three in 10 banks and a quarter of credit unions plan to implement RTP in 2022.

FIs that want to stay in business must deploy connectivity to faster payment networks or suffer the consequences of losing out on valuable account holders – along with their deposits and fee revenue.

Awareness of faster payment rails isn’t something that matters to most consumers or businesses. Most people don’t necessarily care how funds get from one account to the next, but they do care about moving their money in the fastest and most secure fashion. From a consumer’s perspective, RTP and instant payments may look very similar; however, from an FI perspective, the settlement and funding time differs. Below are some examples of different RTP and faster payment types:

As businesses, consumers, and FIs recognize the value of real-time and faster payments, adoption will continue to increase and use cases will continue to emerge. Here are a few use cases FIs should be evaluating:

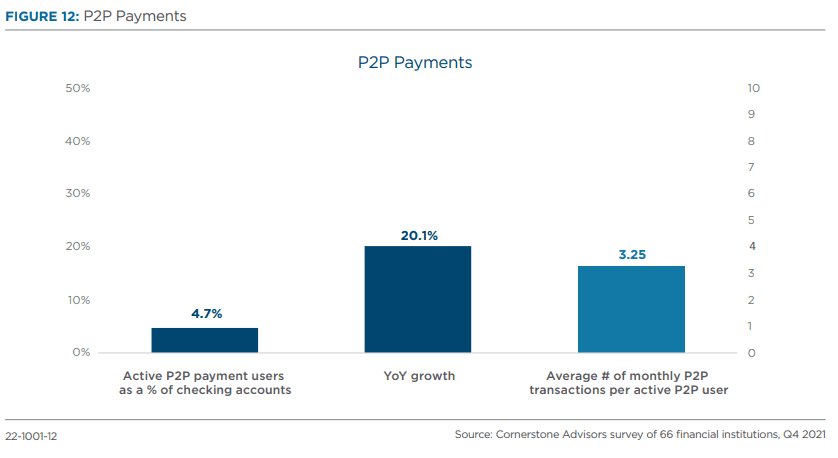

Alkami recently commissioned Cornerstone’s 2022 digital banking benchmarks and found that roughly half of the participating FIs reported P2P payment metrics.

We also discovered that 54% of banks ranked B2B payments as a top three use case for their RTP strategy while only 9% cited B2C. Both FIs and their business clients must play their part in growing awareness of the technology and experimenting with emerging use cases of RTP.

As more FIs and businesses embrace RTP to increase efficiency and meet consumer demands, FIs need to be aware of the risks associated with originating these types of payments.

RTP transactions are irrevocable. When a fraudster uses social engineering tactics to request money and the victim authorizes the payment, the funds are available in the fraudster’s account within seconds. The same goes for account takeover scams where fraudsters will use phishing or other scams to gain access to the account holder’s password or Personal Identifiable Information (PII) to transfer funds. Fraudsters will then quickly move those funds or withdraw the money, and victims (or their FIs) are unable to reverse payment of the funds. FIs need to educate their users and be prepared with similar guidelines and approvals for RTP as they have for wires to reduce the level of risk associated with these instant payments that allow for little to no time for due diligence.

RTP transactions operate 24/7/365. Traditional FIs operate typical business hours Monday through Friday with closures for national holidays. Payments like ACH and wires align with the bank operating hours with cut-off times at the end of the business day; however, RTP, push-to-card payments and FedNow will operate 24/7/365. FIs need to consider the impact this will have on staffing schedules to ensure they have sufficient support available at all times to coordinate between the core, provider, and consumer.

RTP risk management processing systems are not commercially available. Mature payment channels, like ACH and wires, have been around for quite some time and have very sophisticated risk management processing systems that have evolved as payments and risks have changed. FIs use this commercial software to limit their exposure by evaluating risk before an ACH or wire is processed. Right now, RTP does not have a risk management processing system in place to control transaction limits, velocity, or payment delays to allow for the appropriate time for payments to be analyzed for risk and verified before processing payment to the receiver. This puts a tremendous risk on the FI to put their guidelines and processes in place and educate their employees and user base to reduce risk. FIs can also reduce risk by implementing transaction limits for RTP and restricting the types of faster payments your organization engages in.

RTP is a very complex payment channel and the industry as a whole is struggling with understanding the intricacies, risks and best practices around originating and receiving these types of payments. Nevertheless, FIs do understand that this new payment channel is a must-have feature to retain account holders. If you aren’t ready to dive in fully to RTP at your organization, you might consider getting your feet wet by allowing your account holders to receive payments which is less risky than originating payments. Starting with this functionality will give your organization and account holders a chance to better understand the process, make sure you have the required staff in place, and make significant strides to feel confident to add origination of RTP to your FI offerings.