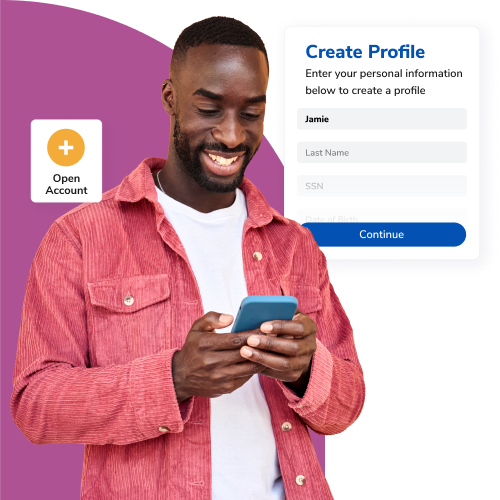

Build lasting relationships with prospects via an intuitive digital account opening solution. Elevate your digital and physical branch with intuitive applications, real-time identity verification, and integrations to cultivate account holder relationships.

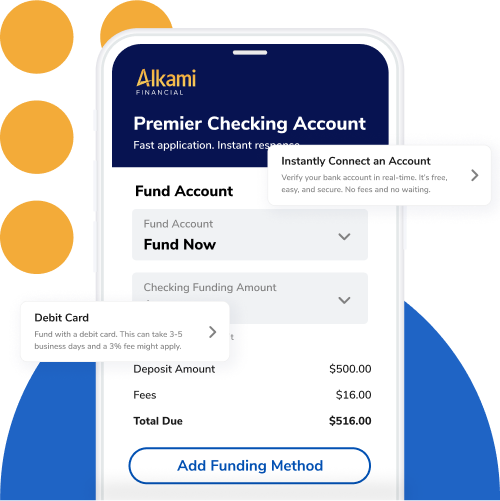

Increase conversion rates by removing barriers for users. Offer multiple funding options and streamline the process with bank account authentication or card-based funding.

With instant account verification, your FI can ensure compliance, enable applicants to seamlessly initiate deposits, and successfully capture funds.

As soon as an applicant leaves the application workflow, the risk of abandonment grows. Solve this challenge by automating messaging to remote applicants and users with incomplete tasks.

Encourage applicants to securely provide their necessary details, reducing delays, eliminating points of friction, and increasing successful conversion rates.

Opening a new account can be cumbersome for internal teams – between verifying identities, and successfully booking account holders into the core.

Extend the benefit of online account origination beyond your account holders and into your back office. Create efficiencies with instant identity verification and automated settlement of funds.

Becoming users’ primary financial institution (PFI) is no small feat. It takes an enormous amount of effort to gain trust. Account holders have shown their loyalty to you, why not reward them with a superior user experience?

Empower existing users to effortlessly open a new account within digital banking via a streamlined application experience.