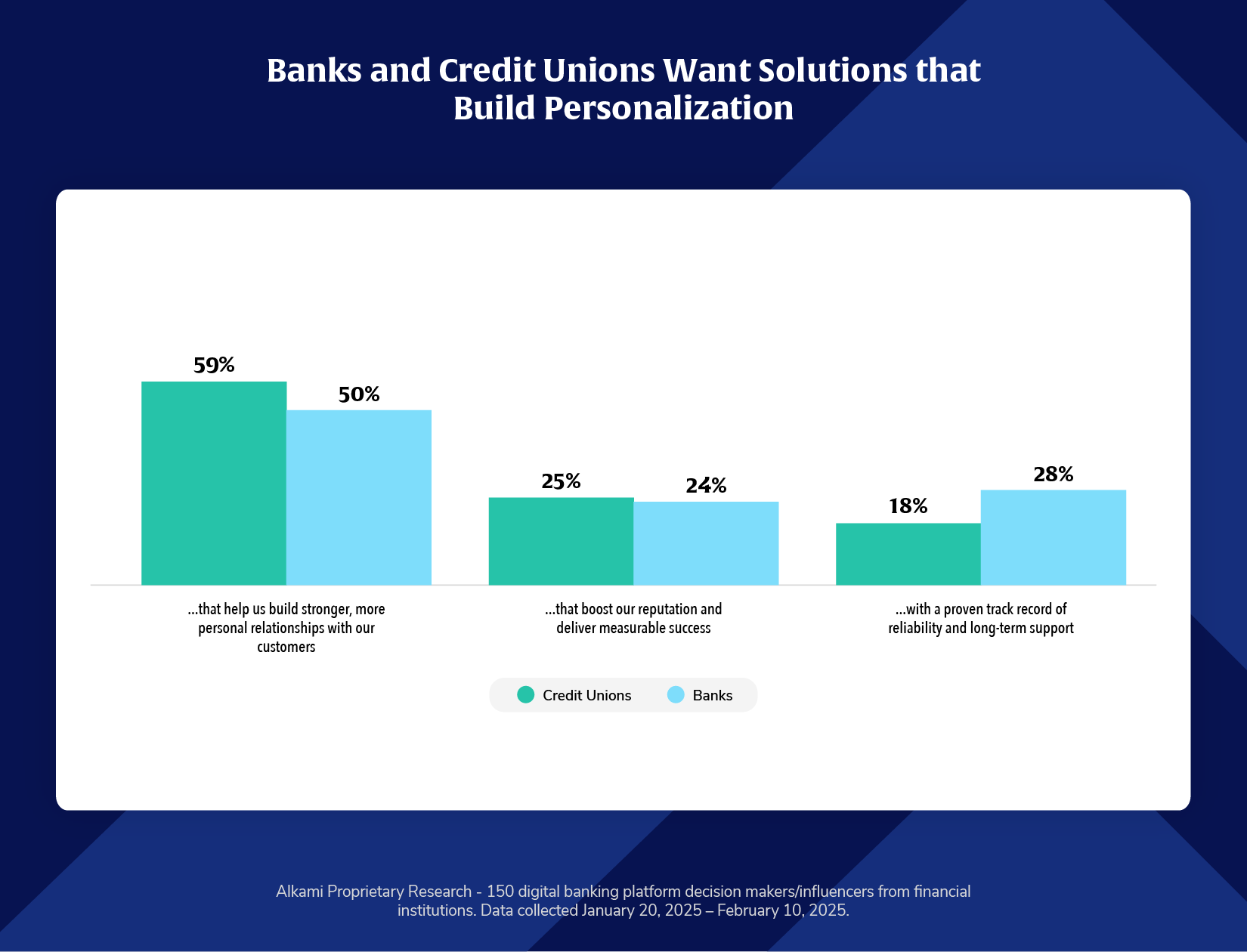

Financial institutions are placing human connection at the center of their technology strategies. In recent market research* conducted by Alkami, the majority of both credit unions and banks say they value solutions that deepen personal relationships with their account holders—outweighing even reputation-boosting capabilities or long-term track records. This shift signals a growing focus on relational over transactional, with financial institutions actively seeking platforms that enable trust, empathy, and personalization at scale.

For credit unions, this aligns closely with their member-first mission. For banks, it reflects a recognition that long-term success depends not just on performance, but on building emotionally resonant connections that increase loyalty at all of life’s financial stages.

Financial institutions looking to prioritize relationship-centric solutions should consider investing in platforms designed to enhance the account holder experience that will deliver tailored and meaningful interactions. Also, use data. Behavioral and predictive analytics can support not only cross-sell, but provide intel on how to service customers and members in a way that works for them, with relevant products. Engaging with third-party vendors and partners can layer on solutions that support the overall relationship strategy.

Combining sales and service, while providing personalization that matters, is the new era of digital banking, allowing financial institutions to onboard, engage, and grow with their customers and members.

*Alkami Proprietary Research – 150 digital banking platform decision makers/influencers from financial institutions. Data collected January 20, 2025 – February 10, 2025.