Previously, the data panel was analyzed for consumer accounts being used for business banking, and a comparison was made between the overall spend of those that had identified debits being deducted for payroll and benefits payments versus those that did not.

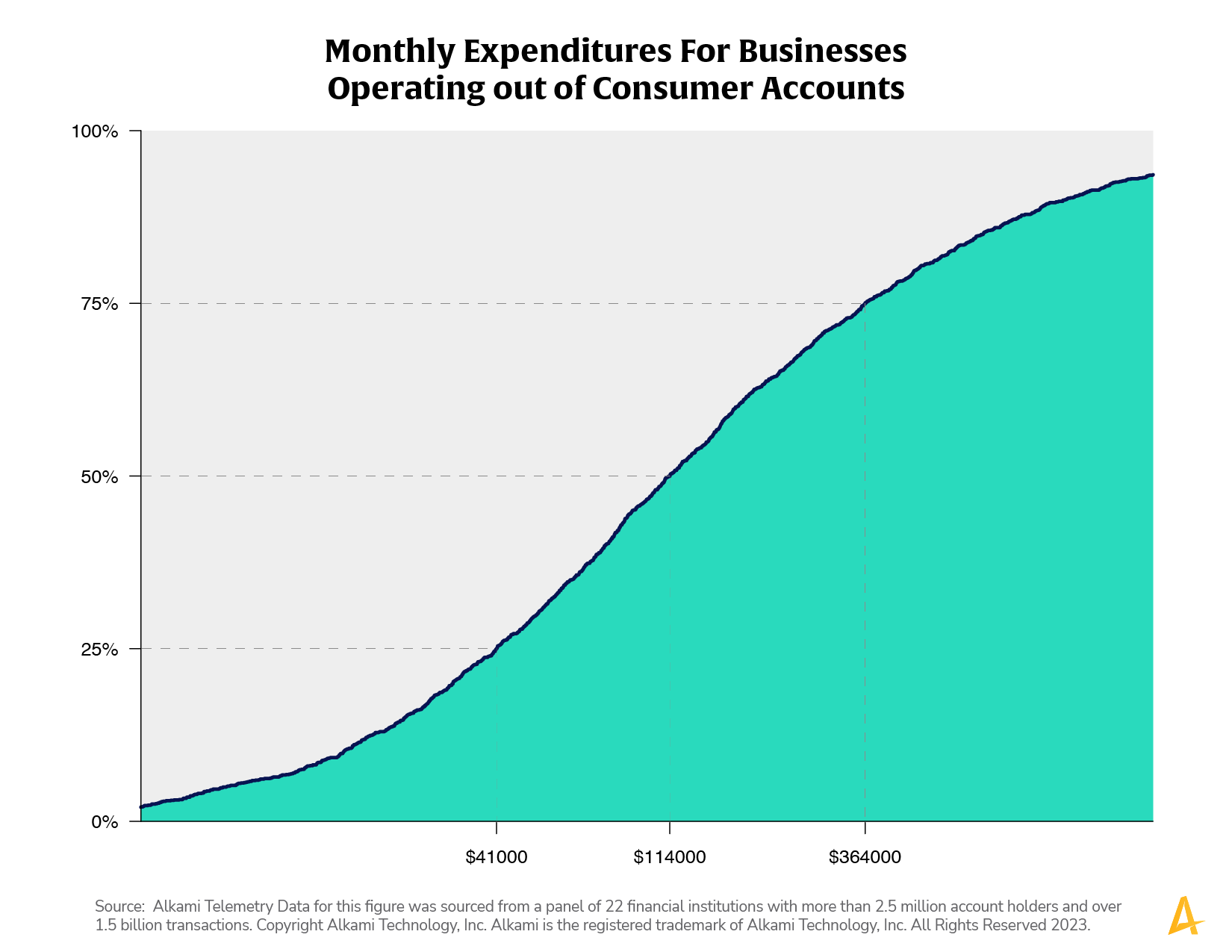

This week, the analysis focused on those businesses that have identified payroll and benefits transactions. Within this group, the businesses operating out of consumer accounts were split into two segments – the top quartile and the bottom three quartiles by annual business expenditures.

Businesses in the bottom three quartiles averaged just above $300K in payroll expenses, representing approximately 10 percent of the overall business spend. Businesses in the top quartile paid an average of $5.5M in payroll annually, meaning nearly 30 percent of the $18M in total expenditure was spent on payroll and benefits. One business operating out of a consumer account spent over $100M on payroll and benefits over the last year!

When strategizing how to convert businesses operating out of consumer accounts to business banking products, understanding each business’ unique expense structure can provide the foundation for tailored and relevant messaging. For businesses with significant payroll, benefits and other working expenses, consider suggesting a business line of credit or a financial plan to help manage cash flow.

Alkami Telemetry Data for this figure was sourced from a panel of 22 financial institutions with more than 2.5 million account holders and over 1.5 billion transactions.