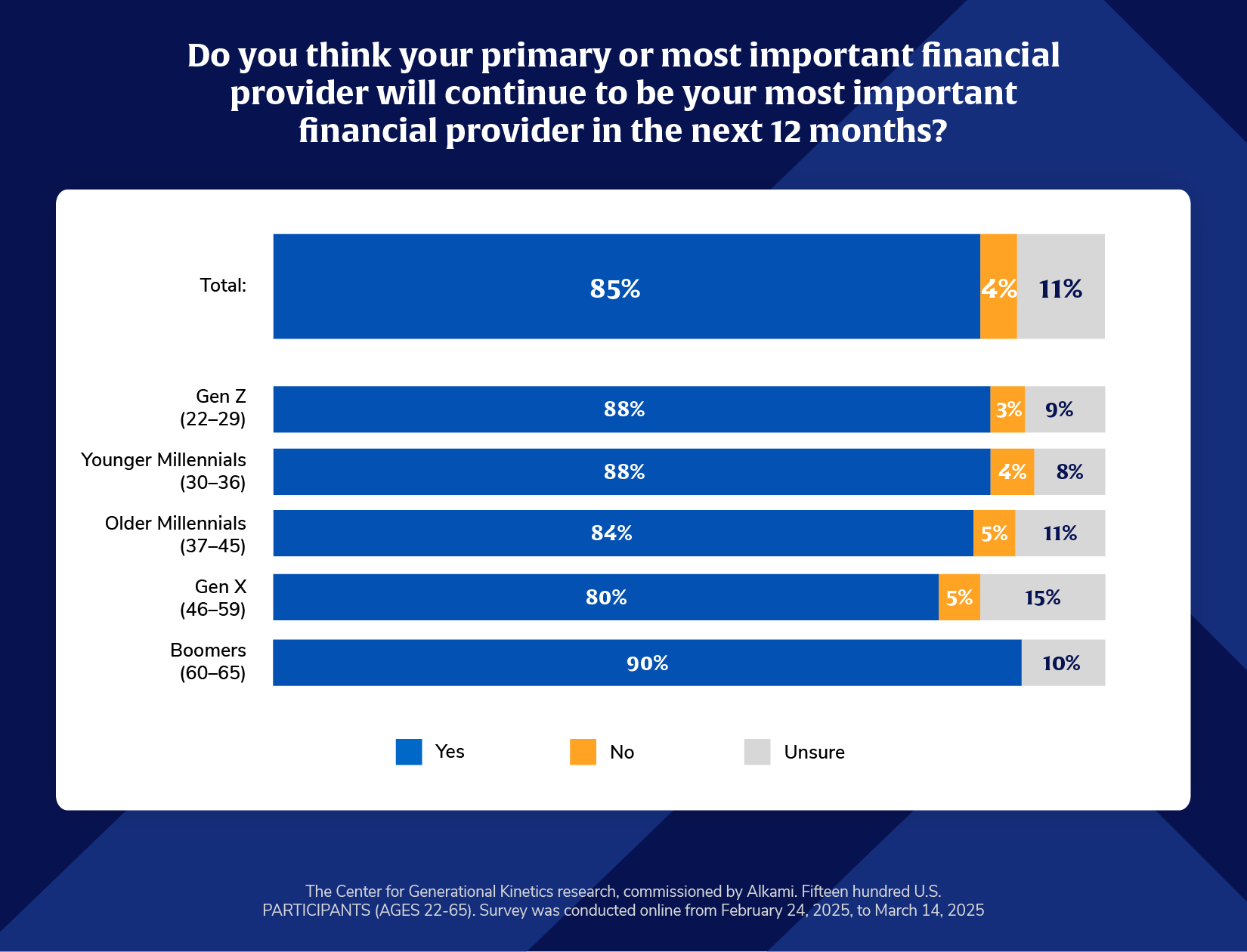

Despite the rise of fintechs and an increasingly fragmented financial ecosystem, new research reveals that the concept of a primary financial institution (PFI) still carries significant weight. While consumers may open accounts with multiple providers for niche services—like an investment application or a cryptocurrency wallet—the majority of digital banking Americans (85%) say their core financial relationship will remain their most important one.

This data reveals that being the PFI is still a deeply valuable position. Even among digitally native users who are comfortable juggling multiple accounts, the institution where they most often use their debit card is who they consider to be their primary financial provider (46%). That central role provides a powerful foundation for deepening relationships and cross-selling additional services.

Furthermore, the data points to an opportunity—and a risk. Institutions that assume they hold primacy based on legacy relationships may be surprised by how fast account holders can shift their allegiance. What’s changed, however, is how PFIs earn and retain that status. Historically, it was about proximity and inertia—whichever branch was closest often won by default. Today, it’s about experience. Second to the use of their debit card, Americans’ primary or most important financial provider is the most significant to them because it is where they do most of their online or mobile banking. The next steps to exceeding exceptions with modern account holders will be delivering fast, intuitive digital interactions, real-time insights, and personalized engagements that anticipate needs.

The value of holding PFI status extends beyond satisfaction—it’s measurable in wallet share, retention, and long-term profitability. Institutions that serve as a user’s PFI see higher usage rates across products, and stronger loyalty. In essence, primacy acts as both a moat and a growth engine.

The idea is not that “primacy is dead,” but needs to be looked at differently. Institutions that rethink their strategy as it relates to digital channels to earn and keep that trusted role are positioned to not only survive but thrive. It’s no longer about being the only option; it’s about being the best one.