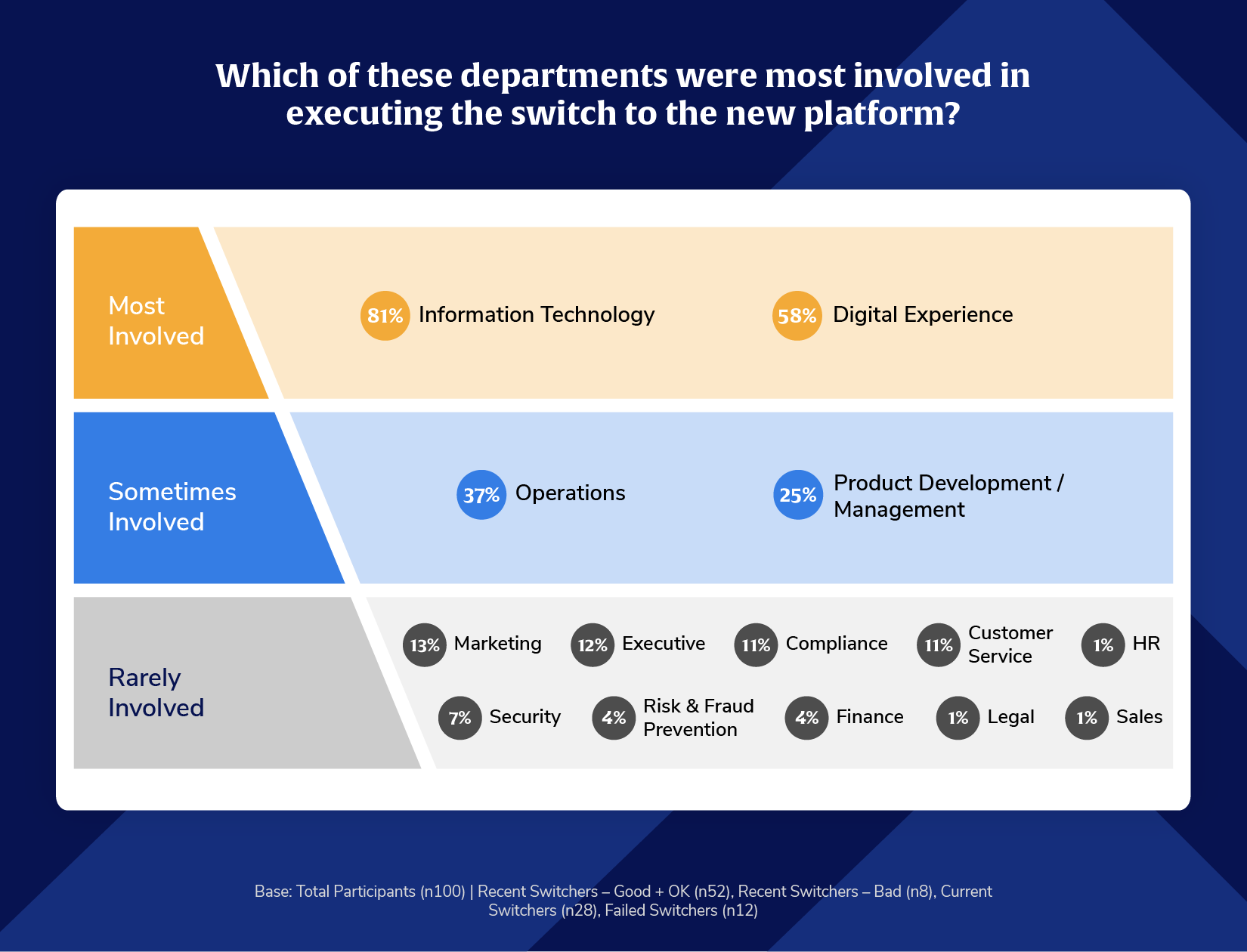

What we’re seeing:

Today’s digital banking decisions are made by diverse, cross-functional teams. Alkami Research shows that the evaluation and selection process involved information technology (IT), digital experience, operations and product, while most other departments are involved at a lower rate.

This multi-stakeholder reality reflects the increasing strategic importance of digital banking platforms. Financial institutions view their platforms as mission-critical infrastructure—capable of impacting growth, retention, compliance, brand reputation, and operational efficiency – reflective in the research showing the cross departmental collaboration. Each member of the decision-making team brings different priorities. Information Technology is focused on architecture, scalability, and integration. Operations is evaluating how the platform affects internal workflows and the employee experience. Finance is most likely evaluating return-on-investment (ROI) and total cost of ownership. Executives are consulted for long-term strategy, risk, and competitive differentiation while marketing brings a perspective on clean data, account holder intelligence and campaign automation. Institutions that navigate change successfully do so by intentionally aligning internal stakeholders early, defining shared success metrics, and giving each voice equal weight in the evaluation.

Takeaway and Call-to-Action:

The modern digital banking platform decision takes a team of various areas of expertise—and to successfully choose and implement a new solution, every leader can provide valuable input. From IT to operations to executive leadership, multiple departments now have a seat at the table, each bringing unique perspectives to the selection process. Successful platform evaluations require alignment across departments and a clear articulation of how each stakeholder’s goals will be met.

*These findings have not been previously published.