Last week, we analyzed the average dollar amount of charitable donations made month-by-month from January 2022 through March 2024. In that case, the average amount of individual gifts show seasonality, peaking in December.

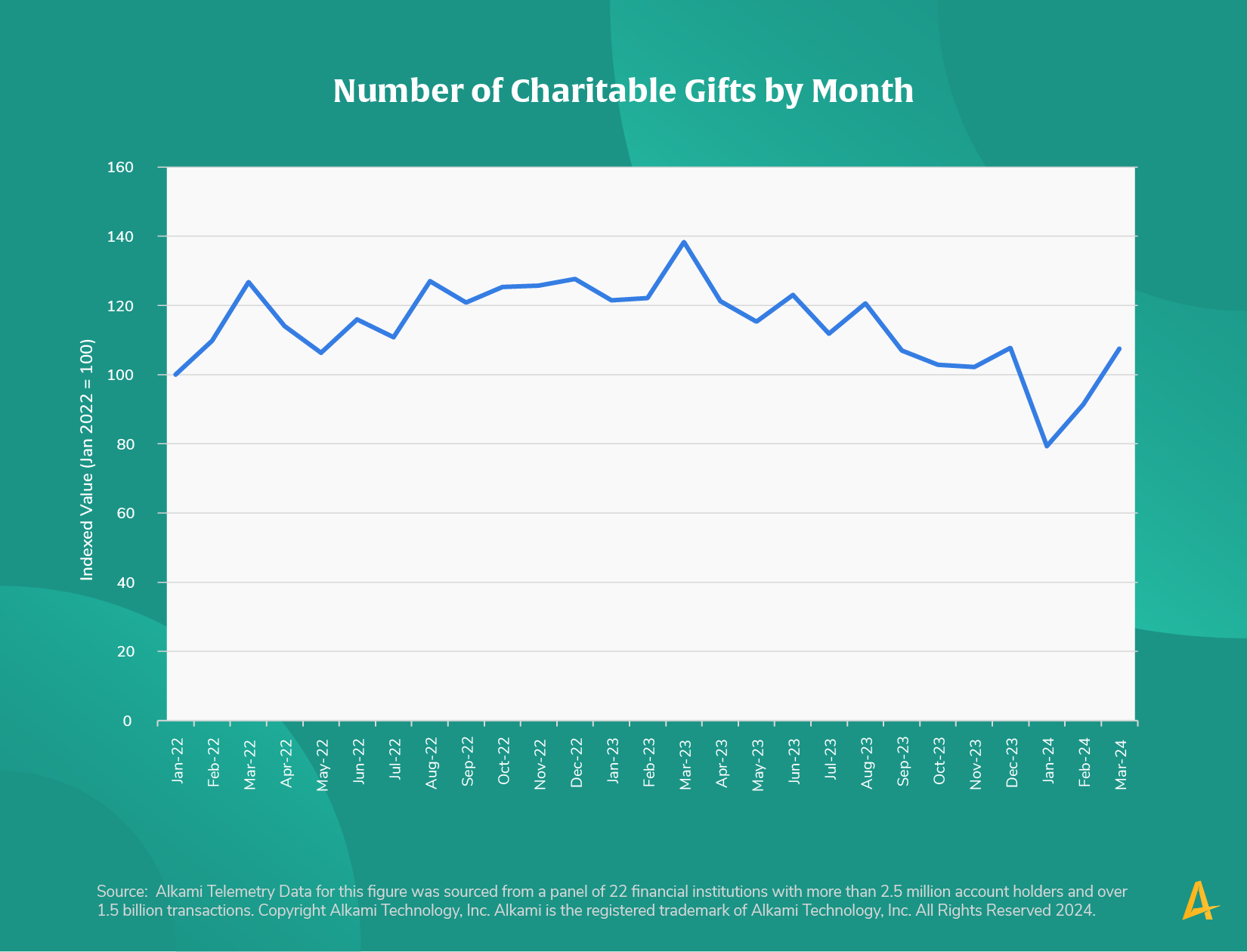

This week, Alkami Research examined the number of charitable donations made by month, and the data showed the number of donations does not peak in December and doesn’t have any clear seasonality across the 27 months examined, with 2022 and 2023 having a small spike in March. Paired with last week’s data, this indicates that Americans likely give throughout the year, but remember to make their biggest gifts in December.

Americans give throughout the year, but habitually make their largest donations in dollar amounts in December, a clear reminder that the tax year is closing. Perhaps financial institutions could educate account holders to make large savings transfers at key points during the year. For example, if an account holder regularly gets tax refunds (more on this in two weeks), early spring is a great time to launch a campaign promoting personal finance housekeeping and contribute to their emergency savings fund. On the other hand, if an account holder is typically paying a tax bill in April, reminders that individual retirement account (IRA) contributions can offset that tax bill and can be made for the previous year up until taxes are filed is another way to drive saving behavior.