According to Javelin’s 2023 Identity Fraud Study: The Butterfly Effect, identity fraud losses totaled $43 billion in 2022, a 17% decline from 2021. While rates of identity theft may have decreased in the past year, cybercriminals are becoming more creative in their fraud tactics. Financial institutions (FIs) should remain on the offense and stay vigilant by strengthening their fraud prevention strategy while prioritizing their account holders’ experiences. Below we will discuss these three ways to safeguard the identity of your account holders from identity theft:

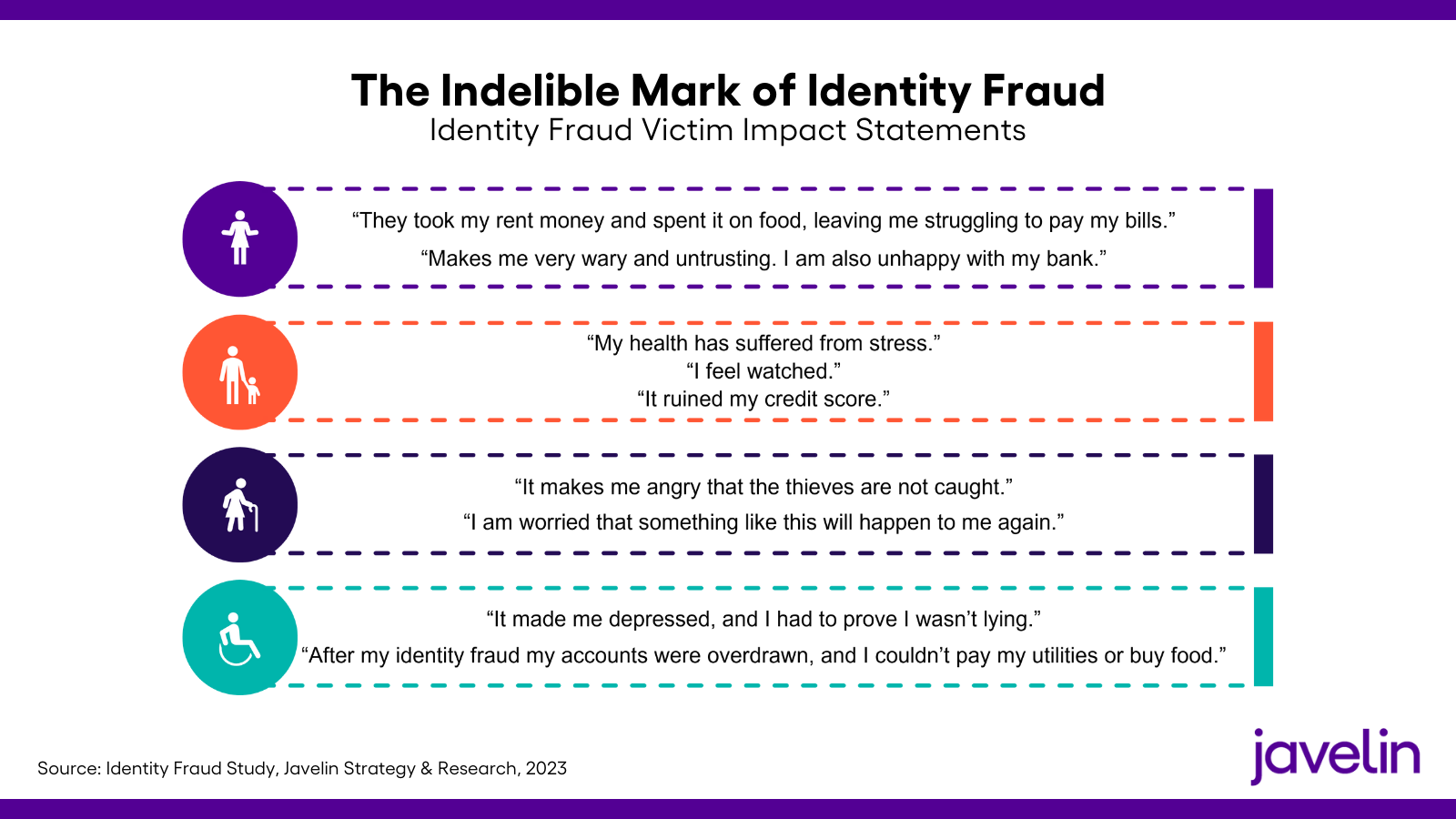

It’s important to remember the person behind the bank account and the tangible impact on mental health as a result of an identity fraud attack. In Javelin’s report, they surveyed identity theft victims to humanize these crimes.

By focusing on protecting account holders from these indelible impacts, FIs can strengthen institutional loyalty by preserving one of consumers’ greatest assets – their identities. There are several ways your FI can instill confidence, maintain trust, and preserve account holders’ credit and financial well-being.

Taking extreme precautions to prevent fraudsters from accessing an institution, FIs often go overboard with security and fraud protection for digital account opening, making the experience fraught with obstacles. If an applicant is met with stone walls, a moat filled with crocodiles, and an army defending the castle, are they really going to open a new account with your bank or credit union? Odds are, probably not.

While some FIs offer an online account opening solution, the experience may be lacking speed and simplicity – oftentimes resulting in a ten to fifteen-minute application process. Requiring an applicant to verify their identity by uploading proof of identification or requiring a trip to the branch instantly creates friction and accelerates abandonment rates.

Let’s take a different approach to digitally onboarding prospective account holders by eliminating friction from the equation:

But what happens once you’ve successfully onboarded a new customer or member into digital banking? How will you develop an experience that is both intuitive and secure?

Oftentimes, credit scores are thought of solely as a financial wellness indicator. While it offers powerful insights into a consumer’s financial well-being, credit scores can also be used as a signal of identity theft. If an account holder experiences significant changes in their credit score that they are not privy to, it should immediately be looked into for fraudulent activity.

However, depending on manual credit monitoring is easier said than done. Here’s where fintech partnerships can alleviate time-intensive efforts and elevate an FI’s security stature. Powered by Alkami’s diverse partner ecosystem, FIs can deepen trust by implementing a three-pronged approach for identity protection:

You know your customers and members well, that’s one of the primary reasons they bank with you – the intimate level of service and trust you provide. Tap into that relationship to improve fraud prevention tactics.

When managing finances and engaging in regular digital banking activities, account holders do not want to feel troubled by security prompts. In research conducted by PYMNTS, 52 percent of consumers who use biometrics prefer it over other authentication measures. Behavioral biometrics use digital banking users’ patterns of digital interactions to determine if the user is who they say they are. Compared to other means of authentication, like two-factor authentication or one-time passcodes, Behavioral biometrics recognizes the user by how they navigate the app, keystrokes, typing speed, screen pressure, and more.

By tapping into insights from behavioral biometrics, your FI can elevate your security screening without compromising the user experience. This allows you to detect and respond in real time to any cyberattacks while reducing costs from fewer alerts, fraudulent claims, or actual fraud losses.

Using a trusted vendor can protect users from digital threats with:

While your users want a seamless digital banking experience, they also expect it to be secure. Per the previously referenced PYMNTS study, “despite a general satisfaction with existing security measures FIs use, half of all adult consumers feel their banks must take additional steps to protect their assets and personal information — especially for non-routine transactions.” One-time password (OTP) tokens allow you to strike the right balance by authenticating digital banking users for only one session or transaction at a time.

“With the rise of digital-first engagement, customers are more aware of the vulnerability of their personal information, so having confidence in their financial institutions’ security measures is growing in importance,” (Verint, 2022).

Your FI’s brand and reputation are one of your greatest assets. If fraud were to occur, it’s a roll of the dice if your account holder will stay with your FI or move their funds to a new institution. That’s why it’s absolutely crucial to maximize your security & fraud protection solutions before they’re actually needed.