2026 is the year business and commercial banking gets sorted into two camps: experiences businesses tolerate and experiences businesses gravitate towards.

For a lot of financial institutions, the playbook used to be simple in that they would win relationships through local presence, have strong service, and thrive with competitive pricing. That still matters. What’s changed is what business customers and members expect before they’ll even start a conversation. They want commercial banking solutions that move at the speed of their operations — digital account opening and onboarding in minutes; controls that reduce risk without adding friction; visibility that helps them make decisions now; and tools that fit into the software they already use to run their business.

That means financial institution leaders stepping into business banking for the first time face a fork in the road:

Meanwhile, for financial institutions already well-established in business/commercial banking, the gap between “we offer treasury services” and “clients actually use them” is being discerned. Leading institutions are packaging advanced capabilities in a way that’s intuitive, promotes self-service, and is designed for working roles who all need the right access at the right moment.

Those who can get this right can differentiate quickly without trying to outspend their competition. They can earn trust at account setup, then continue to earn it every time the digital banking experience empowers a business user to act with confidence.

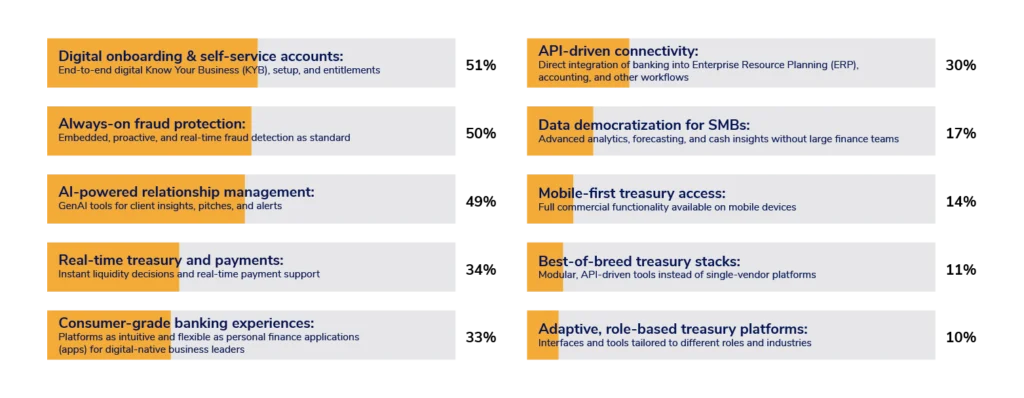

The top trends selected by financial institutions based on proprietary research show that leaders are not “digitizing” manual processes. The future of business/commercial banking solutions is a growth engine; one that brings together digital onboarding, self-service entitlements, fraud protection, real-time visibility, application programming interface (API) connectivity, and smarter relationship management.

Whether you’re entering business banking, expanding into more advanced commercial capabilities, or modernizing what you already have, here’s the question to lead with:

How do we make it effortless for businesses to choose us, stay with us, and grow with us at every stage in their financial journey?

Below, we break down the 10 trends shaping commercial banking solutions in 2026, along with clear actions leaders can take and the product capabilities that bring them to life. Based on proprietary research with digital banking decision-makers across banks and credit unions, The Top Trends Shaping Business and Commercial Banking in 2026 report explores what banking leaders believe will make the biggest impact on commercial banking in 2026.

(% selected within top 3)

End-to-end digital Know Your Business (KYB), automated entitlements, and faster time-to-value are the new baseline. Financial institutions that streamline digital account opening are boosting conversions, speeding up funding, and opening the door to smarter cross-sell and deeper engagement.

Always-on, embedded, and adaptive fraud prevention secures institutional trust, reputation, and a competitive edge. Financial institutions are flipping fraud from a cost center into a revenue engine.

Artificial intelligence (AI) helps teams walk into every conversation fully prepared to spot opportunities, personalize outreach, and scale trust across every interaction.

Business clients want real-time visibility, instant liquidity decisions, and proactive alerts. Commercial teams equipped with real-time money movement move faster and foster retention.

Business owners are used to frictionless apps in their personal lives. Your digital experience can’t feel a decade behind. Simple, intuitive interfaces reduce support load and signal digital leadership.

Commercial clients want banking embedded where they already work — in Enterprise Resource Planning (ERP) systems, accounting, and vertical Software as a Service (SaaS) tools. API-first strategies make that integration seamless.

Business clients crave insight. SMBs know their data is out there. The financial institutions that deliver forecasting and dashboards that help businesses plan and act faster demonstrate their commitment to the client’s success.

Mobile should be viewed as the command center for commercial clients who are operating wherever their businesses take them. Full-featured tools on-the-go are a competitive edge.

Business needs don’t scale in a straight line, and your tech stack shouldn’t either. Modular, API-based commercial banking solutions let you add high-impact capabilities by segment, enabling financial institutions to move faster, specialize where it matters, and keep evolving without overhauling everything.

Business and commercial banking solutions serve a network of different roles who all require different access, tools, and confidence to act. Adaptive, permission-based experiences tailor workflows and entitlements to the user, reducing friction and making advanced capabilities easier to adopt and stick with, while creating guardrails.

The trends show that growth won’t come from adding one more feature. It will come from removing the moments that slow businesses down and replacing them with moments that feel surprisingly easy:

Pointing to one destination: Anticipatory Banking – where financial institutions can predict and meet needs before they’re communicated, using integrated technology and data insights to guide measurable outcomes. If you’re moving into business banking for the first time, this is your time to build the right foundation from day one. If you’re expanding into advanced commercial banking solutions, this is your moment to simplify and scale so your best services are widely adopted.

If you’re evaluating business or commercial banking solutions for 2026, the winning path looks like this:

That’s the vision The Digital Sales & Service Platform is built. To help financial institutions onboard faster, enable self-service, compete boldly, deepen relationships, and turn insight into growth across the relationship lifecycle.

The competitive bar is moving. The good news is you can move faster.

Commercial banking solutions are digital capabilities and services that help financial institutions serve business and commercial clients — covering onboarding, entitlements, treasury, payments, security, analytics, and integrations.

According to Alkami research, the top priorities are digital onboarding and self-service (51%), always-on fraud protection (50%), and AI-powered relationship management (49%).

Focus on end-to-end digital KYB, simplified setup, and self-service entitlements so applicants can get from application to funded account with fewer manual steps.

API-driven connectivity embeds banking into ERP, accounting, and workflow tools, reducing manual work and creating partnership-based revenue opportunities.