What we’re seeing:

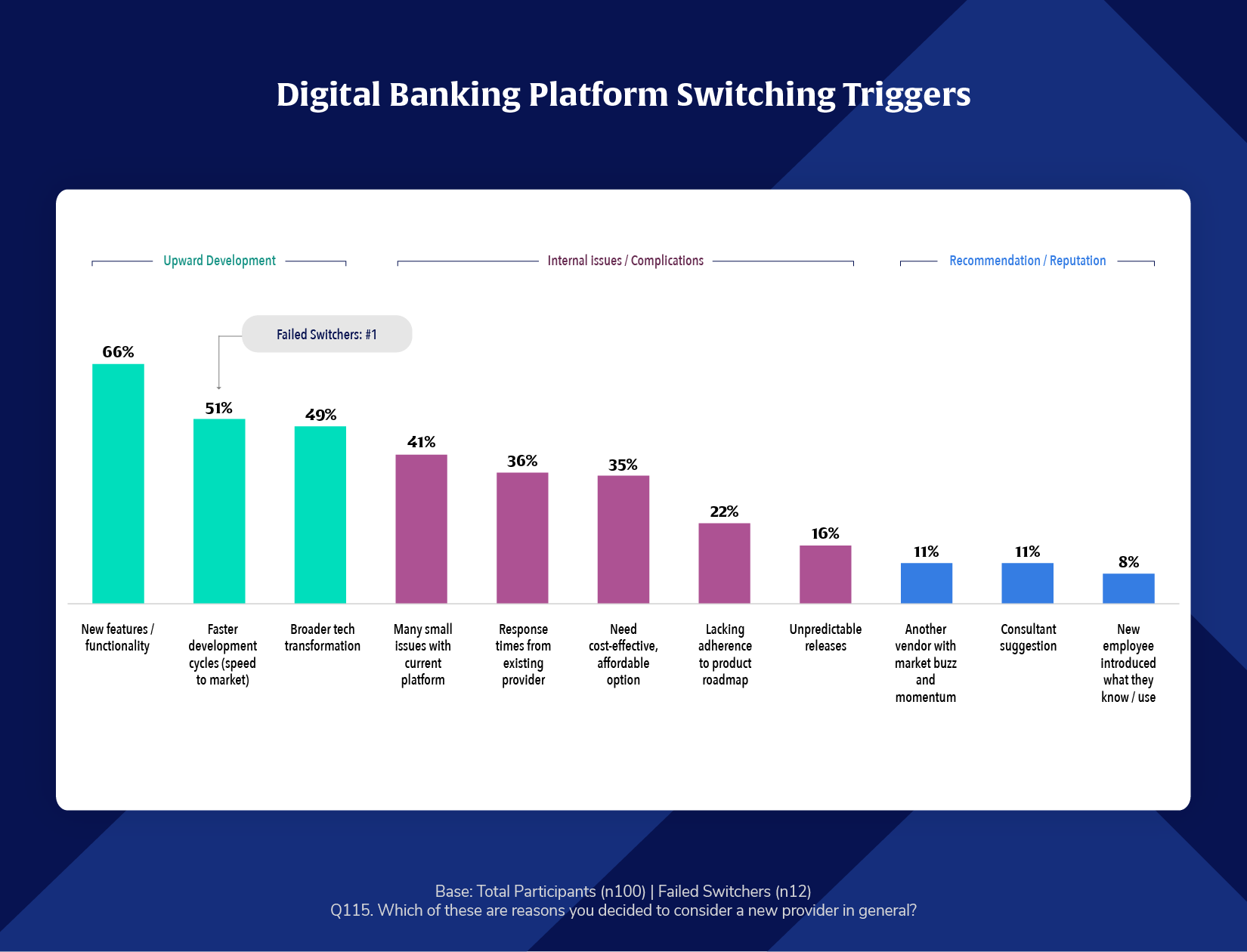

When financial institutions decide to change their digital banking platform, it’s rarely about a single use case, but more distinctly tied to evolving their technology offerings. Alkami’s latest proprietary research—surveying digital banking decision-makers and influencers who have either switched or considered switching—reveals the catalysts driving these strategic decisions.

According to the research, the top three switching triggers are new features/functionality, faster speed to market and broader technology transformation. With new entrants and consumer technology expectations constantly raising the bar, banks and credit unions aspire to improve their customer or member experience, all while growing their database of account holders. According to research commissioned by Alkami through the Center for Generational Kinetics, 91% of respondents say the user experience and functionality of their mobile banking application or online website are the most important when thinking about their ideal financial provider. The research also points to a growing emphasis on strategic alignment. Institutions are increasingly seeking active partners that can, with speed, integrate third party solutions—not just traditional vendors. A long-term relationship with these partners can bring understanding to business models, support long-term growth goals, foster collaboration on a proactive roadmap, and demonstrate adaptability.

Takeaway and Call-to-Action:

This data signals a shift from reactive to proactive decision-making. Financial institutions are monitoring signals from both the market and account holders and preparing to pivot when opportunities for growth and differentiation appear. Consumers are expecting an integrated digital experience no matter when they do their banking.

*These findings have not been previously published.

Source: Alkami Proprietary Research – Surveyed 100 digital banking platform decision makers/influencers who recently switched or explored switching platforms. Data collected November 27, 2024 – December 19, 2024.